Note 14, Derivative financial instruments, refers to the sensitivity analysis of the balances

payable to suppliers in US dollars in relation to changes in the exchange rate at year-end.

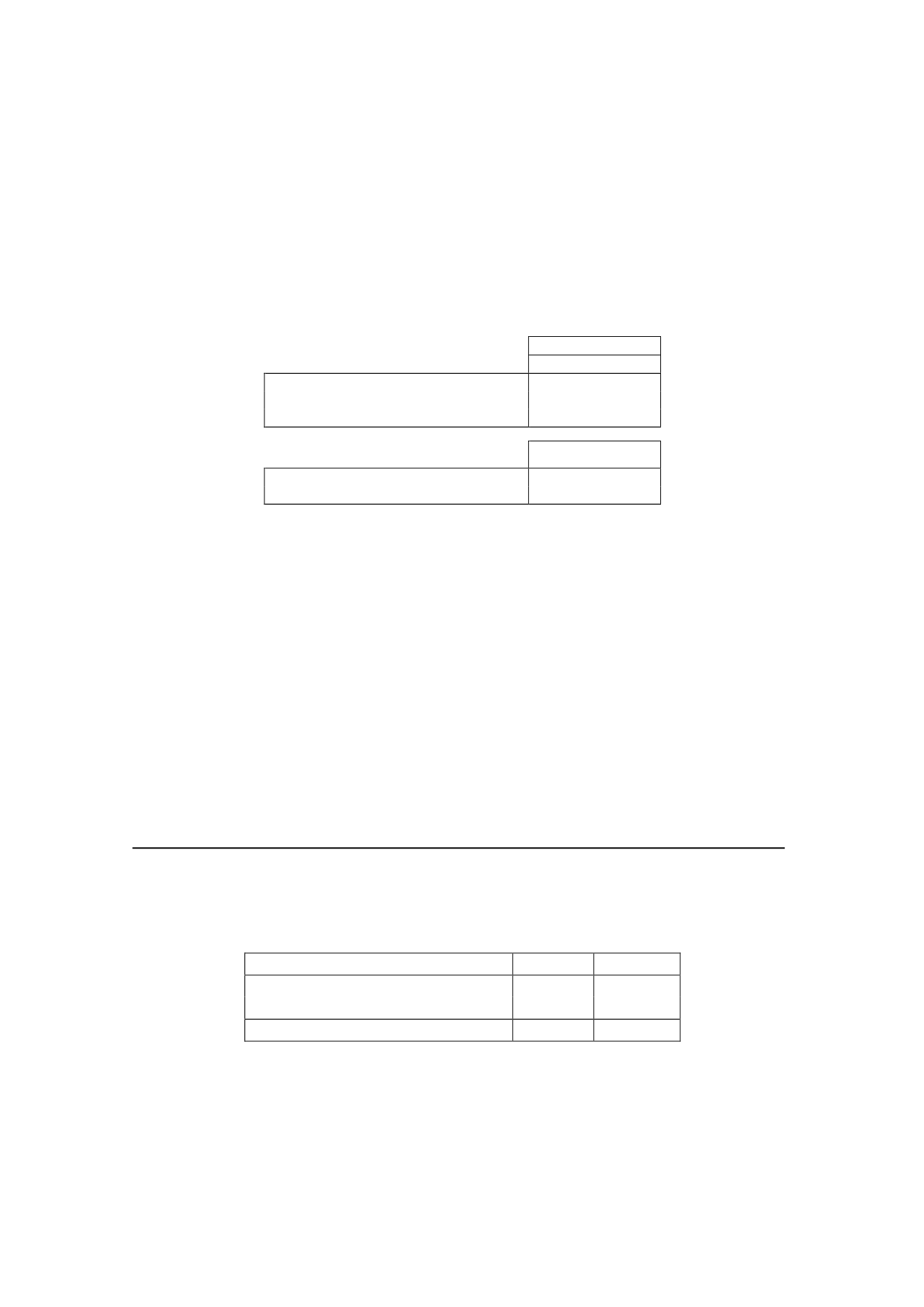

Set forth below are the disclosures required by Additional Provision Three of Law 15/2010, of

5 July (amended by Final Provision Two of Law 31/2014, of 3 December), prepared in

accordance with the Spanish Accounting and Audit Institute (ICAC) Resolution of 29 January

2016 on the disclosures to be included in notes to financial statements in relation to the

average period of payment to suppliers in commercial transactions.

As provided for in the Single Additional Provision of the aforementioned ruling, no

comparative information is presented since this year is the first in which it is applicable.

2015

Days

Average period of payment to suppliers

76

Ratio of transactions settled

86

Ratio of transactions not yet settled

39

Thousands

of euros

Total payments made

614,873

Total payments outstanding

159,282

In accordance with the ICAC Resolution, the average period of payment to suppliers was

calculated by taking into account the commercial transactions relating to the supply of goods

or services for which payment has accrued since the date of entry into force of Law 31/2014,

of 3 December.

For the sole purpose of the disclosures provided for in the Resolution, suppliers are

considered to be the trade creditors for the supply of goods or services included in “Payable

to Suppliers” and “Payable to Suppliers - Payable to Associates and Related Parties” under

current liabilities in the consolidated balance sheet.

“Average period of payment to suppliers” is taken to be the period that elapses from the

delivery of the goods or the provision of the services by the supplier to the effective payment

of the transaction.

16. Other guarantee commitments to third parties and contingent assets and liabilities

a)

Guarantee commitments to third parties

The detail of the guarantees provided by the Group to banks for third- and related parties is

as follows:

Thousands of euros

2015

2014

Group companies and associates

1,510

2,641

Other guarantees

17,505

10,985

Total

19,015

13,626

The Parent’s directors consider that any liabilities not foreseen at 31 December 2015 that

might arise from the guarantees provided would not be material.