43

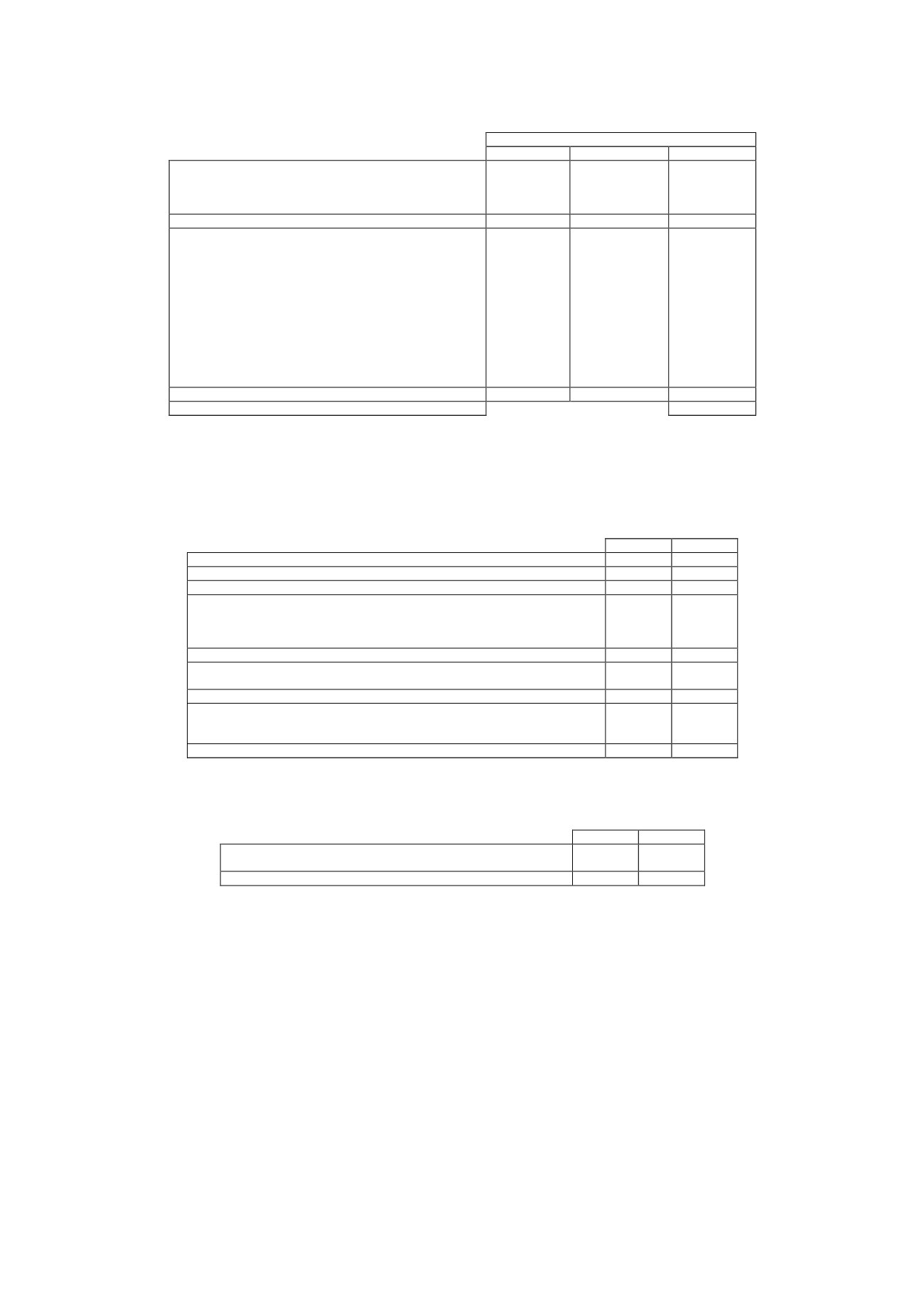

The detail of the taxes recognised directly in equity in 2014 is as follows:

Thousands of euros

Increase

Decrease

Total

Current taxes:

Capital increase expenses

Capital reduction expenses

Total current taxes

Deferred taxes:

Arising in the year:

Available-for-sale financial assets

Revaluation of other financial assets

Grants

Effect of first-time application of New Spanish

National Chart of Accounts

Arising in prior years:

Available-for-sale financial assets

Revaluation of other financial assets

Grants

-

571

(571)

Total deferred taxes

-

571

(571)

Total tax recognised directly in equity

(571)

16.4 Reconciliation of the accounting profit to the income tax expense

The reconciliation of the accounting profit to the income tax expense is as follows (in thousands of

euros):

2015

2014

Accounting profit before tax

107,649

87,130

Tax charge at 28%

30,141

26,139

Tax credits earned in the year:

Audiovisual productions

Donations to not-for-profit entities

Other

(6,297)

(6,112)

(185)

-

(11,425)

(11,342)

(83)

-

Offset of tax losses:

Other -

Permanent differences (Note 16.2)

(5,635)

(5,081)

Total income tax expense for the year

18,209

9,633

Income tax adjustments

Adjustment - difference in income tax per tax return

Adjustment - change in income tax rate

(63)

569

(632)

32,264

(1,242)

33,506

Total income tax expense recognised in profit or loss

18,146

41,897

The breakdown of the income tax expense for the year is as follows (in thousands of euros):

2015

2014

Current tax

8,384

902

Deferred tax

9,825

8,731

Total income tax expense for the year

18,209

9,633

Spanish Income Tax Law 27/2014, of 27 November, effective from 1 January 2015, established,

among other changes, a change in the income tax rate to 28% in 2015 and 25% in 2016 and

subsequent years.

In 2014 the Company made adjustments to bring the existing balance of deferred tax assets and

deferred tax liabilities -calculated in the past at a rate of 30%- into line with the recoverable

amount thereof calculated at 25%, based on the Company's best estimates of the recovery of tax

assets in future reporting periods.

The differences between the estimate made at year-end and the tax return effectively filed gave

rise to differences that not only affect the income tax expense, but also the adjustment arising

from the change in the tax rate, amounting to EUR 569 thousand and EUR (632) thousand,

respectively.