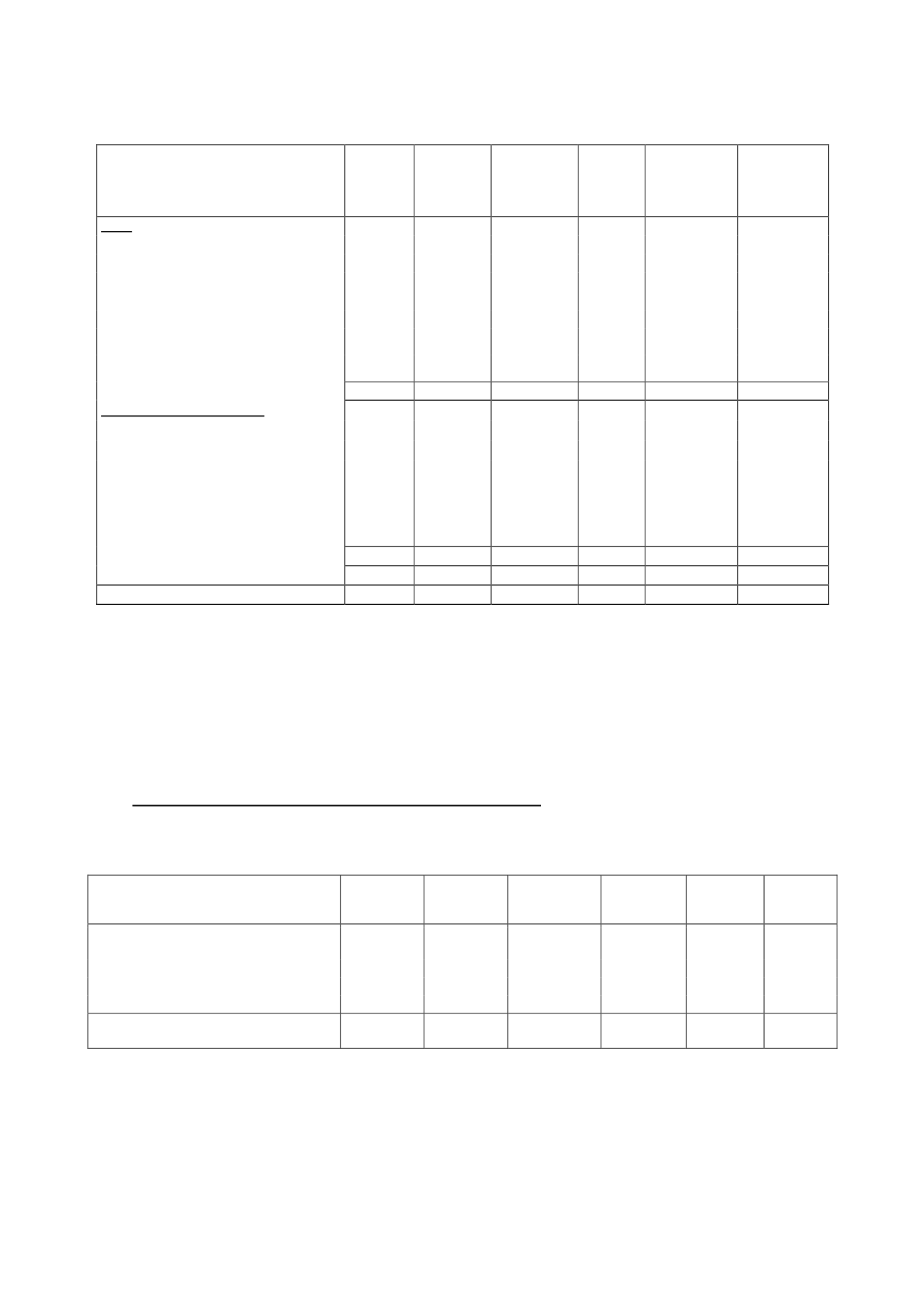

Thousands of euros

Balance at

01/01/14

Additions

or charge

for the year

Disposals or

reductions Transfers

Additions/

disposals due

to changes in

the scope of

consolidation

Balance at

31/12/14

Cost:

Land and buildings

65,498

-

-

335

-

65,833

Plant and machinery

89,327

-

(2,715)

4,588

-

91,200

Other fixtures and tools

52,673

-

-

987

-

53,660

Furniture

13,234

-

(206)

268

-

13,296

Computer hardware

35,761

-

(1,892)

1,812

-

35,681

Transport equipment and other items of

property, plant and equipment

2,319

-

(288)

89

-

2,120

Property, plant and equipment in the

course of construction

255

7,858

- (8,045)

-

68

259,067

7,858

(5,100)

34

-

261,858

Accumulated depreciation:

Land and buildings

(33,255)

(1,665)

-

-

-

(34,920)

Plant and machinery

(76,845)

(5,820)

2,662

14

-

(79,989)

Other fixtures and tools

(48,525)

(1,368)

-

-

-

(49,893)

Furniture

(12,142)

(496)

204

-

-

(12,434)

Computer hardware

(31,396)

(2,091)

1,880

-

-

(31,607)

Transport equipment and other items of

property, plant and equipment

(2,242)

(44)

288

-

-

(1,998)

(204,405)

(11,483)

5,034

14

-

(210,841)

Net impairment losses:

(2,687)

-

3

-

-

(2,684)

Total

51,975

(3,626)

(63)

48

-

48,333

At 31 December 2015, fully depreciated property, plant and equipment in use amounted to

EUR 162,740 thousand (31 December 2014: EUR 158,603 thousand). The Group does not

have any temporarily idle items.

The Group has taken out insurance policies to cover the possible risks to which its property,

plant and equipment are subject and the claims that might be filed against it for carrying on

its business activities. These policies are considered to adequately cover the related risks.

7.

Investments accounted for using the equity method

The changes in the investments accounted for using the equity method in 2015 and 2014

were as follows:

Thousands of euros

Balance at

01/01/15

Changes in

the scope of

consolidation

Additions or

disposals

Share of

results

Other

changes

Balance at

31/12/15

Investments accounted for using the

equity method

Atlantis Global Solutions, S.L.

45

(45)

-

-

-

-

I3 Televisión, S.L.U.

209

-

-

26

-

235

Hola TV América Group

-

-

3,083

(2,346)

(737)

-

Investments accounted for using the

equity method

254

(45)

3,083

(2,320)

(737)

235