46

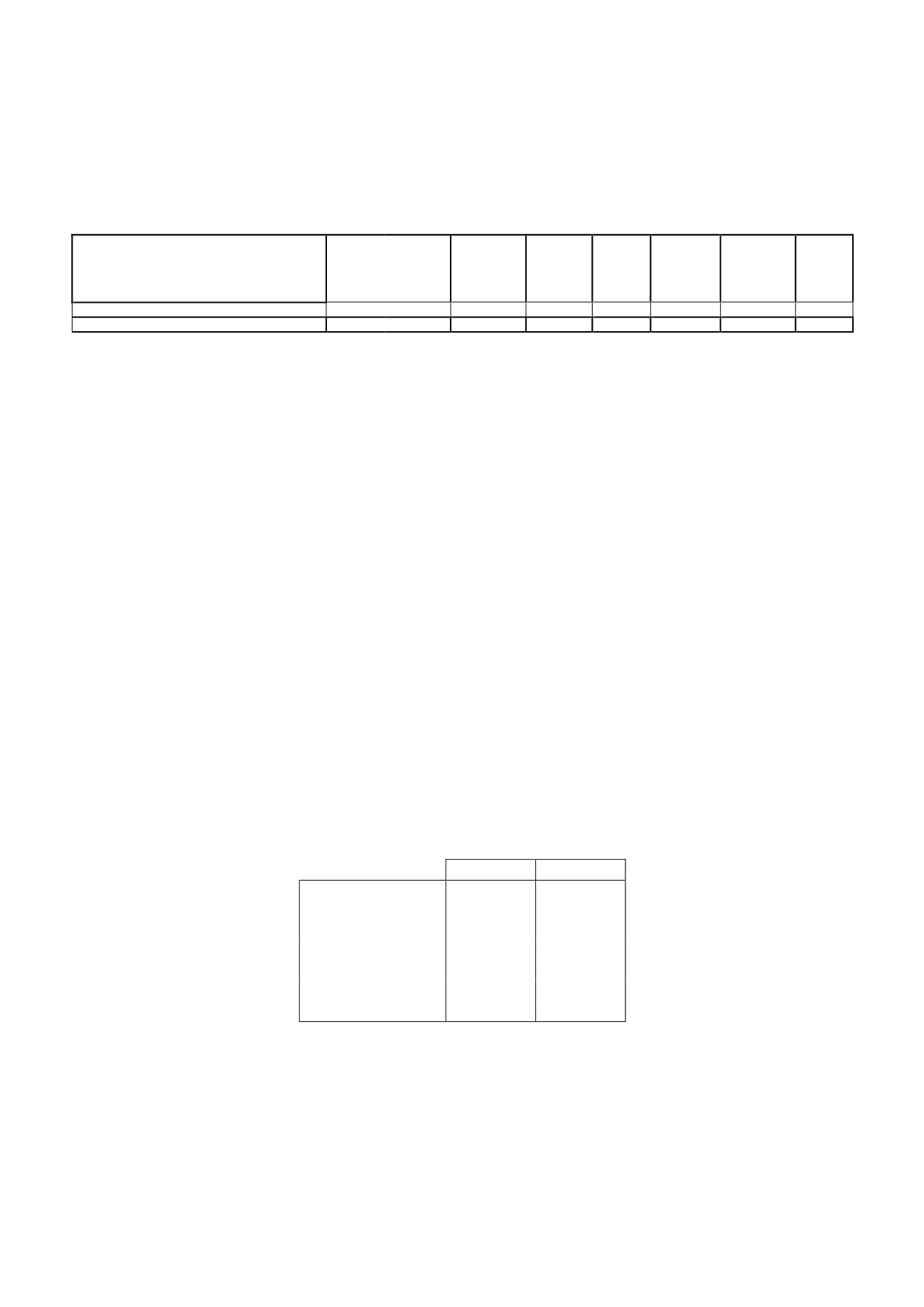

16.6 Deferred tax liabilities recognised

The detail of “Deferred Tax Liabilities" and of the changes therein is as follows:

DEFERRED TAX

LIABILITIES

2013 Additions Reductions

Effect

of the

change

in the

tax rate

2014 Additions Reductions 2015

Tax effect of identification of intangible assets 22,649

-

(237)

(3,712) 18,700

-

(221) 18,479

Total

22,649

-

(237) (3,712) 18,700

-

(221) 18,479

In accordance with income tax recognition and measurement standard number 13, the Company

will recognise the deferred tax liabilities relating to goodwill provided that these do not arise on the

initial recognition thereof.

The deferred tax liabilities relate to the identification of the "La Sexta" brand and signal

transmission licence. The brand is amortised for accounting purposes at an annual rate of 5%

(amortisation charge for 2015: EUR 791 thousand), while the licence is not amortised.

The amortisation is not deductible for tax purposes and, therefore, gives rise to a positive

adjustment to the taxable profit (tax loss) which is recognised as a deferred tax liability.

16.7 Years open for review and tax audits

Under current legislation, taxes cannot be deemed to have been definitively settled until the tax

returns filed have been reviewed by the tax authorities or until the four-year statute-of-limitations

period has expired. At 31 December 2015, the Company had from 2010 open to review for all the

taxes applicable to it.

The Company's directors consider that the tax returns for the aforementioned taxes have been

filed correctly and, therefore, even in the event of discrepancies in the interpretation of current tax

legislation in relation to the tax treatment afforded to certain transactions, such liabilities as might

arise would not have a material effect on the accompanying financial statements.

17.- Foreign currency balances and transactions

The detail of the most significant balances and transactions in foreign currency, valued at the year-

end exchange rate and the average exchange rates for the year, respectively, is as follows (in

thousands of euros):

2015

2014

Accounts receivable

1,141

990

Accounts payable

167,858

182,131

Sales

-

-

Purchases

139,891

131,750