45

The changes in deferred tax assets recognised under "Other” include the difference between the

estimated tax for 2014 and the amount actually reported in the tax return, giving rise to an

adjustment of EUR (1,958) thousand to deferred tax assets. Also, the effect of this difference,

amounting to EUR (569) thousand, on the income tax expense is recognised under “Adjustments

to Income Tax”.

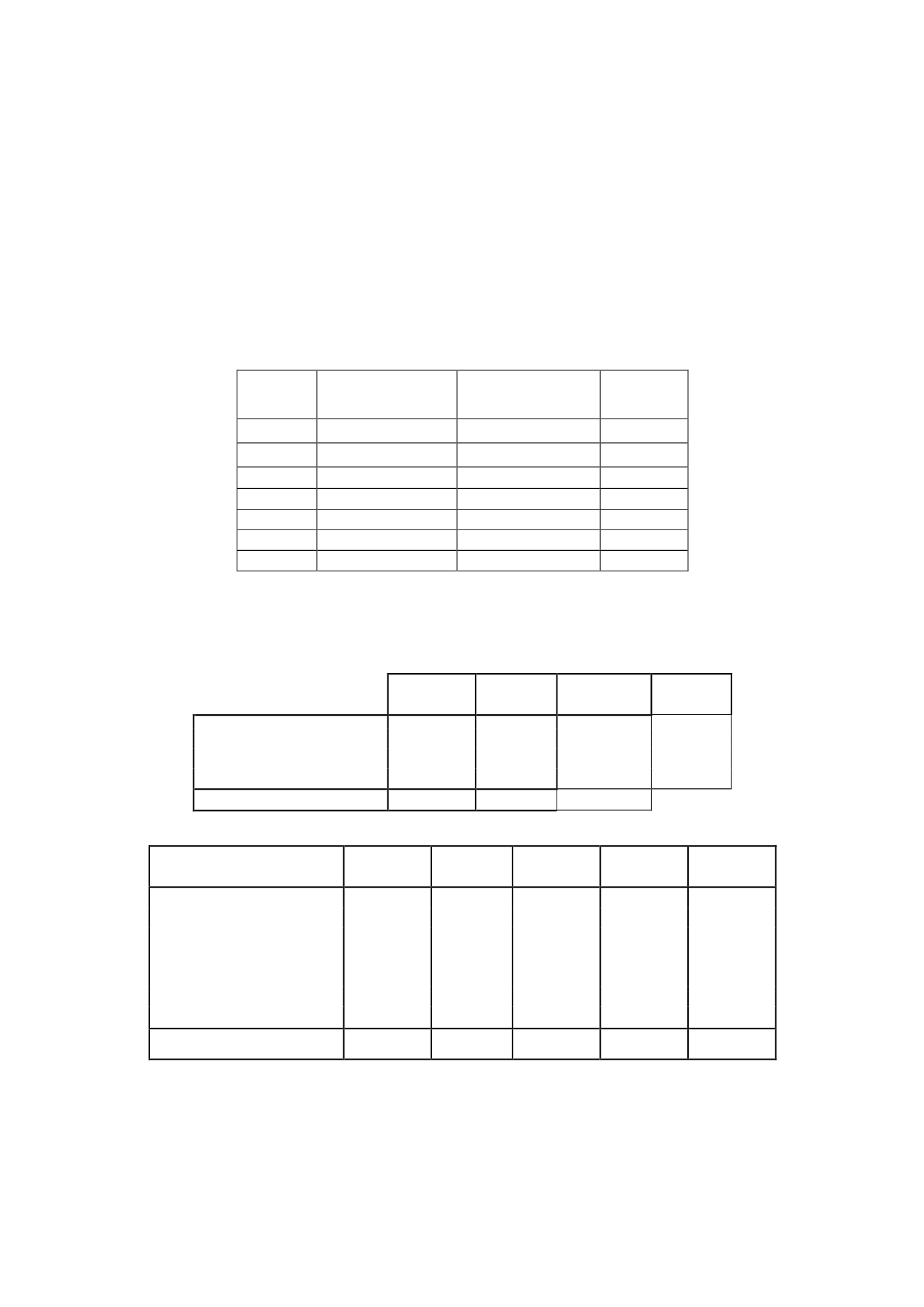

At 31 December 2015, the Company had unused tax credits amounting to EUR 86,555 thousand,

of which EUR 77,389 thousand are recognised in the balance sheet. Of the total tax credits, EUR

2,148 thousand arose from the merger with La Sexta. The Company also recognised tax losses

arising in full from the merger with La Sexta amounting to EUR 168,832 thousand.

Amount

Used in

the year

Carried

forward

Limit

14,369

4,300

10,069

2025

21,023

-

21,023

2026

17,478

-

17,478

2027

10,990

-

10,990

2028

11,715

-

11,715

2029

15,280

-

15,280

2030

90,855

4,300

86,555

As a result of the merger by universal succession, the Company assumed the right to deduct the

tax credits and tax loss carryforwards of the transferor, in accordance with the following schedule

of deductions:

Thousands

of euros at

31/12/14

Used

in the

year

Unused at

31/12/15

Last year

for

deduction

2010

1,010

1,010

-

2025

2011

2,148

-

2,148

2026

Unused

3,158

1,010

2,148

Year earned

Amount

Used

in the

year

Other

Effect of

change in

the tax rate

Unused at

31/12/15

2006

42,166

8,977

572

96

33,857

2007

37,654

-

-

-

37,654

2008

31,918

-

-

-

31,918

2009

28,965

-

-

-

28,965

2010

8,378

-

-

-

8,378

2011

15,473

-

-

-

15,473

2012

12,510

-

-

77

12,587

Total tax assets

177,064

8,977

572

173

168,832

The “Other” column includes the differences between the estimate at year-end and the tax return

actually filed.

Of the EUR 7,552 thousand of tax credits taken in 2015, EUR 6,544 thousand were deductions for

audiovisual production, of which EUR 4,300 thousand related to Atresmedia Corporación de Medios

de Comunicación, S.A. and EUR 2,244 thousand to a Group company, EUR 762 thousand were for

international double taxation and EUR 246 thousand for donations to not-for-profit entities.