58

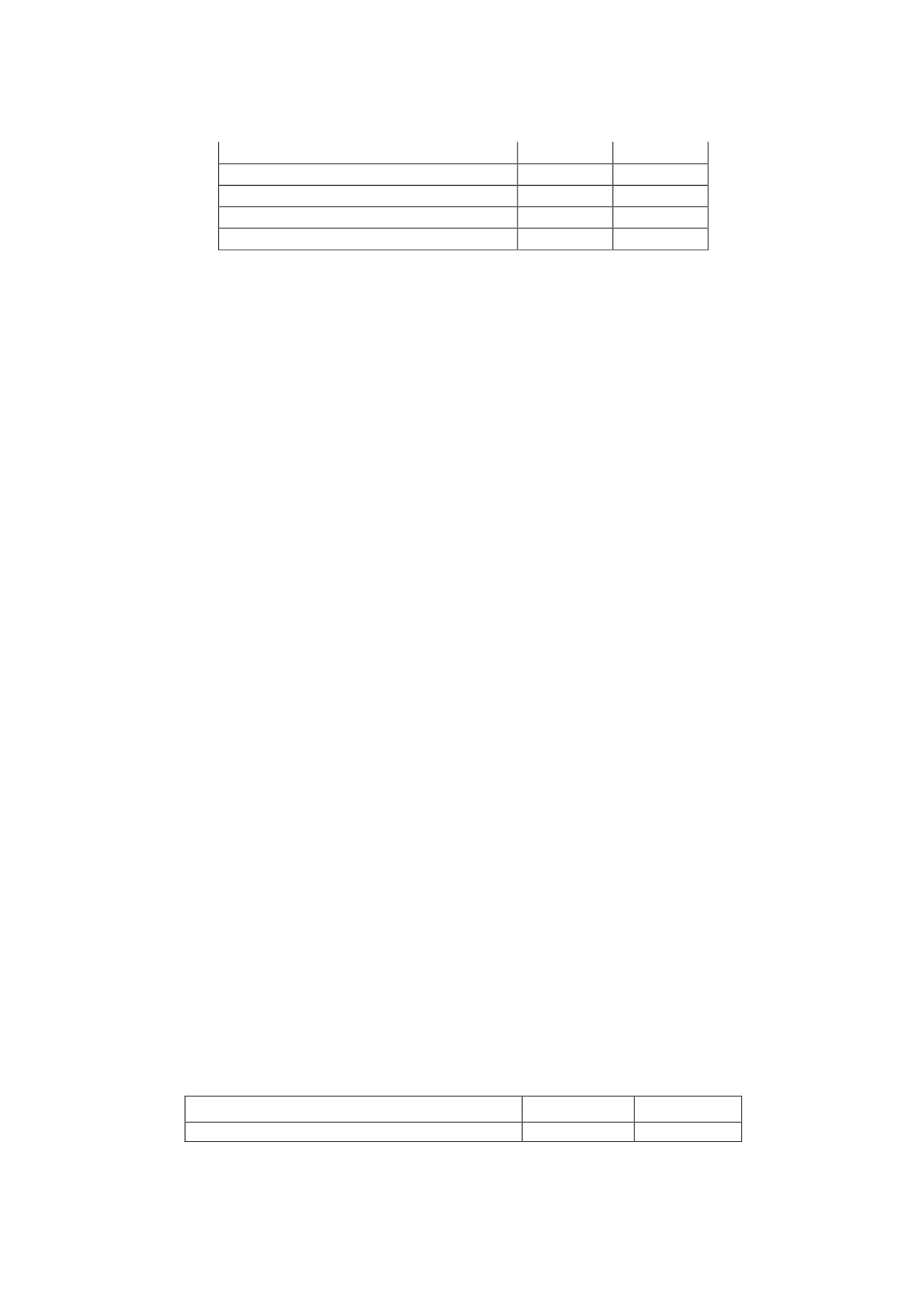

Current income tax expense (benefit)

16,868

2,129

Deferred tax expense

(1,426)

(87)

Income tax adjustment

33,233

(289)

Total tax expense (benefit)

48,675

1,753

Effective tax rate

51.06%

3.67%

The 2013 permanent differences include mainly negative consolidation differences (EUR 1,661

thousand) and, with a positive sign, non-deductible impairment losses on equity instruments

(EUR 5,781 thousand), other non-deductible expenses (EUR 361 thousand) and donations

(EUR 287 thousand).

The negative consolidation differences arise from changes in the scope of consolidation (EUR

22 thousand), the share of results of companies accounted for using the equity method (EUR

2,218 thousand), increased amortisation of the trademark under IFRSs (EUR 289 thousand)

and accounting elimination differences (- EUR 4,167 thousand).

The tax credits indicated in the table above were earned by the Group in 2013 for investment

in audiovisual production and donations to not-for-profit organisations (EUR 13,073 thousand

and EUR 85 thousand, respectively).

“Income Tax Adjustment” includes the difference between the projected income tax expense

recognised in 2013 and the effective tax return filed (- EUR 1,242 thousand) and the effect on

profit or loss of the tax rate, provided for in Spanish Corporation Tax Law 27/2014, of 27

November, effective from 1 January 2015, which establishes, among other changes, a change

in the income tax rate to 28% in 2015 and 25% in 2016 and subsequent years.

This change affects the balances of "Deferred Tax Assets" and "Deferred Tax Liabilities", which

must be adjusted to the tax rates at which are expected to be reversed.

Accordingly, the Company made an adjustment of EUR 34,475 thousand with a charge to

"Adjustments to Income Tax" arising from the calculation of the balance of "Deferred Tax

Assets" (deferred tax assets and tax loss carryforwards, see Table 21-e) and "Deferred Tax

Liabilities" (see Table 21-e) at the 28% rate and a subsequent calculation of these balances at

25% based on the Company's best estimate of the recovery of tax assets in future years.

"Deferred Tax Expense" relates to the tax effect of the deferred tax liability under IFRSs (see

Note 21-e) amounting to EUR 1,426 thousand, of which EUR 1,340 thousand relate to the

effect of the tax rate.

Accordingly, of the total adjustment in this connection (EUR 33,135 thousand), EUR 34,475

thousand are recognised under "Adjustments to Income Tax" and a negative figure of EUR

1,340 thousand is recognised under "Deferred Tax Expense".

c) Reconciliation of the accounting profit to the taxable profit

The reconciliation of the accounting profit to the taxable profit for income tax purposes for

2014 and 2013 is as follows:

Thousands of euros

2014

2013

Accounting profit after tax

46,652

46,054