arranged at interest rates tied to Euribor. In view of the bank borrowings at 31 December

2015, changes of 100 basis points in the total cost borne would give rise to a +/- EUR 1.6

million change in the interest on the borrowings at that date. To mitigate this risk, the Parent

has arranged interest rate swaps to limit the finance costs arising from its floating-rate

borrowings (see Note 14).

Foreign currency risk is concentrated at the Parent and relates basically to the payments to

be made in international markets to acquire broadcasting rights. In order to mitigate foreign

currency risk, the Parent arranges hedging instruments, mainly currency forwards, to hedge

its exposure to the USD/EUR forward exchange rate. Sensitivity to changes in the exchange

rate is described in Note 14.

18. Income and expenses

a)

Revenue

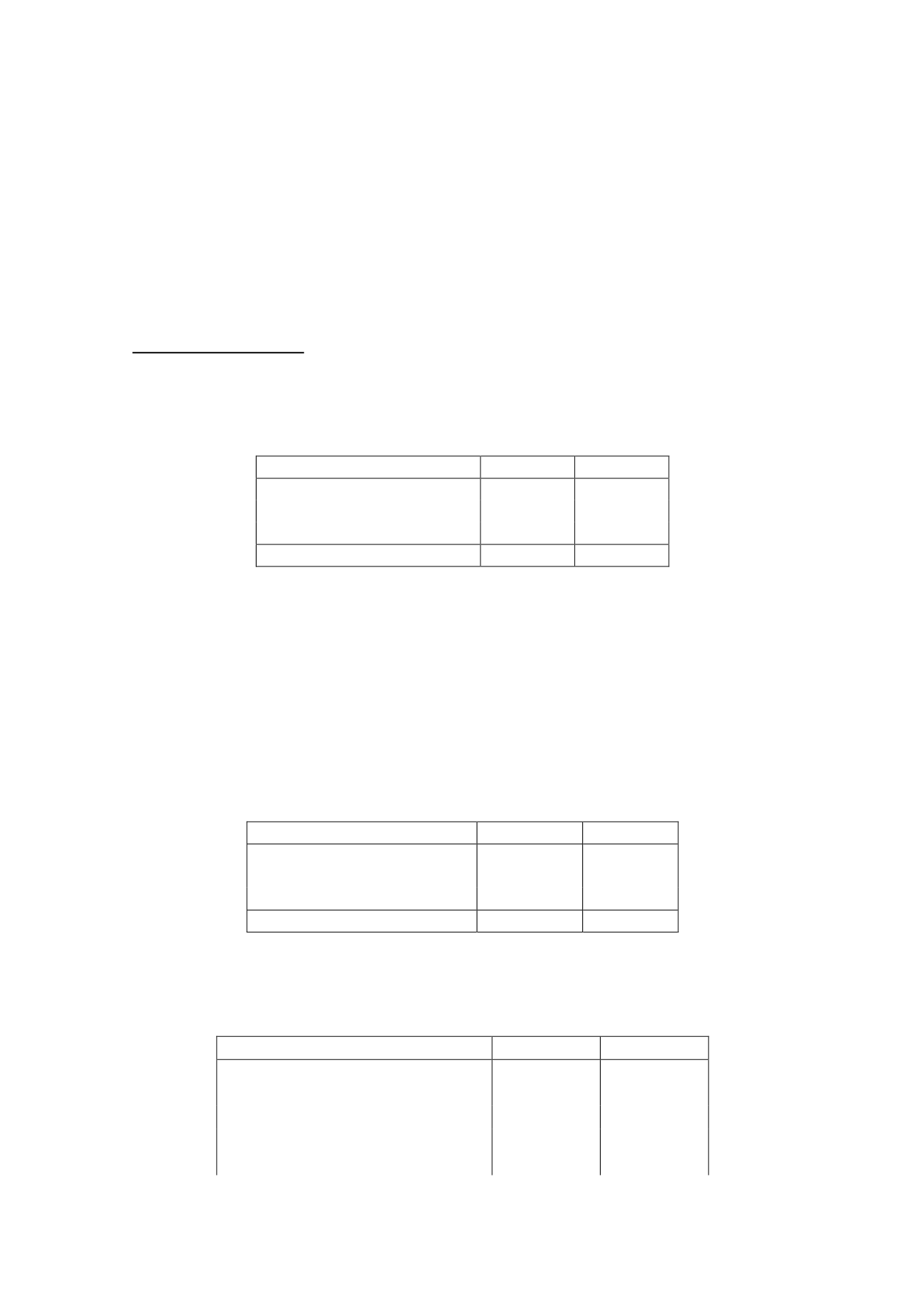

The detail, by business line, of the Group's revenue for 2015 and 2014 is as follows:

Thousands of euros

2015

2014

Advertising sales

925,421

858,017

Other sales

41,070

29,578

Trade and other discounts

(41,922)

(37,704)

Total

924,569

849,891

In 2015 transactions exceeding 10% of total operating income were performed with two

customers (media buyers grouping together advertising orders of various advertisers), which

represented 19% and 17% (individually) and 36% (as an aggregate) of total advertising

sales.

In 2014 transactions exceeding 10% of total operating income were performed with two

customers (media buyers grouping together advertising orders of various advertisers), which

represented 19% and 18% (individually) and 37% (as an aggregate) of total advertising

sales.

The detail, by geographical market, of the Group's revenue for 2015 and 2014 is as follows:

Thousands of euros

2015

2014

Spain

918,853

845,147

Other EU countries

5,102

3,298

Other non-EU countries

614

1,446

Total

924,569

849,891

b)

Programme amortisation and other procurements

The detail of “Programme Amortisation and Other Procurements” is as follows:

Thousands of euros

2015

2014

External production services

245,433

215,563

Broadcasting of in-house productions

229,348

221,154

Programme broadcasting rights

167,932

165,364

Live broadcasting rights

49,827

36,706

Performances and contributions of entertainers

13,842

13,219