The market variables that influence the value of this asset are the market price of the

Parent's share, its volatility and its dividend yield. The Group's estimated results also have

an influence. The market price and historical volatility at 31 December 2015 were used to

measure the value of the asset at that date, and the market consensus at year-end and

credit risk (due to application of IFRS 13) were used to estimate results and the dividend

yield.

9.

Programme rights

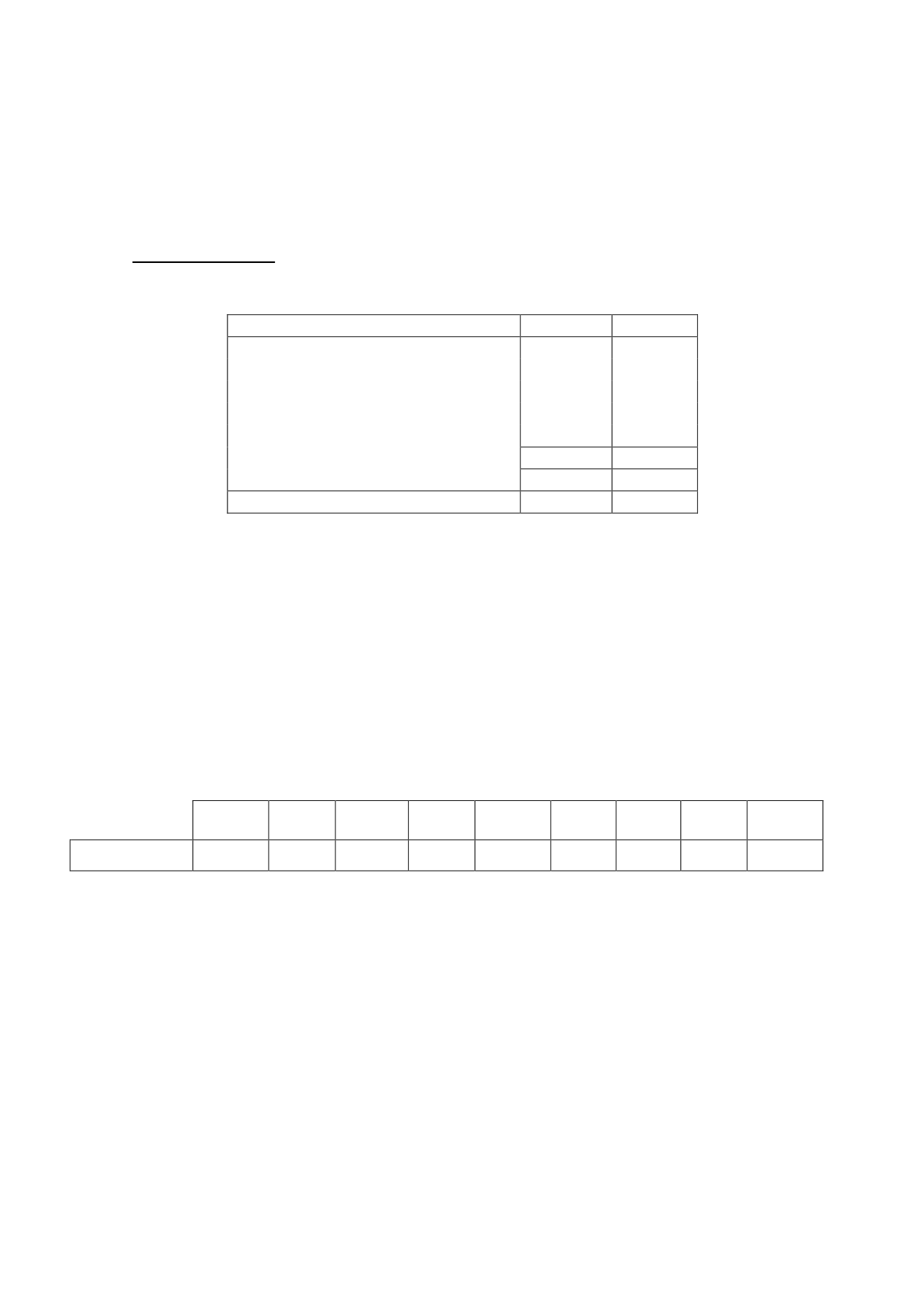

The detail of “Programme Rights” is as follows:

Thousands of euros

2015

2014

Programme rights, net

Rights on external productions

330,017

277,114

In-house productions and productions in process

25,171

18,782

Sports broadcasting rights

14,568

3,214

Write-down of external productions

(35,545)

(38,406)

334,211

260,704

Advances to suppliers

14,457

25,171

Total

348,668

285,875

At 31 December 2015, the Parent had commitments, mainly for the purchase of audiovisual

property rights and the production of programmes, amounting to EUR 299,204 thousand

(2014: EUR 279,146 thousand). In addition, the Parent has purchase commitments to

distributors, the definitive amount and price of which will be determined once the

programmes are produced and, in certain cases, by establishing the acquisition price on the

basis of box-office takings. In 2015 the best estimate of these commitments amounted to

EUR 120,913

thousand (2014:

EUR 94,312 thousand).

It is estimated that inventoriable in-house productions will be amortised in full and

approximately EUR 170,000 thousand of external production rights will be amortised in

2016.

The changes in the write-downs of external production rights included under “Programme

Rights” in the consolidated balance sheet were as follows (in thousands of euros):

Balance at

31/12/13

Additions

Transfers

Disposals

or

reductions

Balance at

31/12/14

Additions Transfers

Disposals

or

reductions

Balance at

31/12/15

Write-downs

(33,755)

(7,073)

315

2,106

(38,406)

-

-

2,861

(35,545)

The write-downs recognised arose since it was decided that certain titles would not be

marketable and it was not likely that they would form part of the Parent’s programme

schedule. Also, in 2014 in relation to the impact of the shutdown of three channels (see Note

1), an adjustment of EUR 3 million was made to the value of certain audiovisual rights, as it

was no longer possible to broadcast the channels. These write-downs were recognised under

“Programme Amortisation and Other Procurements” in the consolidated statement of profit or

loss.