36

The terms and conditions agreed upon in the integration agreement relating to Gala Desarrollos

Comerciales, S.L. remain unchanged and, accordingly, it continues to be entitled to receive an

additional ownership interest of 0.508% of the share capital of Atresmedia Corporación de Medios

de Comunicación, S.A., conditional upon the earnings performance of the Atresmedia Group in the

period from 2012 to 2016, as indicated above. The delivery of these additional shares will be

carried out in full through treasury shares of the Company and, therefore, does not constitute an

additional issue.

"Other Equity Instruments" includes the measurement of the aforementioned consideration at the

fair value of the shares whose delivery was deferred. This measurement was calculated on the

basis of the forward price of the shares of Atresmedia Corporación de Medios de Comunicación,

S.A. on 5 October 2012 taking into account a 0.90% IRS rate and in accordance with

management's estimate of the profit for 2012 to 2016 in order to estimate the time of delivery.

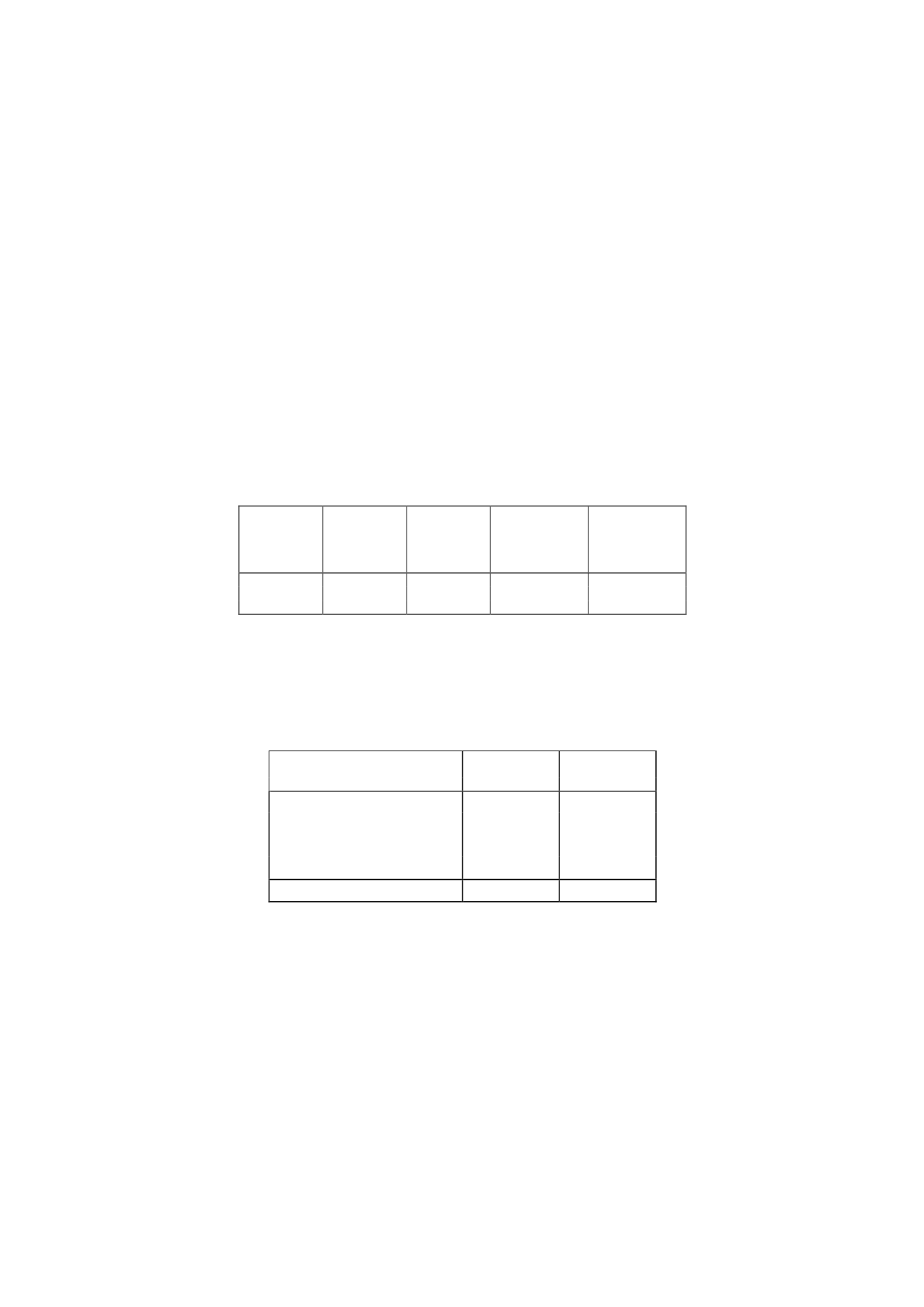

12.3 Treasury shares

The detail of the treasury shares held by the Company at the end of 2015 and 2014 is as follows:

No. of

shares

Par value

(euros)

Average

acquisition

price

(euros)

Total

acquisition cost

(Thousands

of euros)

2015

789,738

592,304

10.97

8,666

2014

1,145,594

859,196

6.29

7,202

At 31 December 2015, the shares of the Company held by it represented 0.350% of the

Company's share capital and totalled 789,738 shares, with a value of EUR 8,666 thousand and an

average acquisition price of EUR 10.97 per share.

The changes in “Treasury Shares” in 2015 and 2014 were as follows:

Number of shares

2015

2014

At beginning of year

1,145,594

15,818,704

Purchases

558,957

-

Sales

-

(6,298,784)

Delivery (Note 12.2)

(914,813)

(8,374,326)

At end of year

789,738

1,145,594

Pursuant to the partial novation of the integration agreement entered into on 14 December 2011,

which definitively concluded a series of matters related to the guarantee and commitment regime

of the initial integration agreement for the merger with Gestora de Medios Audiovisuales la Sexta,

S.A., the Company delivered to the shareholders Imagina Media Audiovisual, S.L. and Mediapro

Contenidos, S.L. (Sole-Shareholder Company) an additional ownership interest equal to 0.248% of

the Company's share capital, i.e. a total of 558,957 shares (see Note 8-b).

Also, under the integration agreement relating to Gala Desarrollos Comerciales, S.L. (see Note

12.2), a portion of the aforementioned additional ownership interest, equivalent to 0.158%

(355,856 shares) was transferred to that company.

On 6 March 2014, the Company reported through a relevant event communication the sale for EUR

79,680 thousand of a total of 6,298,784 treasury shares representing 2.79% of its share capital.

The carrying amount of these shares was EUR 39,601 thousand. The difference between both

amounts was recognised in equity. This transaction carried a cost of 1% on the sale price, which

was also recognised in equity.