61

The tax credit earned at Group level in this connection is EUR 820 thousand and was credited

to "Adjustments to Income Tax".

In 2014 the Group acquired ownership interests of 40% and 14% in the Enelmar Productions

economic interest grouping (EIG) and Producciones Ramsés economic interest grouping (EIG),

respectively.

In view of the particular nature of income taxation of EIGs (including the assignation of tax

credits and tax losses to the partners), deferred tax assets amounting to EUR 10,724 thousand

were generated at the Group.

Under Transitional Provision 37 of the Spanish Corporation Tax Law 27/2014, companies

subject to the limit on the depreciation and amortisation charge established in Article 7 of Law

16/2012, of 27 December, adopting various tax measures aimed at shoring up public finances

and boosting economic activity, will be entitled to a tax credit, to be deducted from the gross

tax payable, of 5% of the taxable profit, arising from the depreciation and amortisation not

deducted in the tax periods commencing in 2013 and 2014.

The tax credit earned at the Company in this connection is EUR 820 thousand and was

credited to "Adjustments to Income Tax".

Of the total tax credits, EUR 120 thousand were not recognised.

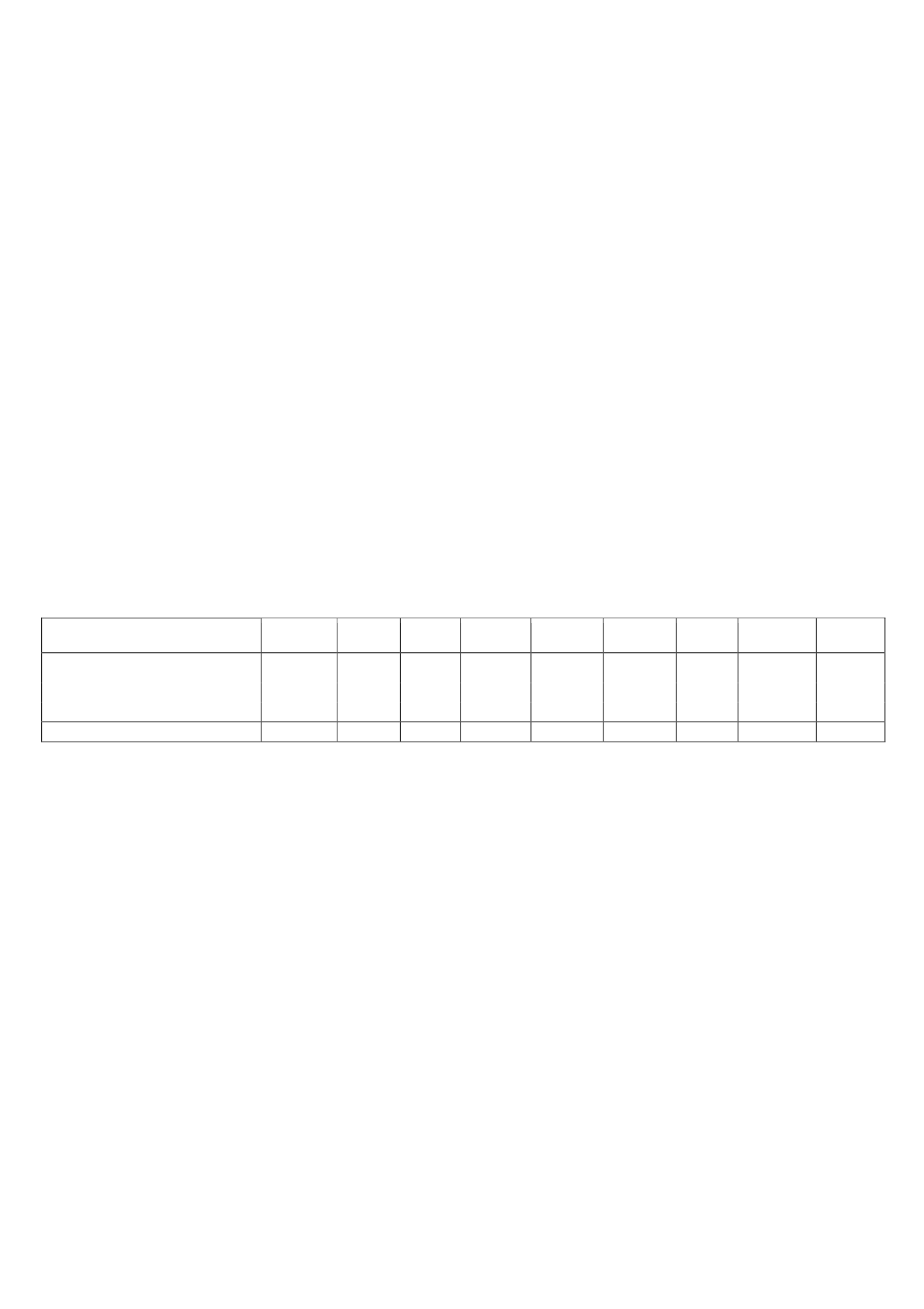

The changes in “Deferred Tax Liabilities” were as follows:

DEFERRED TAX LIABILITIES

Thousands of euros

Balance at

31/12/11

Additions Disposals

Balance at

31/12/12

Additions Disposals

Other

Tax Effect

Balance at

31/12/13

Recognition of intangible assets at fair

value

31,238

-

(324)

30,914

-

(324)

-

(5,051)

25,539

Grants

250

-

(191)

59

-

(48)

96

(13)

94

Amortisation of merger goodwill

-

372

-

372

297

-

(76)

(129)

464

Total

31,488

372

(515)

31,345

297

(372)

20 (5,193) 26,097

“Hedging Instruments” in the “Deferred Tax Assets” table is not included in the temporary

differences or deferred tax assets in the tables in Note 22-c) since for tax purposes they are

recognised directly in equity.

The “Recognition of Intangible Assets at Fair Value” deferred tax liability relates to the

temporary difference arising as a result of the difference between the carrying amount and the

tax base of the identified trademark and signal broadcasting licence (IAS 12).

The trademark is amortised for accounting purposes at a rate of 5%, the amortisation charge

in 2014 being EUR 1,079 thousand.

The amortisation is not deductible for tax purposes and, therefore, gives rise to a positive

adjustment to the taxable profit which is recognised as a deferred tax liability.

The different interpretation provided under International Financial Reporting Standards, as

compared with local accounting standards, in relation to the recognition of intangible assets at

fair value, gives rise to a greater deferred tax liability under IFRSs than that recognised in

accordance with the Spanish National Chart of Accounts, to which the income tax legislation is

not applicable.