42

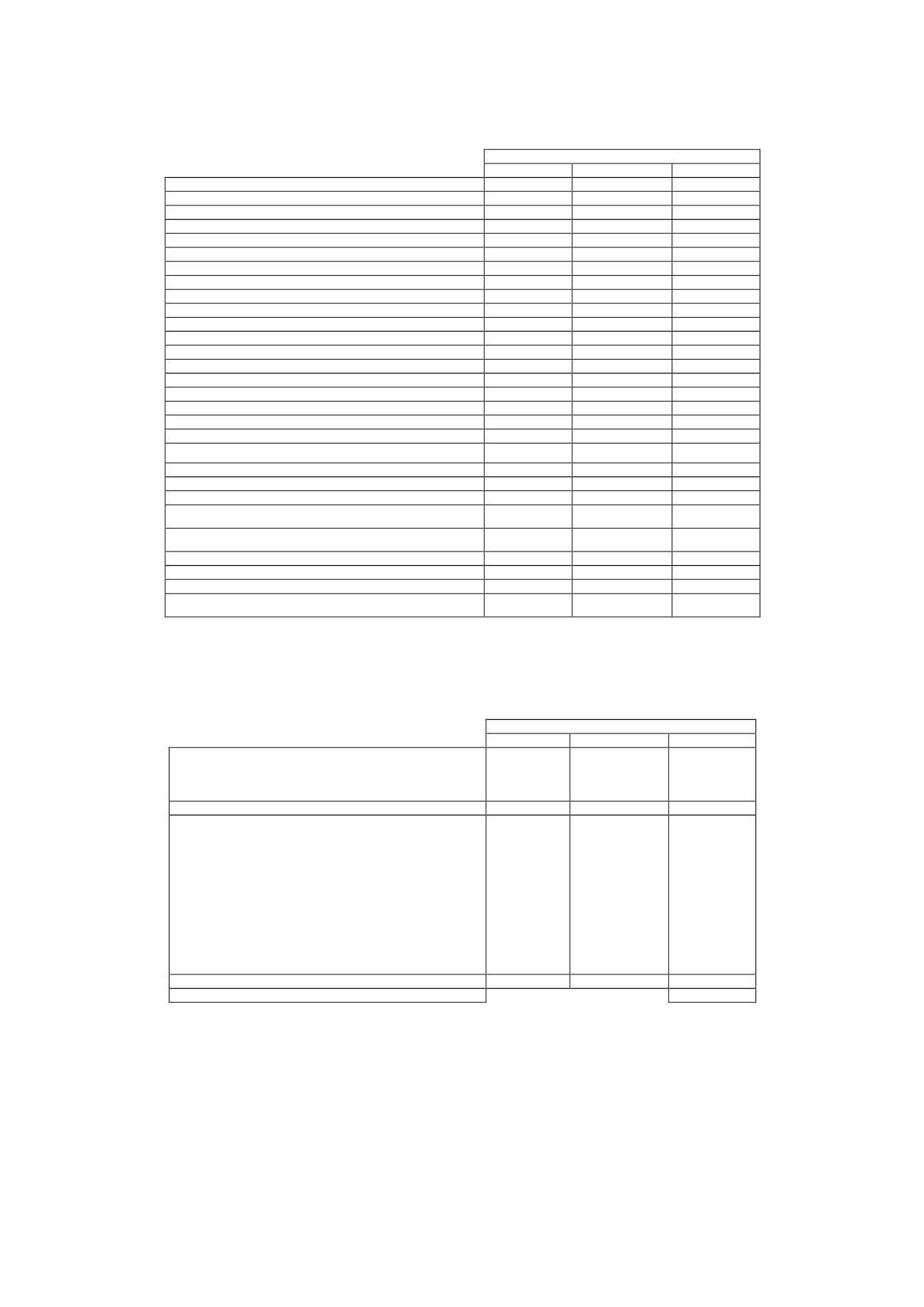

The reconciliation of the accounting profit to the taxable profit for income tax purposes for 2014 is

as follows:

Thousands of euros

Increase

Decrease

Total

Accounting profit after tax

45,233

Income tax

41,897

-

41,897

Permanent differences -

6,616

23,554

(16,938)

Penalties

79

-

79

Donations

237

-

237

Impairment of investments

5,195

-

5,195

Elimination of dividends

-

3,359

(3,359)

Inclusion of impairment of investments

20,195

(20,195)

Elimination of intra-Group transactions

1,105

1,105

Deductible temporary differences:

12,358

13,951

(1,593)

Arising in the year:

Provision for contingencies and charges

7,251

-

7,251

Non-current accounts payable

1,000

-

1,000

Net impairment losses

4,107

4,107

Arising in prior years

:

Provision for contingencies and charges

-

6,954

(6,954)

Non-current accounts payable

-

53

(53)

Net impairment losses

6,944

(6,944)

Taxable temporary differences:

791

-

791

Arising in the year:

Net impairment losses

791

-

791

Gross taxable profit

19,765

37,505

69,390

Offset of prior years' tax losses

(28,303)

Tax rate

30%

Gross tax payable

12,326

Accounts receivable from (payable to) Group companies

13,155

Tax credits used in 2014

(6,704)

2014 tax prepayments

(19,745)

Income tax payable (refundable)

(968)

16.3 Tax recognised in equity

The detail of the taxes recognised directly in equity in 2015 is as follows:

Thousands of euros

Increase

Decrease

Total

Current taxes:

Capital increase expenses

Capital reduction expenses

Total current taxes

Deferred taxes:

Arising in the year:

Available-for-sale financial assets

Revaluation of other financial assets

Grants

Effect of first-time application of New Spanish

National Chart of Accounts

Arising in prior years:

Available-for-sale financial assets

Revaluation of other financial assets

Grants

-

198

(198)

Total deferred taxes

-

198

(198)

Total tax recognised directly in equity

(198)