in the fair value recognised of around EUR +/-15.9 million, and would be sufficiently offset

by the changes in the value of the derivatives arranged.

In 2014 changes of +/-10% in the exchange rate prevailing at year-end would have given

rise to changes in the fair value of the derivatives of around EUR +/-17.5 million and of EUR

+/-18.0 million of the accounts payable in USD. In 2014 the impact of the changes in fair

value of the derivatives related mainly to the hedges, the underlying of which was in force at

year-end.

Financial instruments measured at fair value must be classified as levels 1 to 3, based on the

degree of verification of their fair value. Therefore, fair values derived from quoted prices on

active markets will be classified as level 1. Those derived from external information other

than quoted prices will be classified as level 2. And values obtained using valuation

techniques including data that are not observable in active markets will be classified as level

3. The Group's derivatives detailed in this heading would be classified as level 2, since they

are observable inputs that refer to market data.

Interest rate hedges

In May 2015 the Parent arranged interest rate swaps in order to fix the finance cost arising

from the floating rates applicable to each of the tranches of the syndicated financing

arranged at that date. These swaps expire in August 2019 and the hedged amount is EUR

121,500 thousand, with a fixed interest rate of 0.94%. At 31 December 2015, the fair value

of the swaps amounted to EUR 2,592 thousand and was recognised as a financial liability.

This derivative would be included in level 2.

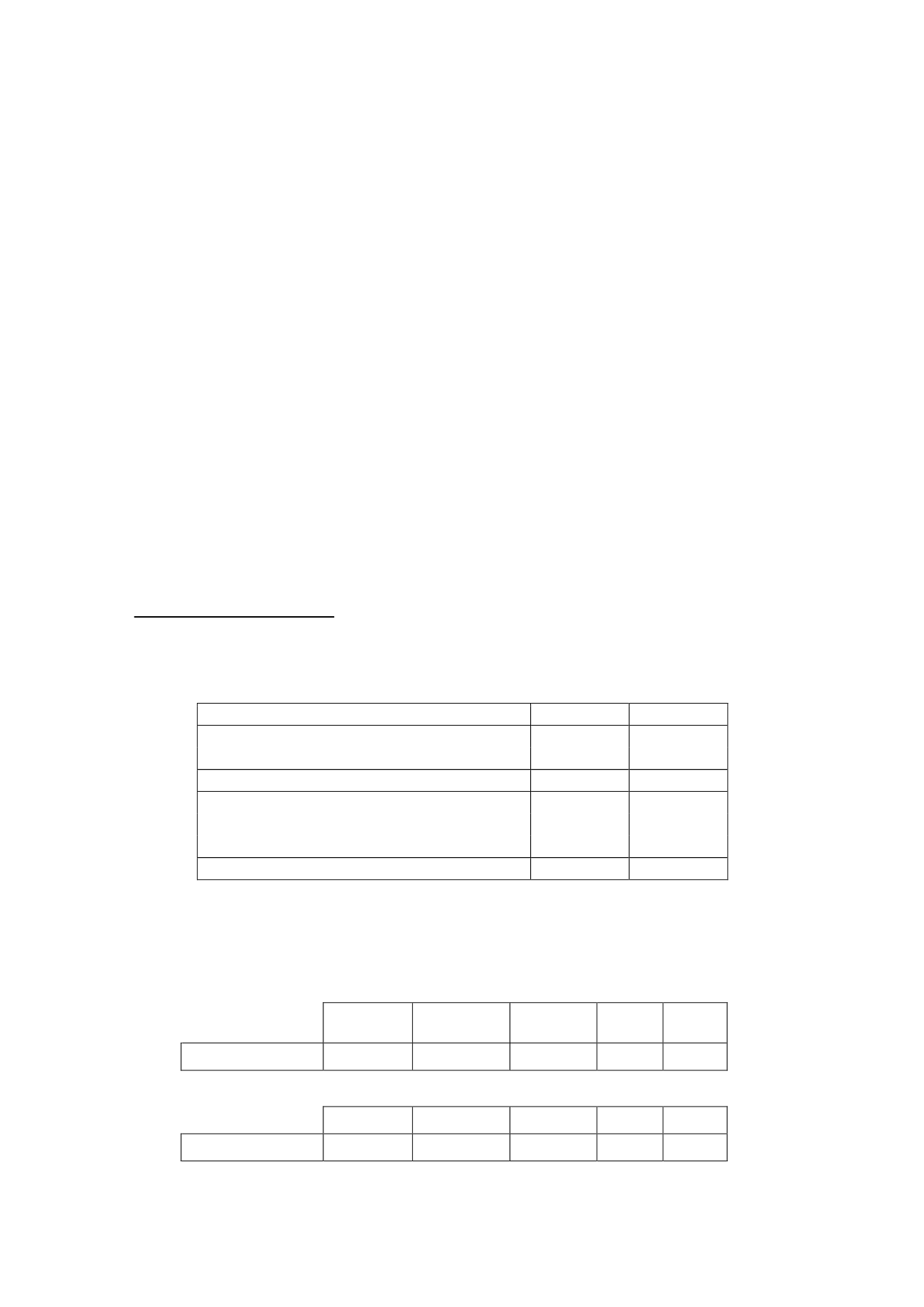

15. Trade and other payables

The detail of trade and other payables in the consolidated balance sheets as at 31 December

2015 and 2014 is as follows:

Thousands of euros

2015

2014

Payable to suppliers

346,046

339,879

Payable to associates and related parties (Note 22)

53,148

59,178

Total payable to suppliers

399,194

399,057

Other accounts payable to public authorities (Note 21-d)

18,067

10,699

Other non-trade payables

17,645

16,218

Customer advances

1,398

2,552

Total other payables

37,110

29,469

The Group has accounts payable to suppliers, relating mainly to external production rights

denominated in foreign currency, mostly US dollars, which are recognised at each accounting

close using the USD/EUR exchange rate prevailing at that date. The detail, by maturity, in

2015 and 2014 is as follows (in thousands of euros):

2015

Thousands of euros

2016

2017

2018

2019

Total

Payable to suppliers,

foreign currency

126,595

37,411

1,560

61

165,627

2014

Thousands of euros

2015

2016

2017

2018

Total

Payable to suppliers,

foreign currency

114,926

42,169

4,710

42

161,847