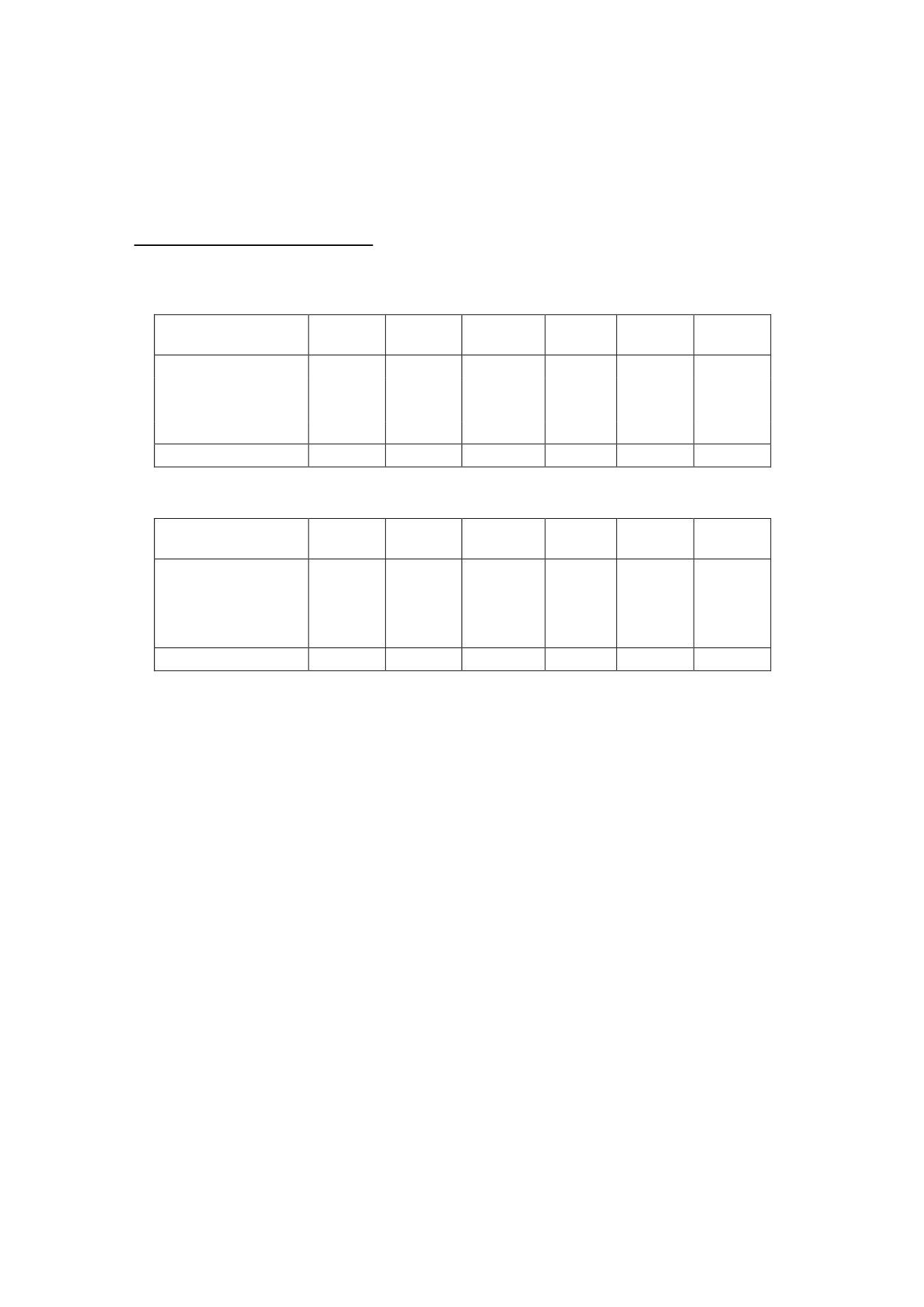

12. Provisions and other liabilities

The changes in the short- and long-term provisions in 2015 and 2014 were as follows:

Thousands of euros

Balance at

31/12/14 Provisions

Amounts

used and

payments

Excessive

provisions Transfers Balance at

31/12/15

Operating provisions

44,488

50,554

(41,426)

-

-

53,616

Provisions for litigation

30,307

10,392

(2,137)

(6,602)

(6,903)

25,057

Other provisions

13,549

2,830

(195)

-

(1,860)

14,324

Total provisions

88,344

63,776

(43,758)

(6,602)

(8,763)

92,997

Thousands of euros

Balance at

31/12/13 Provisions

Amounts

used and

payments

Excessive

provisions Transfers Balance at

31/12/14

Operating provisions

34,206

36,602

(26,320)

-

-

44,488

Provisions for litigation

27,502

7,107

(7,274)

(4,369)

7,341

30,307

Other provisions

13,642

6,532

(730)

-

(5,895)

13,549

Total provisions

75,350

50,241

(34,324)

(4,369)

1,446

88,344

Short- and long-term

provisions in the consolidated balance sheet include, inter alia,

operating provisions relating basically to volume rebates paid yearly which accrue over the

course of the year, the period additions, use and excessive amounts of which are recognised

under “Revenue” in the consolidated statement of profit or loss.

“Provisions for Litigation” relates mainly to the best estimate in this connection. The payment

schedule related to litigation is based on court judgments and is therefore difficult to

estimate. “Other Provisions” relates mainly to estimated future payments. The period

additions, use and excessive amounts of both these types of provisions are recognised under

“Other Operating Expenses” in the consolidated statement of profit or loss.

The agreement for the partial novation of the integration agreement entered into by the

Parent for the merger with Gestora de Medios Audiovisuales La Sexta, S.A. on 19 February

2014 (see Note 11-e), included the assumption of a contingency of the former shareholders

of La Sexta corresponding to the tax assessments relating to the levy on games of luck,

betting or chance, raffles and tombolas. The assumption of this contingency gave rise to the

recognition of the related provision of EUR 6,903 thousand in the Parent's financial

statements. In the first half of 2015, this provision was reversed as a final judgment was

handed down in relation to the proceeding. The accounting entry and the reversal of the

provision did not have any impact on the Group's consolidated statement of profit or loss.

Also, “Other Non-Current Liabilities” relates mainly to the amounts maturing at more than

twelve months of the payables to suppliers of external production rights; these maturities

are set on the basis of the availability periods of those rights. This account payable does not

accrue interest and its measurement at fair value had a negative impact of EUR 1,886

thousand presented under “Net Gain (Loss) Due to Changes in the Value of Financial

Instruments at Fair Value” in the consolidated statement of profit or loss.