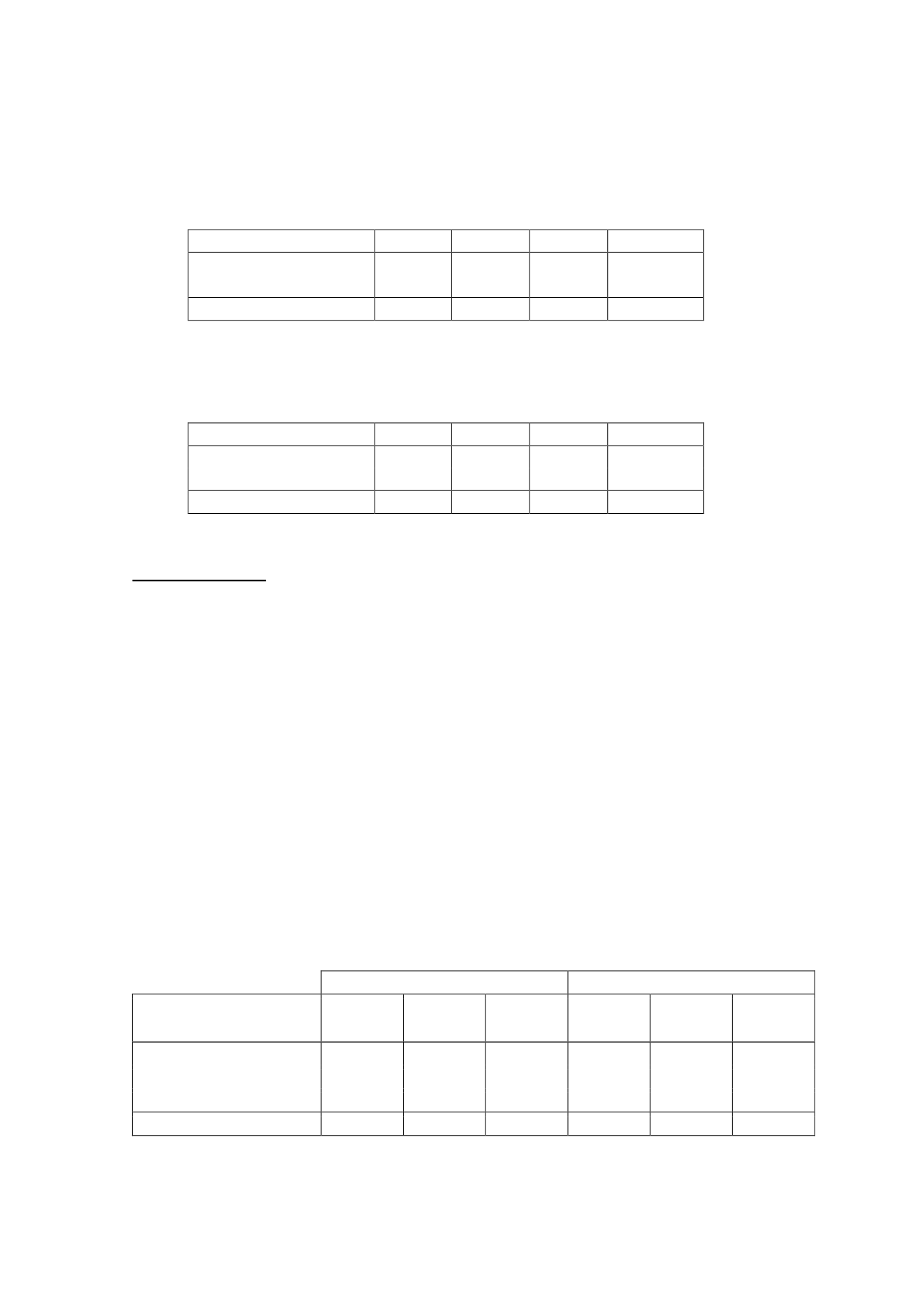

The detail, by maturity, of the balances of “Trade Payables - Other Non-Current Liabilities” at

31 December 2015 is as follows:

Thousands of euros

2017

2018

2019

Total

Trade payables

44,333

1,644

60

46,037

Other non-current payables

574

-

-

574

Other non-current liabilities

44,907

1,644

60

46,611

The detail, by maturity, of the items included under “Other Non-Current Liabilities” at 31

December 2014 is as follows:

Thousands of euros

2016

2017

2018

Total

Trade payables

45,639

4,710

42

50,391

Other non-current payables

304

-

-

304

Other non-current liabilities

45,943

4,710

42

50,695

13. Bank borrowings

On 4 May 2015, the Parent, Atresmedia Corporación de Medios de Comunicación, S.A.,

arranged a new syndicated loan of EUR 270,000 thousand, which was earmarked to repay

the syndicated financing arranged in August 2013 and to meet the Parent's general corporate

and cash requirements. At 31 December 2015, the limit of the aforementioned financing was

EUR 270,000 thousand.

50% of the total amount is a four-year loan with partial repayments and the remaining 50%

is a credit facility maturing at four years. Eight banks with which the Parent has regular

dealings participated in the transaction.

At 31 December 2015, a portion of the financing had not been drawn down as a result of the

cash surplus generated at the end of the year.

The applicable interest rate is Euribor plus a market spread and the transaction is subject to

compliance with financial covenants habitually used in transactions of this kind: the debt to

EBITDA ratio and the interest coverage ratio. The fair value of this financing approximates its

carrying amount.

The detail of the items included under “Bank Borrowings” at 31 December 2015 and 2014 is

as follows:

2015

2014

Thousands of euros

Limit

Short-term

balance

drawn down

Long-term

balance

drawn down

Limit

Short-term

balance

drawn down

Long-term

balance

drawn down

Syndicated financing

270,000

13,500

127,437

235,750

37,574

126,331

Credit facilities

70,000

17,823

-

-

-

Interest payable

-

721

-

-

1,432

-

Total

340,000

32,044

127,437

235,750

39,007

126,331