At 31 December 2015, the Group had arranged instruments to hedge its foreign currency

asset and liability positions amounting to USD 244,048 thousand, at a weighted average

exchange rate of 1.1821 (USD/EUR). At 31 December 2014, the Group had arranged

hedging instruments amounting to USD 230,233 thousand, at a weighted average exchange

rate of 1.3279 (USD/EUR).

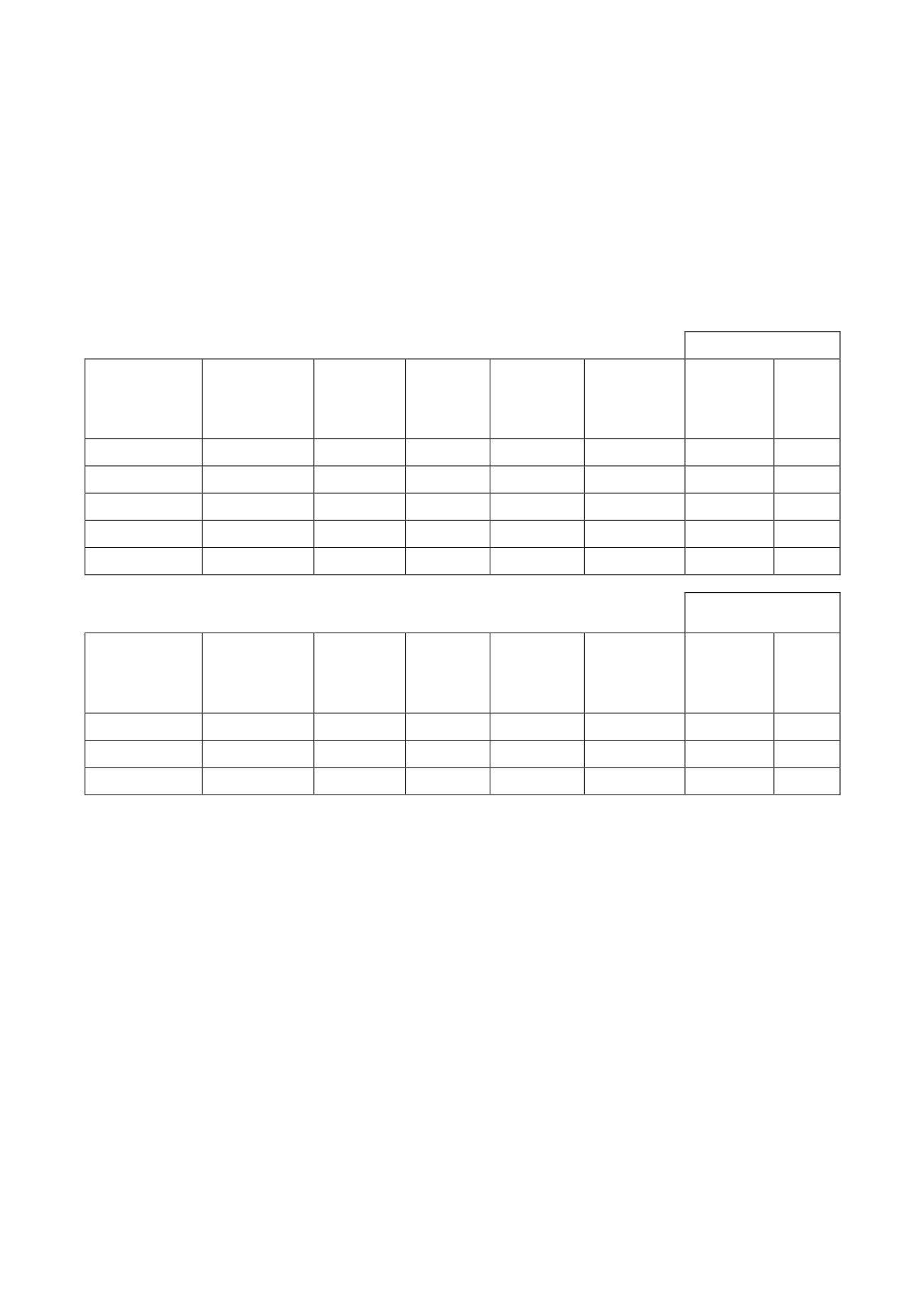

At the end of 2015 and 2014, the total amounts of the outstanding forward currency

purchase contracts entered into by the Group were as follows:

Fair value

(thousands of euros)

2015

Classification

Type

Maturity

Amount

arranged

(thousands

of euros)

Ineffective

portion

recognised in

profit or loss

(thousands

of euros)

Assets

Liabilities

Currency forwards Foreign currency

hedge

Purchase of

USD

2016

126,210

-

13,112

145

Currency forwards Foreign currency

hedge

Purchase of

USD

2017

57,383

-

2,482

41

Currency forwards Foreign currency

hedge

Purchase of

USD

2018

20,465

-

267

107

Currency forwards Foreign currency

hedge

Purchase of

USD

2019

2,002

-

18

17

Currency forwards Foreign currency

hedge

Purchase of

USD

2020

398

-

3

-

Fair value

(thousands of euros)

2014

Classification

Type

Maturity

Amount

arranged

(thousands

of euros)

Ineffective

portion

recognised in

profit or loss

(thousands

of euros)

Assets

Liabilities

Currency forwards Foreign currency

hedge

Purchase of

USD

2015

151,142

-

11,740

8

Currency forwards Foreign currency

hedge

Purchase of

USD

2016

72,103

-

3,982

6

Currency forwards Foreign currency

hedge

Purchase of

USD

2017

6,988

-

415

1

At 31 December 2015, the estimated fair value of the Group's foreign currency derivatives,

which are designated and effective as cash flow hedges, represented a financial asset of EUR

15,882 thousand and a financial liability of EUR 310 thousand (2014: asset of EUR 16,137

thousand and liability of EUR 15 thousand).

The valuation method consists of estimating the present value of the future cash flows that

will arise under the terms and conditions arranged by the parties for the derivative

instrument. The spot price is taken to be the reference exchange rate of the European

Central Bank on 31 December 2015, the swap points (offer/bid), the interest rates prevailing

at the valuation date and the credit risk.

The sensitivity analysis of the foreign currency derivative financial instruments demonstrates

that changes of +/-10% in the USD/EUR exchange rate prevailing at year-end would give

rise to changes in fair value within a range of EUR +/-14.5 million for hedges the underlying

of which is in force at year-end and changes of EUR +/-6.6 million for hedges the underlying

of which is not yet in force and therefore affect equity. Appreciations in the USD/EUR

exchange rate give rise to increases in the value while depreciations in the exchange rate

give rise to decreases in the value.

With respect to the sensitivity analysis of the balances payable to suppliers in USD, changes

of +/-10% in the USD/EUR exchange rate prevailing at year-end would give rise to changes