41

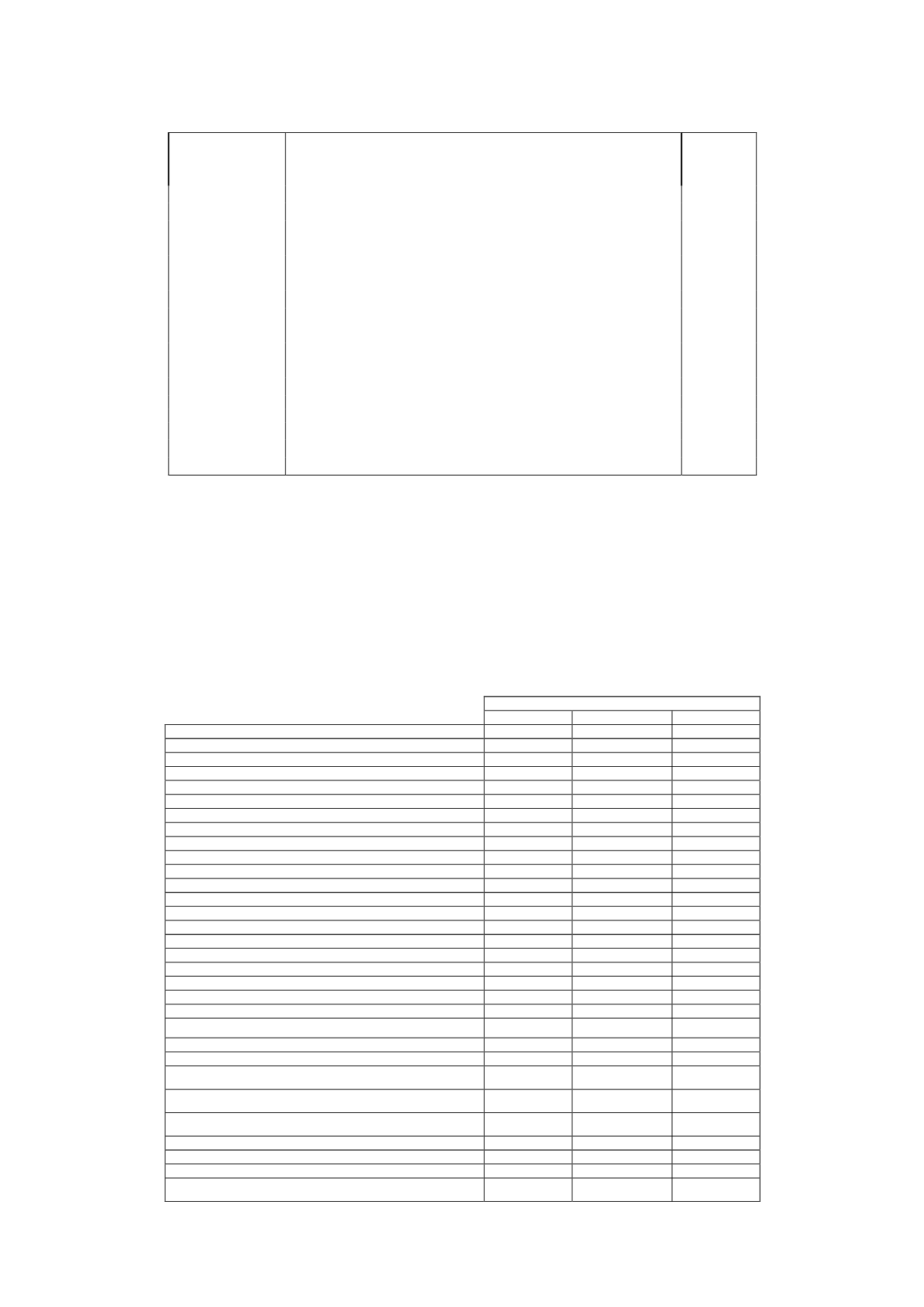

The companies composing the tax Group at 31 December 2015 are as follows:

TAXPAYER

IDENTIFICATION

NUMBER

SUBSIDIARY

Date of

inclusion

in the

Group

B85384881

Antena 3 Eventos, S.L.

01/01/08

B82832841

Atresmedia Cine, S.L.U.

01/01/03

B84187335

Antena 3 Multimedia, S.L.U.

01/01/04

A84920230

Antena 3 Televisión Digital Terrestre de Canarias, S.A.U.

01/01/06

B86424132

Antena 3 Noticias, S.L.U.

01/01/12

B84171453

Atres Advertising, S.L.U.

01/01/04

B86885530

Atresmedia Foto, S.L.

01/01/13

B87294187

Atresmedia Música, S.L.

01/01/15

A81797656

Canal Media Radio, S.A.U.

01/01/05

B65273914

Cordina Planet, S.L. U.

01/01/14

B87377230

Flooxplay, S.L.

01/01/15

A80847601

Guadiana Producciones, S.A.U.

01/01/01

B85408128

La Sexta Editorial Musical, S.L.U.

01/10/12

A79458535

Música Aparte, S.A.U.

01/01/01

B84196914

Uniprex Televisión, S.L.U.

01/01/04

B84405422

Uniprex Valencia TV, S.L.U.

01/01/05

A28782936

Uniprex, S.A.U.

01/01/01

The filing of consolidated tax returns gives rise to reciprocal intra-Group balances, due to the

offset of the losses incurred by certain companies against the profit earned by other Group

companies. These balances are recognised under “Payable to Group Companies” and “Receivable

from Group Companies”, as appropriate.

Income tax is calculated on the basis of the accounting profit determined by application of

generally accepted accounting principles, which does not necessarily coincide with the taxable

profit.

The reconciliation of the accounting profit to the taxable profit for income tax purposes for 2015 is

as follows:

Thousands of euros

Increase

Decrease

Total

Accounting profit after tax

89,503

Income tax

18,146

-

18,146

Permanent differences -

14,410

34,534

(20,124)

Penalties

737

-

737

Donations

530

-

530

Impairment of investments

11,013

-

11,013

Elimination of dividends

-

23,220

(23,220)

Inclusion of impairment of investments

11,067

(11,067)

Elimination of intra-Group transactions

809

809

Other permanent differences

1,321

1,321

Double taxation exemption

247

(247)

Deductible temporary differences:

7,146

10,968

(3,821)

Arising in the year:

Provision for contingencies and charges

7,146

-

7,146

Non-current accounts payable

-

-

-

Net impairment losses

-

-

Arising in prior years

:

Provision for contingencies and charges

-

6,975

(6,975)

Non-current accounts payable

-

1,257

(1,257)

Net impairment losses

2,736

(2,736)

Taxable temporary differences:

791

-

791

Arising in the year:

Net impairment losses

791

-

791

Gross taxable profit

22,347

45,502

84,494

Offset of prior years' tax losses

(32,061)

Tax rate

28%

Gross tax payable

14,681

Accounts receivable from (payable to) Group companies

12,258

Tax credits used in 2015

(7,552)

2015 tax prepayments

(23,871)

Income tax payable (refundable)

(4,485)