57

On 31 October 2012, the merger by absorption of Gestora de Inversiones Audiovisuales La

Sexta ("La Sexta") into Antena 3 de Televisión was registered at the Mercantile Registry of

Madrid.

As a result of the merger, Antena 3 de Televisión acquired all the assets and liabilities of La

Sexta by universal succession and was subrogated to all the rights and obligations of the

absorbed company.

The merger became effective for accounting purposes on 5 October 2012.

The Company opted to avail itself of the special tax regime for mergers, spin-offs, asset

contributions and security exchanges provided in Title VII, Chapter VIII of the Consolidated

Spanish Corporation Tax Law approved by Legislative Royal Decree 4/2004, of 5 March.

In the process of allocating the price of the business combination to assets and liabilities, the

La Sexta trademark and the La Sexta multiplex operating licence were identified. The

trademark will be amortised for accounting purposes over 20 years and the licence is

considered to have an indefinite useful life.

On 8 November 2013 the merger, whereby Estaciones Radiofónicas de Aragón, S.A. (Sole-

Shareholder Company), Ipar Onda, S.A. (Sole-Shareholder Company), Onda Cero, S.A. (Sole-

Shareholder Company) and Radio Media Galicia, S.L. (Sole-Shareholder Company) were

absorbed by Uniprex, S.A. (Sole-Shareholder Company) and dissolved without liquidation, was

executed in a public deed, which also reflected the approval of the balance sheet for the year

ended 31 December 2012 as the merger balance sheet.

Merger goodwill for tax purposes amounted to EUR 554 thousand (EUR 260 thousand of Ipar

Onda, S.A. and EUR 295 thousand of Radio Media Galicia, S.L.) and is being amortised at an

annual rate of 5%, regardless of the rate at which the related amortisation is charged to profit

or loss for accounting purposes. This amortisation is deductible for tax purposes (see Note 5).

On 3 November 2014, the merger, whereby Publiseis Iniciativas Publicitarias was absorbed by

Atres Advertising, S.L.U. and dissolved without liquidation, was executed in a public deed

subsequent to the sale of the ownership interest by Atresmedia Corporación to its subsidiary.

In addition, the balance sheet for the year ended 31 December 2013 was approved as the

merger balance sheet. The company availed itself of the special merger regime provided for in

Title VII, Chapter VIII of the Consolidated Spanish Corporation Tax Law.

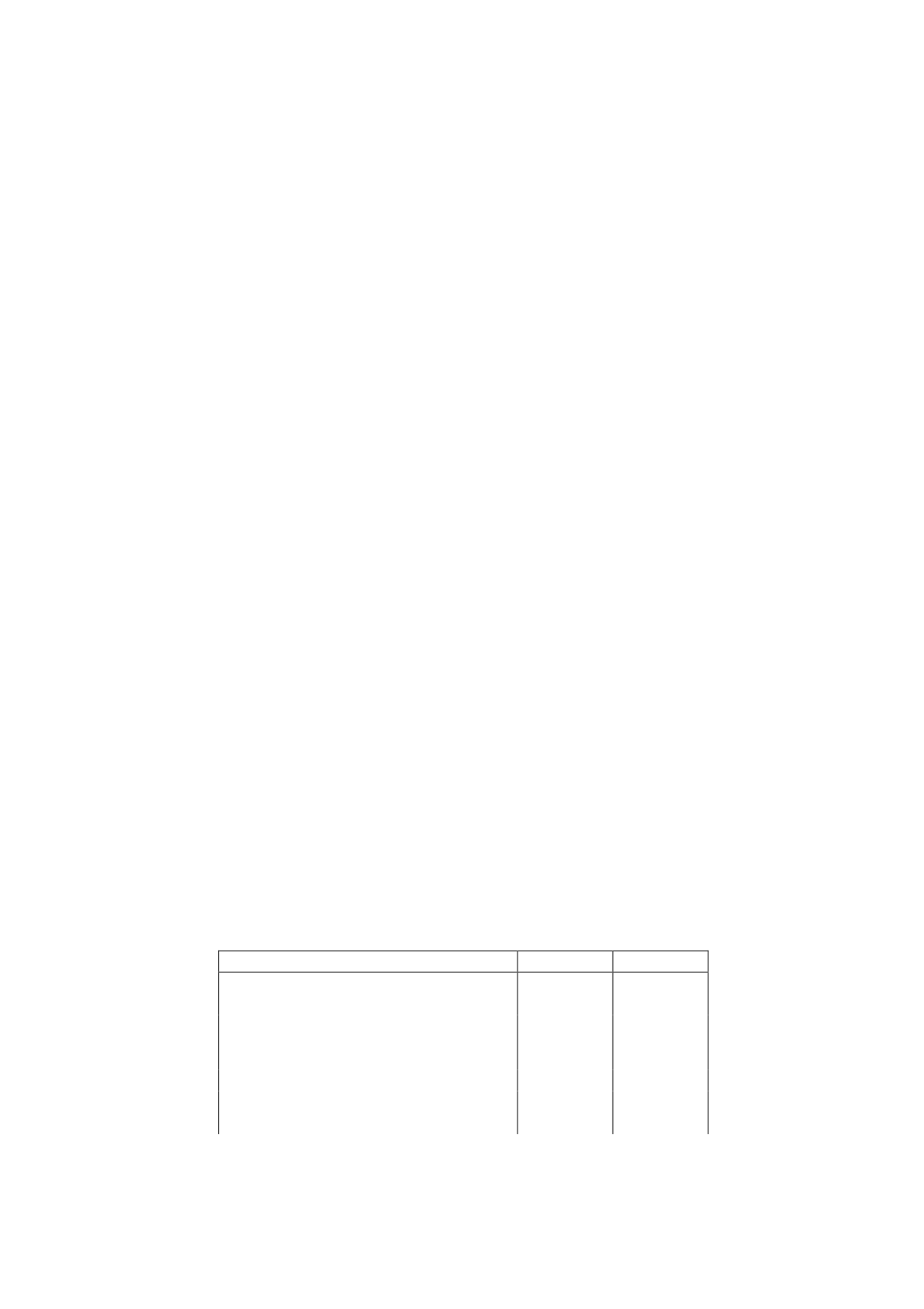

b) Reconciliation of the accounting profit to the income tax expense

The reconciliation of the accounting profit to the income tax expense is as follows:

Thousands of euros

2014

2013

Consolidated profit before tax

95,327

47,807

Permanent differences

4,769

7,312

Tax losses incurred prior to the formation of the tax

group used in 2013

(9)

(4,029)

Adjusted profit (loss)

100,087

51,090

Tax rate

30.00%

30.00%

Adjusted profit (loss) multiplied by tax rate

30,026

15,327

Tax credits

(13,158)

(13,198)