39

50% of the total amount is a four-year loan with partial repayments and the remaining 50% is a

credit facility maturing at four years. Eight banks with which the Company has regular dealings

participated in the transaction.

The applicable interest rate is Euribor plus a market spread and the transaction is subject to

compliance with financial covenants habitually used in transactions of this kind: the debt to

EBITDA ratio and the interest coverage ratio. The fair value of this financing approximates its

carrying amount.

The balance of "Non-Current Trade Payables" relates to the maturities at more than twelve months

of the amounts payable to suppliers for rights on outside productions set on the basis of the

periods in which the productions become available. These payables do not bear interest and the

fair value thereof amounts to approximately EUR 46 million.

14.2 Current financial liabilities

At 31 December 2015, the current bank borrowings amounted to EUR 31,838 thousand (2014:

EUR 38,859 thousand).

The rate of interest paid by the Company in 2015 on the loans and credit facilities arranged with

banks was mainly tied to Euribor.

15.- Trade payables

The maximum payment period applicable to the Company under Law 3/2004, of 29 December, on

combating late payment in commercial transactions and pursuant to the transitional provisions

contained in Law 15/2010, of 5 July, is 60 days from 2013.

Set forth below are the disclosures required by Additional Provision Three of Law 15/2010, of 5

July (amended by Final Provision Two of Law 31/2014, of 3 December), prepared in accordance

with the Spanish Accounting and Audit Institute (ICAC) Resolution of 29 January 2016 on the

disclosures to be included in notes to financial statements in relation to the average period of

payment to suppliers in commercial transactions.

As permitted by the Single Additional Provision of the aforementioned Resolution, since this is the

first reporting period in which it is applicable, no comparative information is presented.

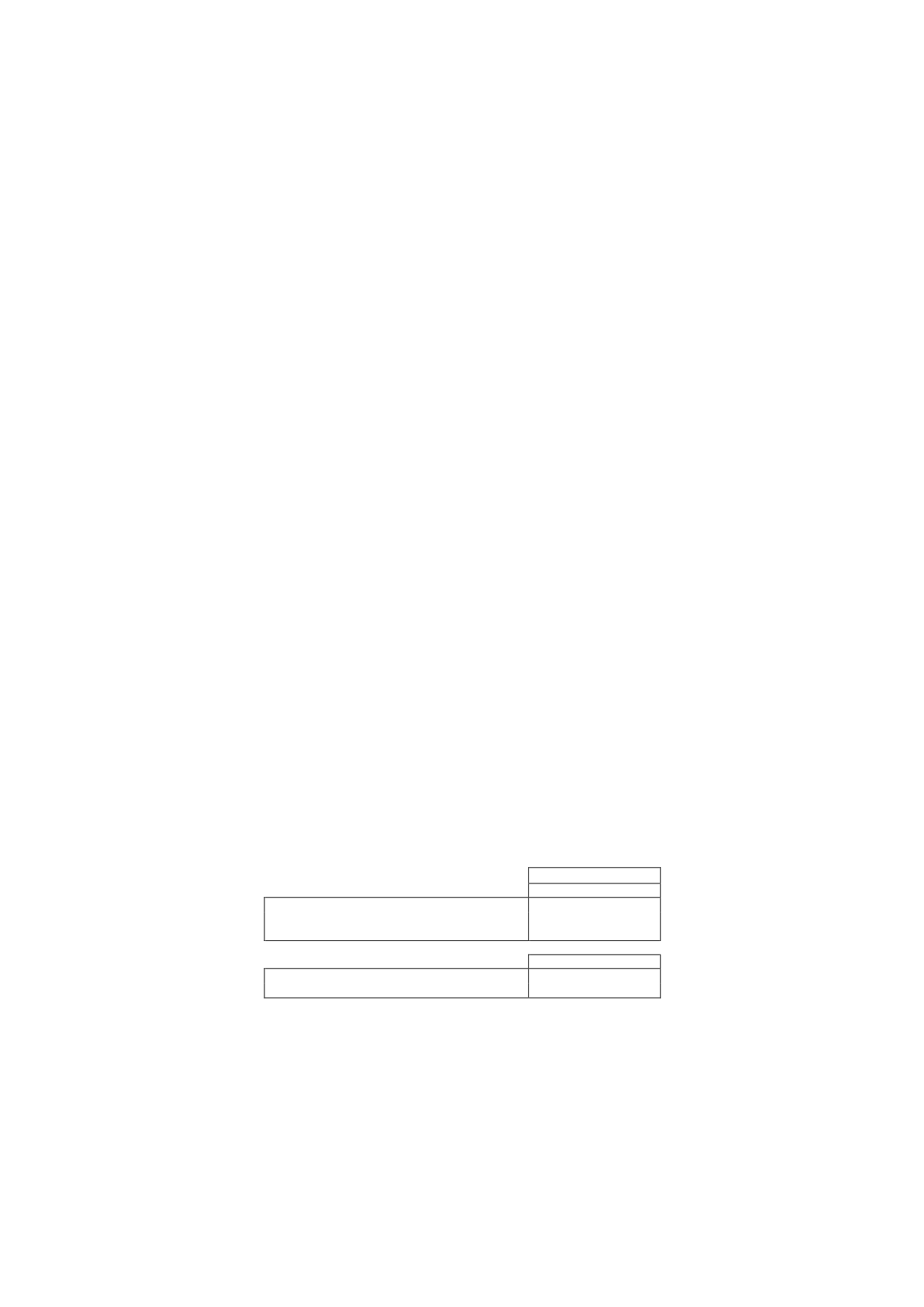

2015

Days

Average period of payment to suppliers

77

Ratio of transactions settled

87

Ratio of transactions not yet settled

39

Thousands of euros

Total payments made

591,850

Total payments outstanding

160,547

In accordance with the ICAC Resolution, the average period of payment to suppliers was calculated

by taking into account the commercial transactions relating to the supply of goods or services for

which payment has accrued since the date of entry into force of Law 31/2014, of 3 December.

For the sole purpose of the disclosures provided for in the Resolution, suppliers are considered to

be the trade creditors for the supply of goods or services included in “Payable to Suppliers” and

“Payable to Suppliers - Group Companies and Associates” under current liabilities in the balance

sheet.