38

The agreement for the partial novation of the integration agreement entered into by the Company

for the merger with Gestora de Medios Audiovisuales La Sexta, S.A. on 19 February 2014 (see

Note 12.3), included the assumption of a contingency of the former shareholders of La Sexta

corresponding to the tax assessments relating to the levy on games of luck, betting or chance,

raffles and tombolas. The assumption of this contingency gave rise to the recognition of the

related provision of EUR 6,903 thousand in the Company's financial statements. In the first half of

2015, this provision was reversed as a final judgment was handed down in relation to the

proceeding. The accounting entry and the reversal of the provision did not have any impact on the

Company's statement of profit or loss.

At 31 December 2015 and 2014, certain civil, labour, criminal and administrative lawsuits had

been filed against the Company which were taken into account in estimating potential contingent

liabilities. Noteworthy, in view of their amount, were the lawsuits with certain collection societies.

The directors of the Company and its legal advisers do not expect any material liabilities additional

to those already recognised to arise from the outcome of the lawsuits in progress.

14.- Non-current and current liabilities

14.1 Non-current financial liabilities

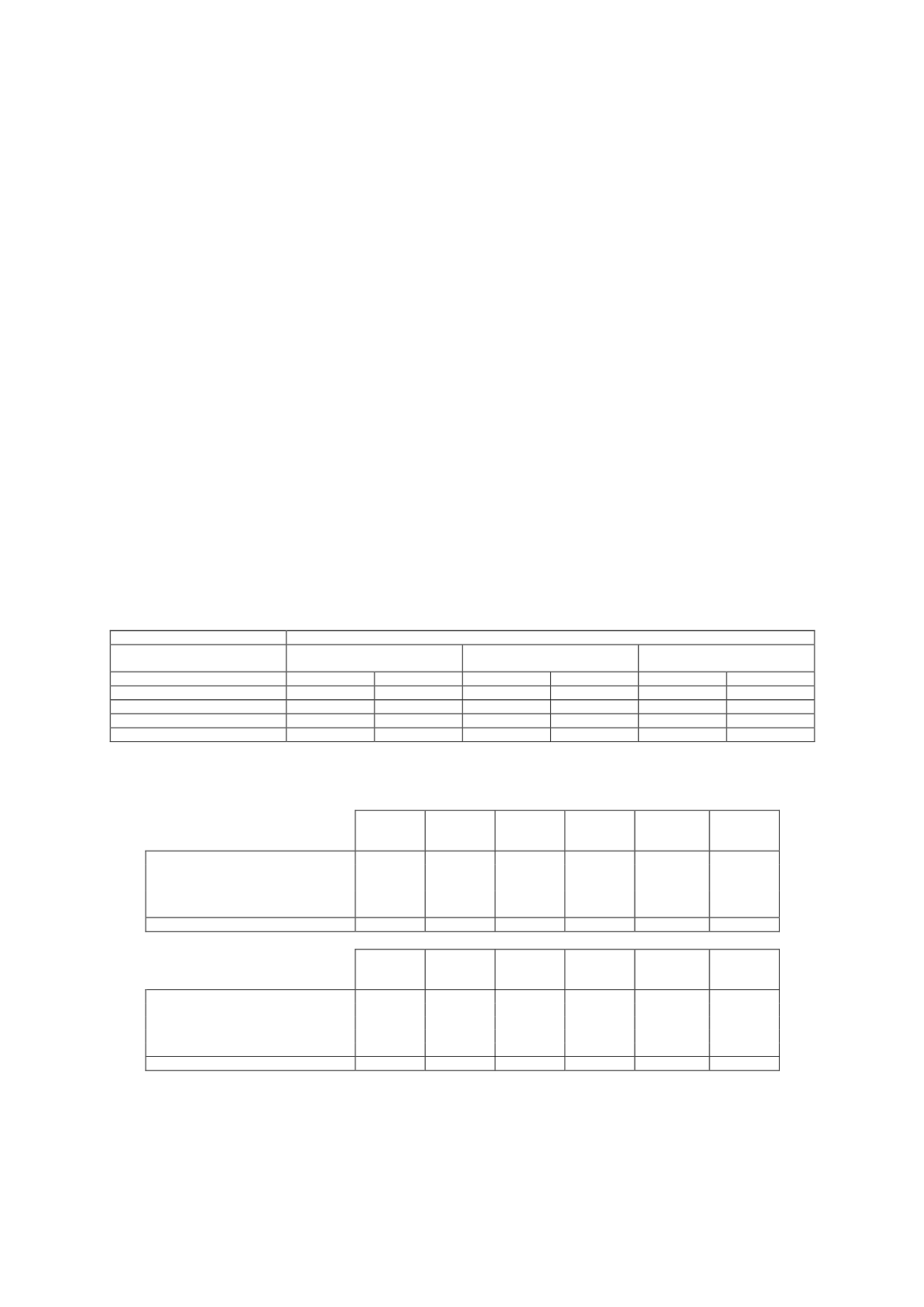

The detail of “Non-Current Payables” at the end of 2015 and 2014 is as follows (in thousands of

euros):

Non-current financial instruments

Bank borrowings

Derivatives and other

Total

2015

2014

2015

2014

2015

2014

Accounts payable

127,437

126,331

46,154

50,511

173,591

176,842

Derivatives

-

-

2,757

7

2,757

7

Total

127,437

126,331

48,911

50,518

176,348

176,849

The detail, by maturity, of “Non-Current Payables” is as follows (in thousands of euros):

2017

2018

2019

2020

2021 and

subsequent

years

Total

Bank borrowings

27,000

27,000

73,437

-

127,437

Trade payables

44,333

1,644

61

-

-

46,038

Derivatives

2,633

107

17

-

-

2,757

Other payables

48

9

41

9

9

116

Total at 31/12/15

74,014

28,760

73,556

9

9 176,348

2016

2017

2018

2019

2020 and

subsequent

years

Total

Bank borrowings

62,331

64,000

-

-

-

126,331

Trade payables

45,639

4,710

42

-

-

50,391

Derivatives

7

-

-

-

-

7

Other payables

75

9

9

9

18

120

Total at 31/12/14

108,052

68,719

51

9

18 176,849

On 4 May 2015, the Company arranged a new syndicated loan of EUR 270,000 thousand, which

was earmarked to repay the syndicated financing arranged in August 2013 and to meet the

Company's general corporate and cash requirements. At 31 December 2015, the limit of the

aforementioned financing was EUR 270,000 thousand.