59

Income tax

48,675

1,753

Permanent differences –

4,769

7,312

Temporary differences –

13,134

(18,751)

Offset of prior years' tax losses

(28,313)

(5,172)

Taxable profit

84,917

31,196

Tax rate

30,00%

30.00%

Gross tax payable

25,475

9,359

Tax credits used in 2013

(6,704)

(3,002)

2013 tax prepayments

(19,739)

(7,004)

Tax payable (refundable)

(968)

(647)

The 2014 temporary differences include additions of EUR 24,038 thousand and reductions of

EUR 19,716 thousand (see Note 21-e).

Additions break down into deferred tax assets of EUR 32,059 thousand and deferred tax

liabilities of EUR 791 thousand, while reductions include deferred tax assets of EUR 18,725

thousand and deferred tax liabilities of EUR 991 thousand.

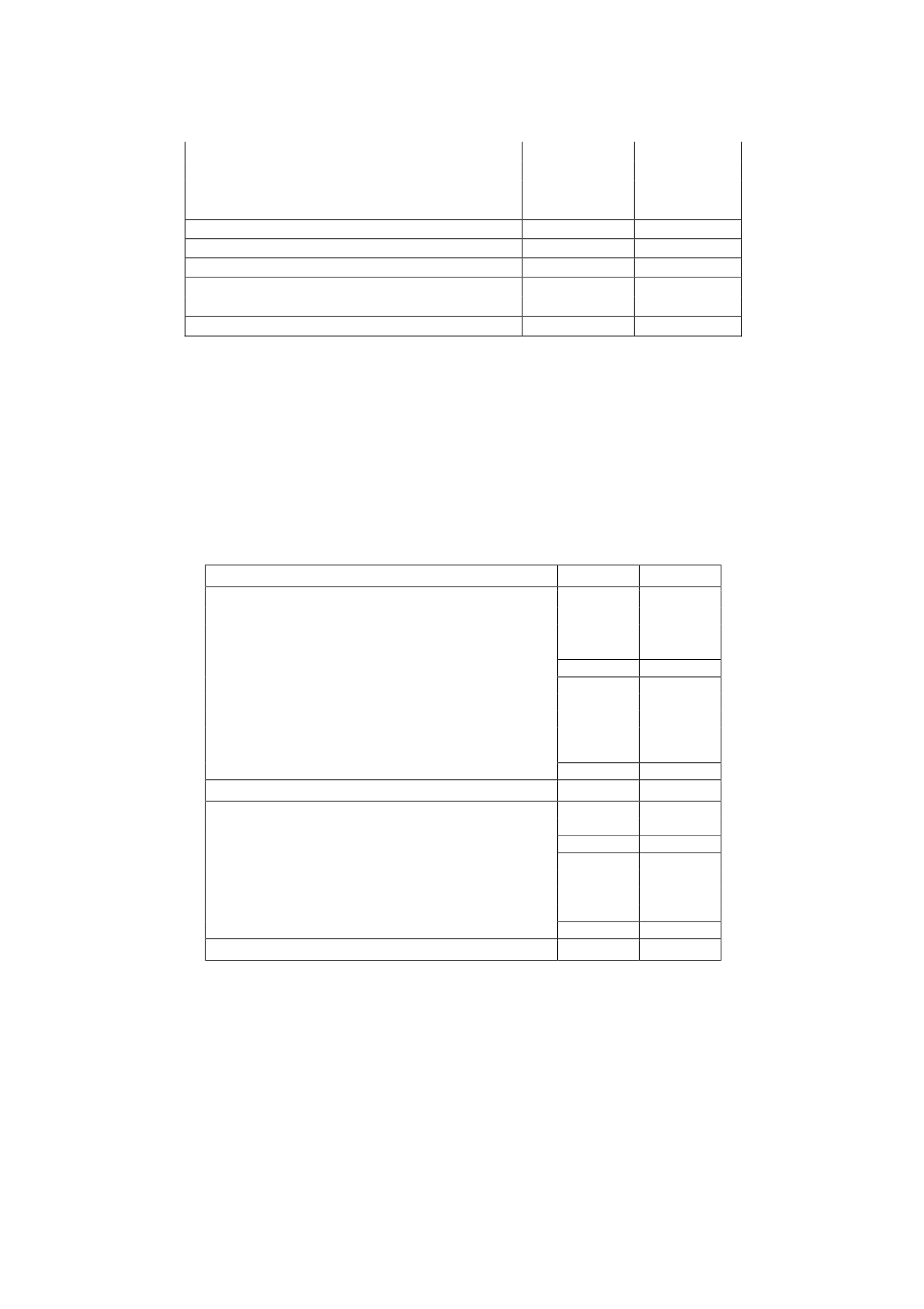

d) Tax receivables and payables

The detail of the tax receivables and payables at 31 December 2014 and 2013 is as follows:

Thousands of euros

2014

2013

NON-CURRENT ASSETS

Deferred tax assets (Note 22-e)

21,132

20,456

Tax loss carryforwards (Note 22-g)

177,485

221,363

Unused tax credits and tax relief

103,349

85,364

301,966

327,183

CURRENT ASSETS

Income tax refundable

1,247

911

2013 income tax refundable (Note 22-c)

968

647

Other tax receivables

10

26

VAT refundable

3,815

2,906

6,040

4,490

Total tax receivables

308,006

331,673

OTHER NON-CURRENT LIABILITIES

Deferred tax liabilities (Note 22-e)

26,097

31,345

CURRENT LIABILITIES

Tax withholdings payable

4,670

4,044

Accrued social security taxes payable

2,012

1,881

VAT payable

4,017

9,815

10,699

15,740

Total tax payables

36,769

47,085

On the basis of the timing estimate of future profits made by the Parent’s directors for the

offset and use of these tax items, only EUR 15,562 thousand were considered to be

recoverable in the tax return for the coming year, EUR 2,985 thousand of which relate to

deferred taxes, EUR 5,390 thousand to unused tax credits and tax relief and EUR 7,187

thousand to tax loss carryforwards.

e) Deferred tax assets recognised