62

On the basis of the timing estimate of future profits made by the Parent’s directors for the

offset and use of these deferred tax assets, EUR 18,147 thousand were considered to be

recoverable in the long term while EUR 2,985 thousand were considered to be recoverable in

the short term. Both amounts are recognised under “Deferred Tax Assets”.

Also, on the basis of the aforementioned timing estimate of future profits, the directors

consider that there are no reasonable doubts as to the recovery of the amounts recognised in

the accompanying balance sheet within the statutory time periods and limits on the basis of

the projections prepared.

The key assumptions on which these projections are based relate mainly to advertising

markets, audience, advertising efficiency ratios and the evolution of expenses. Except for

advertising, the data of which are measured on the basis of external sources of information,

the assumptions are based on past experience and reasonable projections approved by Parent

management and updated in accordance with the performance of the advertising markets.

These future projections cover the next ten years.

The Group analyses the sensitivity of the projections to reasonable changes in the key

assumptions used to determine the recoverability of these assets. Therefore, the sensitivity

analyses are prepared under various scenarios based on the variables that are considered to

be most relevant, i.e. advertising income, which depends mainly on the performance of the

advertising market, the investment share reached and the operating margin achieved. The

discount rate used ranges from 9% to 10%.

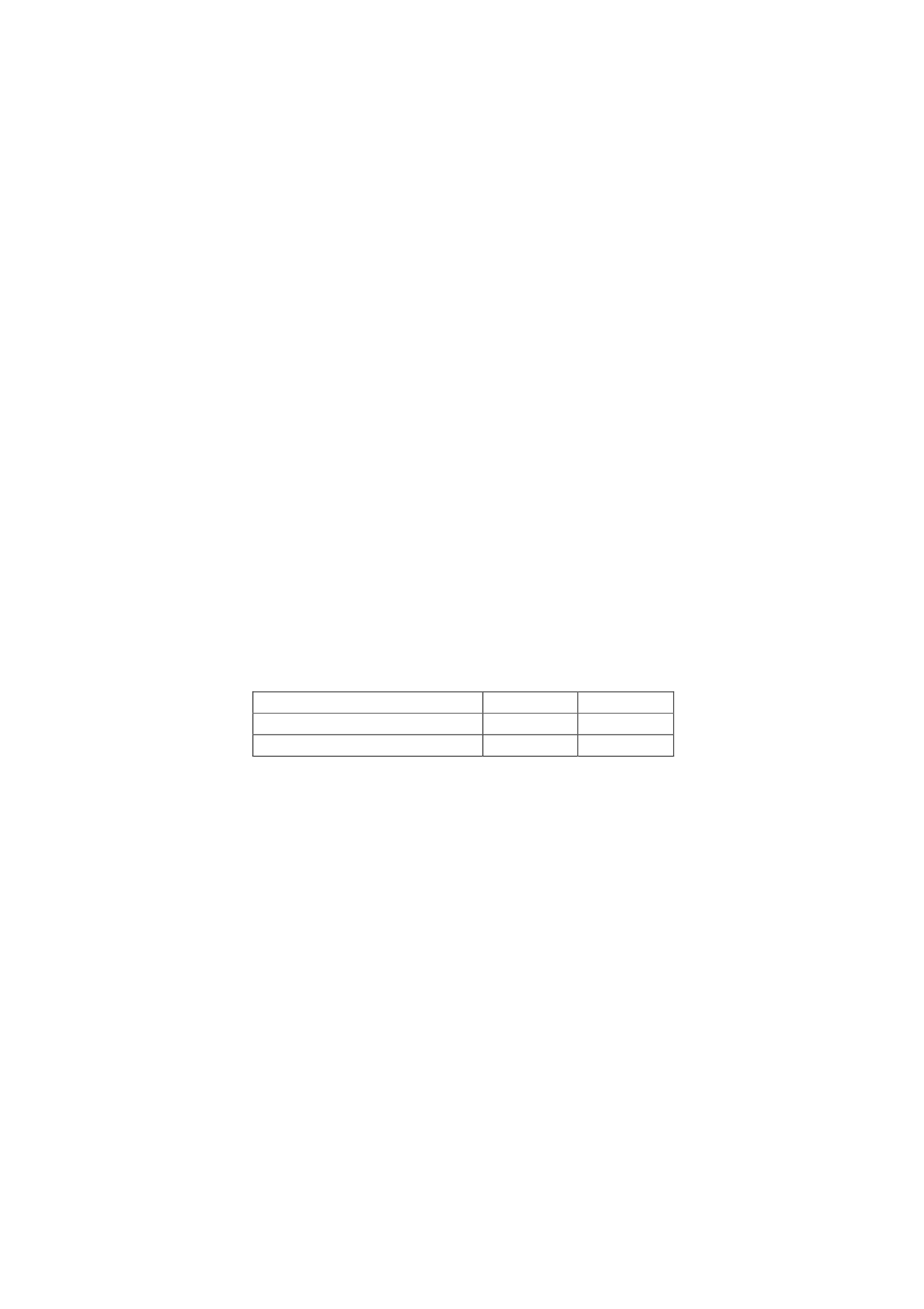

f) Tax recognised in equity

In addition to the income tax recognised in the consolidated income statement, in 2014 and

2013 the Group recognised the following amounts in consolidated equity:

Thousands of euros

2014

2013

Hedging instruments

(932)

(361)

Total

(932)

(361)

g) Other information

In 2009 the Company acquired non-current assets as required under the terms established in

Article 36.ter of the Spanish Corporation Tax Law as amended in Law 24/2001, for the

reinvestment of the extraordinary income obtained by the Company arising from the transfer

of the ownership interest in Gloway Broadcasting Services, S.L. This ownership interest met

the requirements set forth in Article 42 of this Law.

The Company used these tax credits in 2011.

The aforementioned non-current assets continue to be held in use at Atresmedia Corporación

in accordance with Article 42.8 of Spanish Corporation Tax Royal-Decree Law 4/2004.

Following is a detail of the last years for offset of prior years' tax loss carryforwards at 31

December 2014. EUR 177,485 thousand of these carryforwards have been recognised, of

which EUR 177,064 thousand were transferred to Atresmedia Corporación from the absorbed

company, Gestora de Inversiones Audiovisuales La Sexta, as a result of the universal

succession of the former to the rights and obligations of the transferor arising from the

application of the special tax regime for mergers, spin-offs, asset contributions and security