37

The shareholders at the Annual General Meeting held on 22 April 2015 adopted a resolution

authorising the Company to acquire treasury shares provided that they did not exceed the

maximum legal limit permitted by law at any given time. This limit is set at 10% of the subscribed

share capital by Article 509 of the Spanish Limited Liability Companies Law, approved by

Legislative Royal Decree 1/2012, of 2 July. This authorisation is in force until 2020 and rendered

null and void the authorisation granted by the Annual General Meeting on 24 March 2010.

12.4 Dividends

At the Annual General Meeting held on 22 April 2015, the shareholders of the Company ratified,

among other resolutions, the distribution of 2014 profit, allocating the maximum amount of EUR

44,878 thousand to the payment of dividends, of which EUR 22,341 thousand related to the

interim dividend paid on 18 December 2014.

Once the dividend rights of the treasury shares had been attributed, a final dividend amounting to

EUR 22,423 thousand was paid on 18 June 2015, as per the following detail:

-

final dividend of EUR 0.10 per share relating to 223,405,910 ordinary shares identified by

the Spanish National Securities Coding Agency with ISIN 019427734, paid in full out of the

Parent's profit for 2014, amounting to EUR 22,340 thousand and representing 13% of the par

value.

-

dividend of EUR 0.07 per share relating to 1,181,296 ordinary shares identified by the

Spanish National Securities Coding Agency with ISIN 019427015 which, as established when they

were issued, represented the share of profits generated by the Company subsequent to 31 October

2014, amounting to EUR 83 thousand and representing 9% of the par value.

At the Company's Board of Directors meeting held on 18 November 2015, it was resolved to

distribute out of the Company's profit for 2015, the gross amount of eighteen euro cents (EUR

0.18) for each of the 225,732,800 shares with a par value of EUR 0.75 representing the share

capital, of which 789,738 are treasury shares. Accordingly, the dividend rights inherent to treasury

shares were attributed proportionately to the other shares in accordance with Article 148 of the

Spanish Limited Liability Companies Law.

This dividend, which was paid to the shareholders as an interim dividend on 17 December 2015,

totalled EUR 40,490 thousand.

13.- Provisions and contingencies

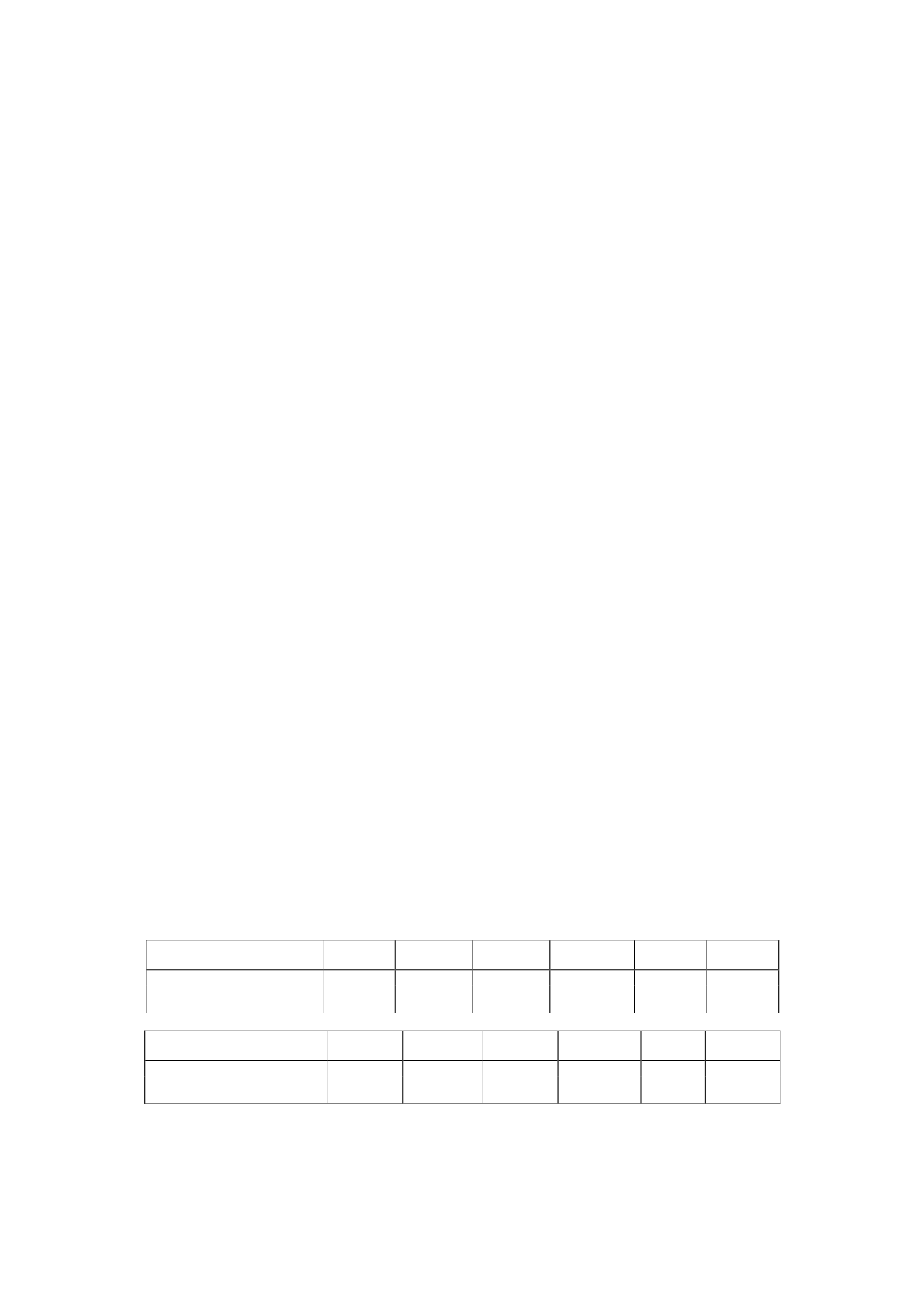

The detail of short- and long-term provisions in 2015 and 2014 were as follows (in thousands of

euros):

Provisions

Balance at

01/01/15

Charge for

the year

Transfers

Amounts

used

Excessive

provisions

Balance at

31/12/15

Litigation and other provisions

28,556

11,242

(8,763)

(1,527)

(6,602)

22,906

Total

28,556

11,242

(8,763)

(1,527)

(6,602)

22,906

Provisions

Balance at

01/01/14

Charge for

the year

Transfers

Amounts

used

Excessive

provisions

Balance at

31/12/14

Litigation and other provisions

34,304

2,301

1,446

(5,126) (4,369)

28,556

Total

34,304

2,301

1,446

(5,126) (4,369)

28,556

The charge for the year is reflected under "Outside Services" and the excessive provisions are

recognised under "Excessive Provisions” in the accompanying statement of profit or loss.