40

“Average period of payment to suppliers” is taken to be the period that elapses from the delivery

of the goods or the provision of the services by the supplier to the effective payment of the

transaction.

16.- Tax matters

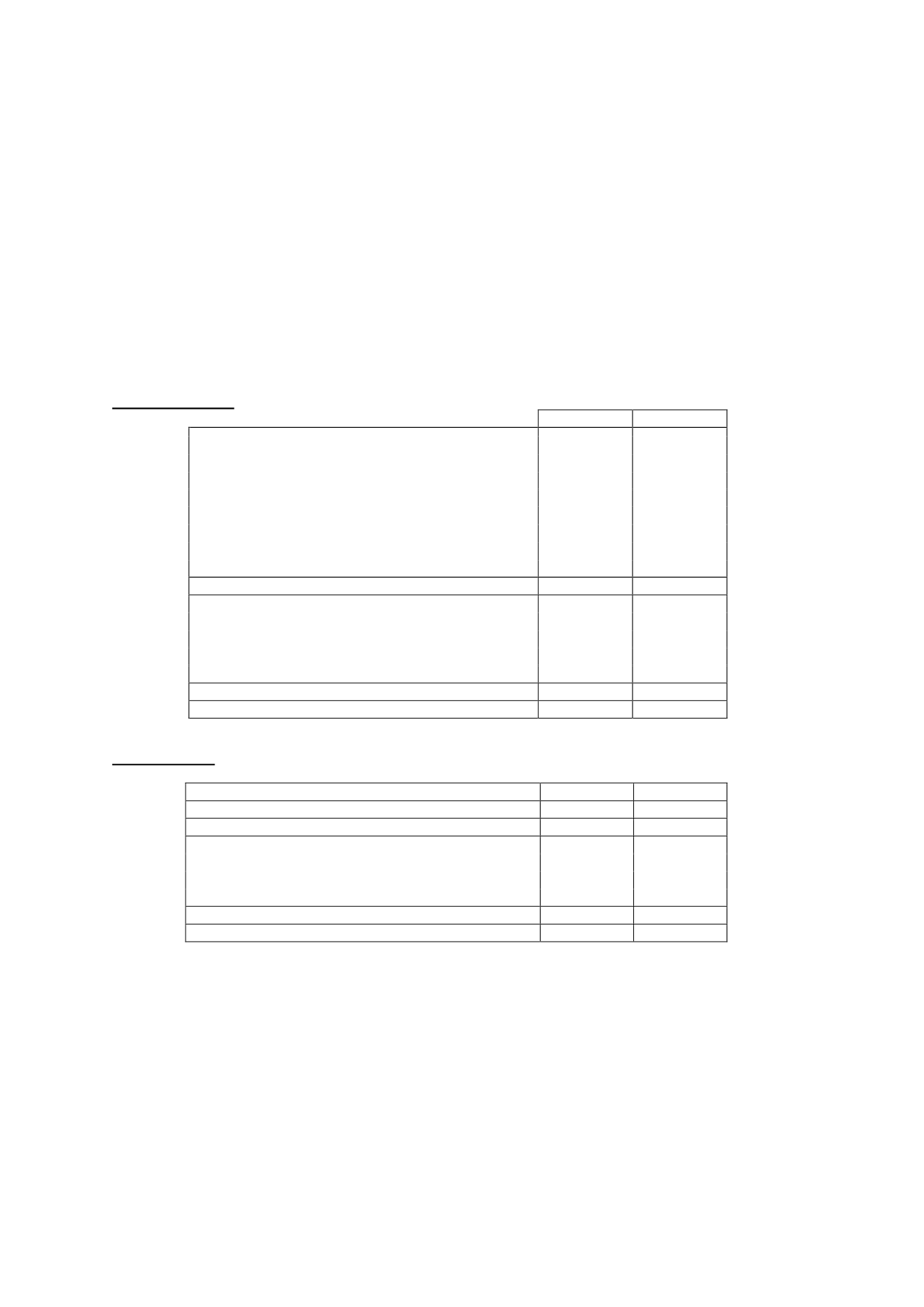

16.1 Current tax receivables and tax payables

The detail of the current tax receivables and payables is as follows (in thousands of euros):

Tax receivables

2015

2014

To be settled in 2016:

22,539

13,314

Deferred tax assets

598

737

Tax loss carryforwards

18,954

7,187

Unused tax credits and tax relief

2,987

5,390

To be settled from 2017:

233,687

252,098

Deferred tax assets

9,407

12,034

Tax loss carryforwards

149,878

169,877

Unused tax credits and tax relief

74,402

70,188

Total non-current assets

256,226

265,413

Income tax refundable

2,308

1,248

2015 income tax refundable

4,485

968

VAT refundable

12

2,879

Other tax receivables

153

126

Total current assets

6,958

5,221

TOTAL TAX RECEIVABLE

263,184

270,637

Tax payables

2015

2014

Deferred tax liabilities

18,479

18,700

Total non-current liabilities

18,479

18,700

Short-term

-

Tax withholdings payable

4,864

3,056

Accrued social security taxes payable

745

689

VAT payable

5,100

-

Total current liabilities

10,709

3,745

TOTAL TAX PAYABLE

29,188

22,445

16.2 Reconciliation of the accounting profit to the taxable profit

Pursuant to Spanish Income Tax Law 43/1995, of 27 December, on 26 December 2000,

Atresmedia Corporación de Medios de Comunicación, S.A. notified the Madrid tax authorities of its

decision to file consolidated income tax returns. This application is considered indefinite provided

that the requirements established in the current Article 67 of the Consolidated Spanish Income Tax

Law are met and the Company does not opt to cease to apply the aforementioned regime.