44

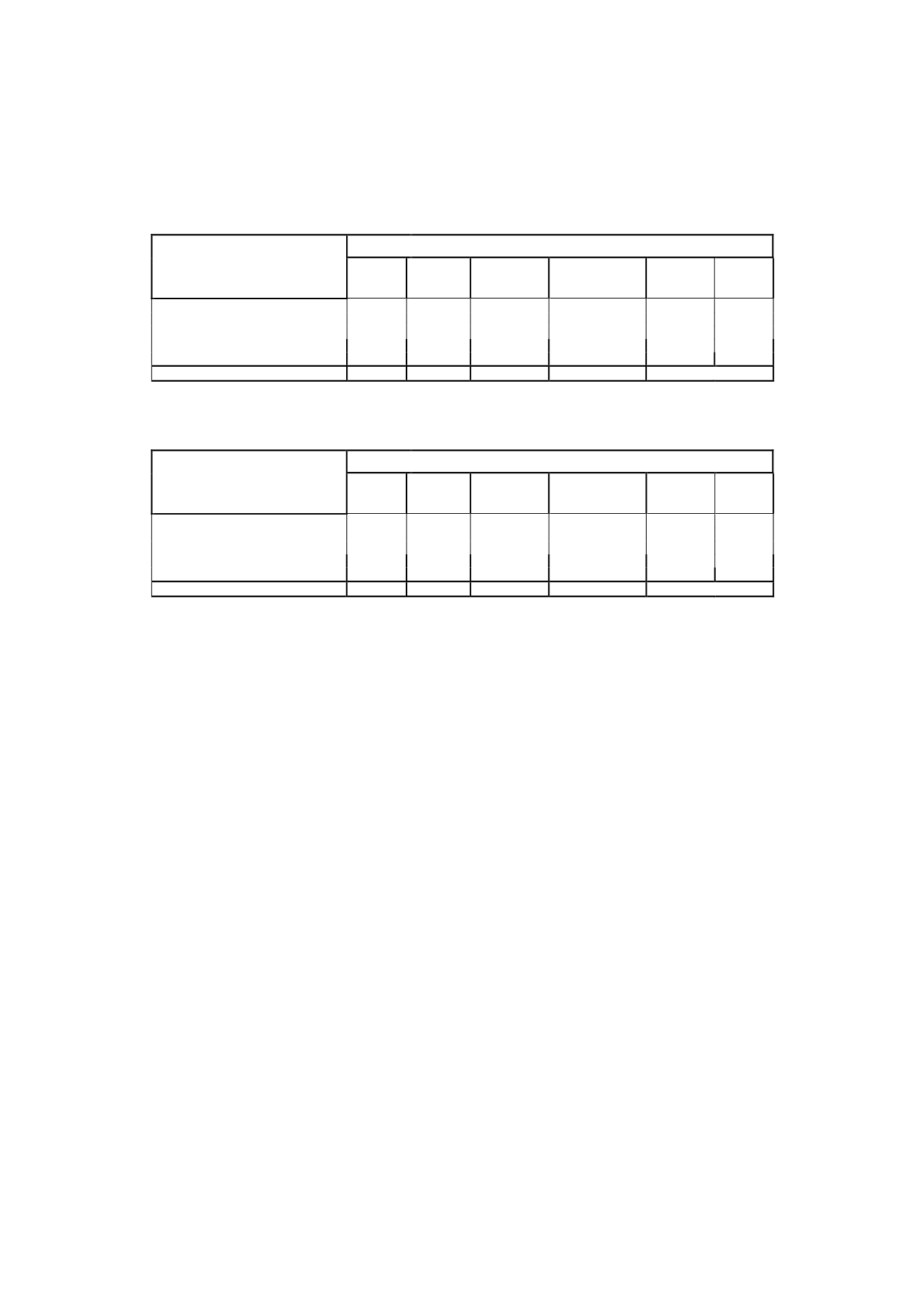

16.5 Deferred tax assets recognised

The difference between the tax charge allocated to 2015 and to prior years and the tax charge

already paid or payable for such years, which is recognised under “Deferred Tax Assets”, arose as

a result of temporary differences derived from the following:

CHANGES IN DEFERRED

TAX ASSETS

Thousands of euros

2014 Additions Reductions

Other tax

receivables

Effect of

change in

tax rate

2015

Contingencies and charges

10,095

2,001

(1,953)

(658)

(929)

8,556

Accounts payable

613

-

(352)

(212)

73

122

Other items

2,311

-

(222)

(887)

687

1,889

Tax effect of assets at fair value

530

-

(544)

(201)

607

392

Financial hedging instruments

(777)

-

(198)

-

21

(954)

Total

12,772

2,001

(3,269)

(1,958)

459 10,005

The detail for 2014 is as follows:

CHANGES IN DEFERRED

TAX ASSETS

Thousands of euros

2013 Additions Reductions

Other tax

receivables

Effect of

change in

tax rate

2014

Contingencies and charges

10,747

2,175

(2,086)

38

(779) 10,095

Accounts payable

653

300

(795)

576

(123)

611

Other items

2,321

1,232

(16)

(143)

(1,081)

2,313

Tax effect of assets at fair value

2,541

-

(1,287)

-

(724)

530

Financial hedging instruments

(361)

-

(571)

-

155

(777)

Total

15,901

3,707

(4,755)

471 (2,552) 12,772

At 31 December 2015, the tax effect of the valuation adjustments relating to the hedging

instruments amounting to EUR (198) thousand was recognised under “Non-Current Assets”.

The deferred tax assets indicated above were recognised because the Company’s directors

considered that, based on their best estimate of the Company’s future earnings, including certain

tax planning measures, it is probable that these assets will be recovered.

On the basis of the estimate made by the Company’s directors of the timing of future profits for

the offset and use of these deferred tax assets, EUR 9,407 thousand were considered to be

recoverable in the long term while EUR 598 thousand were considered to be recoverable in the

short term. Both amounts are recognised under “Deferred Tax Assets”.

Also, on the basis of the aforementioned timing estimate of future profits, the directors consider

that there are no reasonable doubts as to the recovery of the amounts recognised in the

accompanying balance sheet within the statutory time periods and limits on the basis of the

prepared projections.

The key assumptions on which the cash flow projections are based relate mainly to advertising

markets, audience, advertising efficiency ratios and the evolution of expenses. Except for

advertising data, which is measured on the basis of external sources of information, the

assumptions are based on past experience and reasonable projections approved by Company

management and updated in accordance with the performance of the advertising markets. These

future projections cover the next ten years.

The Company performs sensitivity analyses in the event of reasonable changes in the key

assumptions used to determine the recoverability of these assets. Therefore, the sensitivity

analyses are prepared under various scenarios based on the variables that are considered to be

most relevant, i.e. advertising income, which mainly depends on the performance of the

advertising market, the investment share reached and the operating margin achieved. The

aforementioned analyses do not disclose any evidence of non-recoverability of the tax assets and

tax credits recognised.