Reserve for retired capital

As a result of the capital reduction made in 2006, a reserve of EUR 8,333 thousand was

established, equal to the par value of the retired shares, which may only be used if the

same requirements as those for the reduction of share capital are met, pursuant to

Article 335-c of the Spanish Limited Liability Companies Law.

Other restricted reserves

Restricted reserves include an amount of EUR 281 thousand which is restricted as to its

use since it corresponds to the “Reserve for the Adjustment of Share Capital to Euros”.

“Equity - Retained Earnings” in the consolidated balance sheet includes a restricted

reserve arising from the subsidiary Uniprex, S.A. (Sole-Shareholder Company). This is a

reserve for goodwill

recognised by appropriating from profit for the year an amount equal

to 5% of the goodwill on the asset side of the subsidiary's balance sheet until the full

amount of the reserve is reached, as required by Spanish corporate legislation. At 31

December 2015, this reserve amounted to EUR 33,890 thousand (31 December 2014:

EUR 26,484 thousand).

d)

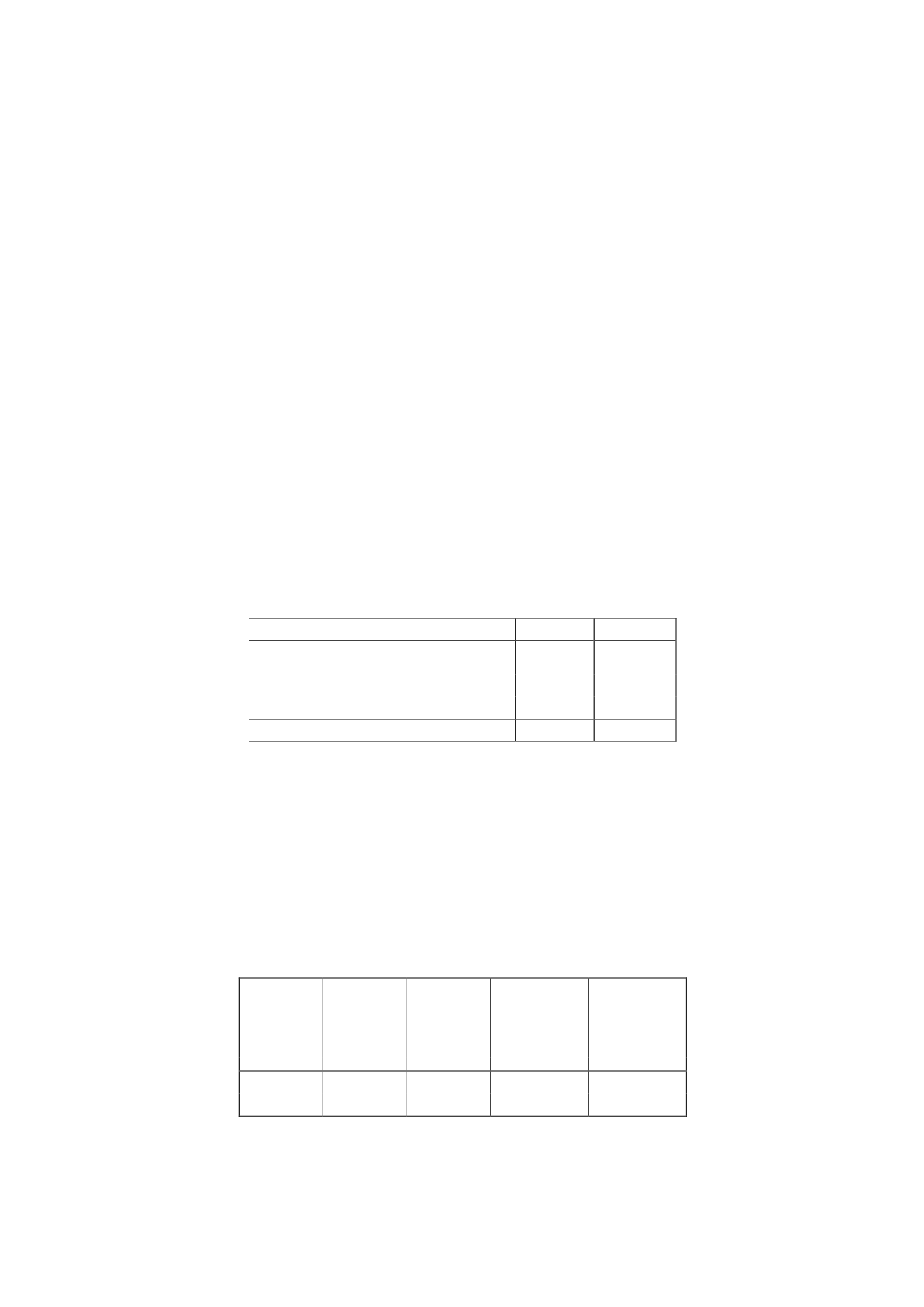

Contributions to consolidated profit by company

The detail of the contributions to the consolidated profit for the year of the fully

consolidated companies and the companies accounted for using the equity method at 31

December 2015 and 2014 is as follows:

Thousands of euros

2015

2014

Atresmedia Corporación de Medios de

Comunicación subgroup

81,716

36,288

Uniprex subgroup

12,729

8,329

Other

4,762

2,035

Total

99,207

46,652

The method used to determine the contribution to consolidated profit maintains the

transactions between Group companies that are necessary for the conduct of their

business activities under normal market conditions.

e)

Treasury shares

The detail of the treasury shares held by the Parent at the end of 2015 and 2014 is as

follows:

Year

No. of

shares

Par value

(euros)

Average

acquisition

price (euros)

Total

acquisition

cost

(thousands

of euros)

2015

789,738

592,304

10.97

8,666

2014

1,145,594

859,196

6.29

7,202