In 2001 the Group began to file consolidated tax returns. Atresmedia Corporación de

Medios de Comunicación, S.A. is the Parent of this consolidated tax group (see Note 21).

p)

Foreign currency transactions

The functional currency of the Parent and its investees is the euro. Therefore,

transactions in currencies other than the euro are deemed to be “foreign currency

transactions” and are recognised by applying the exchange rates prevailing at the date of

the transaction.

q)

Consolidated statements of cash flows

The following terms are used in the consolidated statements of cash flows with the

meanings specified:

Cash flows: inflows and outflows of cash and cash equivalents, which are short-term,

highly liquid investments that are subject to an insignificant risk of changes in value.

Operating activities: the principal revenue-producing activities of the Group and other

activities that are not investing or financing activities.

Investing activities: the acquisition and disposal of long-term assets and other

investments not included in cash and cash equivalents.

Financing activities: activities that result in changes in the size and composition of equity

and borrowings that are not operating activities.

r)

Earnings per share

Basic earnings per share are calculated by dividing net profit for the year attributable to

the Parent by the weighted average number of ordinary shares of the Parent outstanding

during the year.

The Group has not carried out transactions of any kind that have led to diluted earnings

per share differing from basic earnings per share (see Note 23).

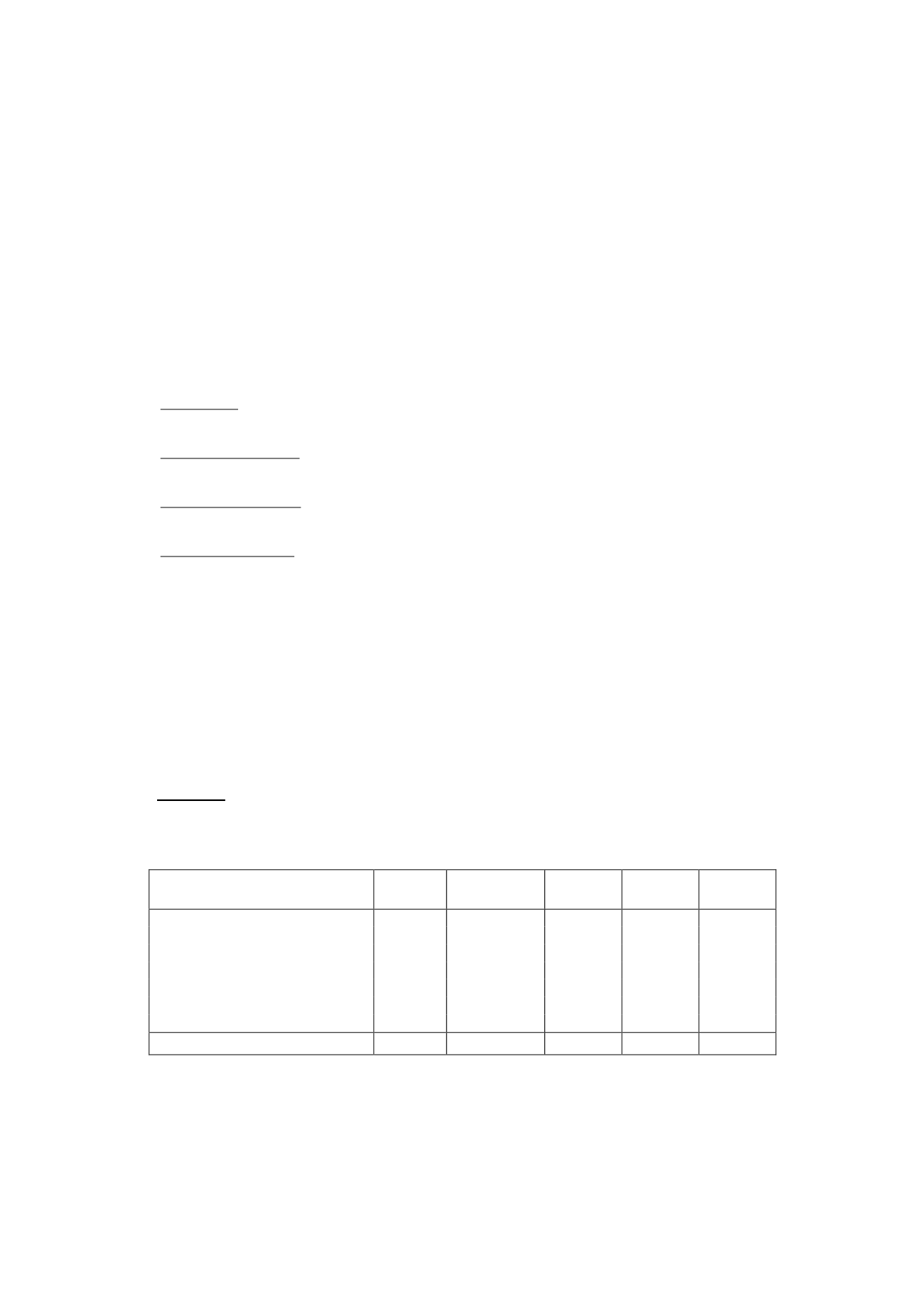

4. Goodwill

The changes in “Goodwill” in the consolidated balance sheets in 2015 and 2014 were as

follows:

Thousands of euros

Balance at

31/12/13

Additions/

Disposals

Balance at

31/12/14 Impairment Balance at

31/12/15

RADIO BUSINESS:

Uniprex, S.A.U.

148,113

-

148,113

-

148,113

Canal Media Radio, S.L.U.

1,899

-

1,899

-

1,899

Canal Media Radio Galicia, S.A.U.

-

-

-

-

-

Ipar Onda, S.A.U.

-

-

-

-

-

OTHER BUSINESSES:

Cordina Planet, S.L.U.

3,181

-

3,181

(3,181)

-

TOTAL

153,193

-

153,193

(3,181)

150,012

The Group periodically assesses the recoverability of the goodwill described in the foregoing

table, considering the cash-generating units on the basis of the business activities of its

subsidiaries, which at year-end were the radio business and other businesses.