60

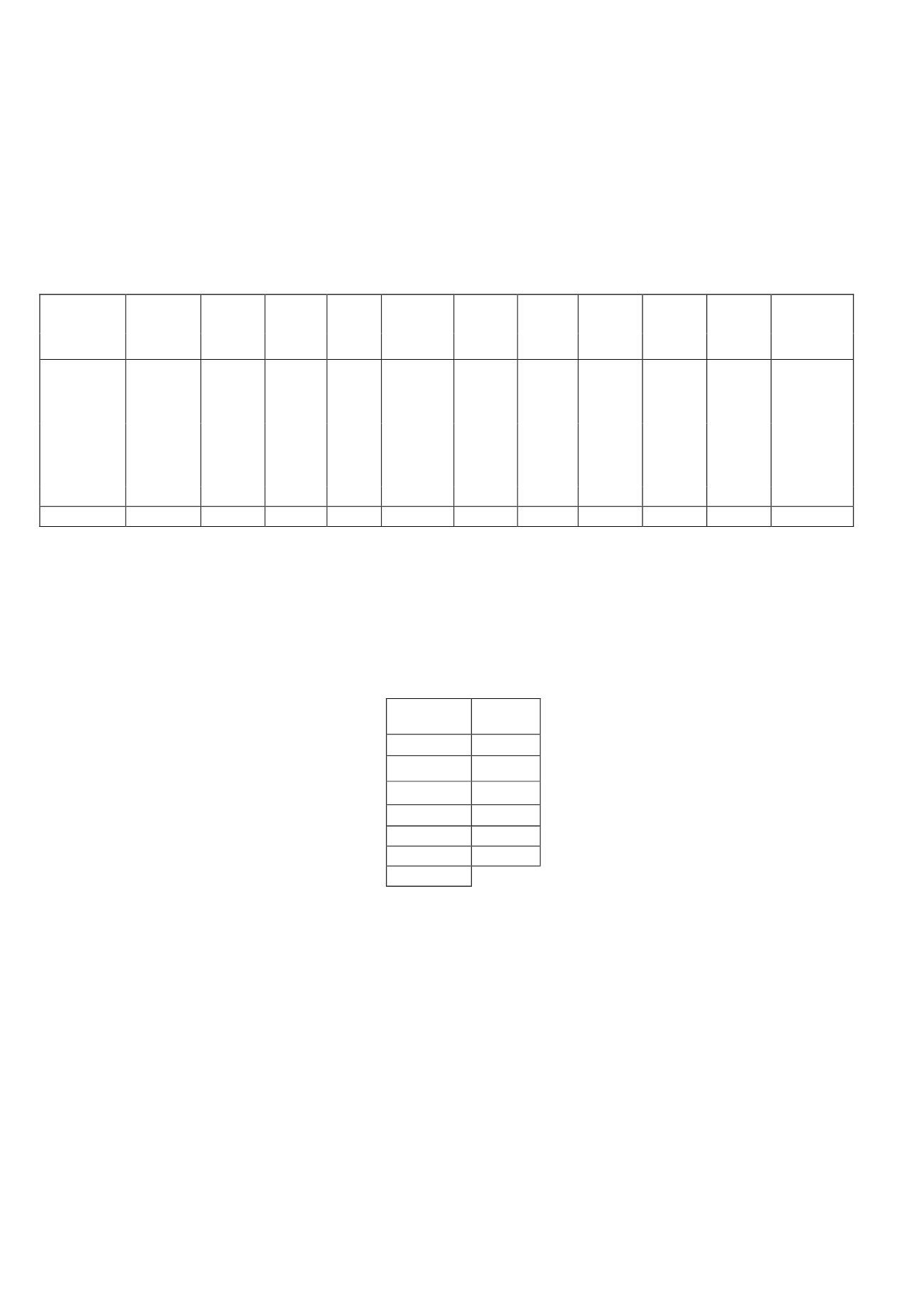

The difference between the tax charge allocated to the current year and to prior years and the

tax charge already paid or payable for such years, which is recognised under deferred tax

assets, arose as a result of temporary differences derived from the following items:

CHANGES IN

DEFERRED

TAX ASSETS

Balance at

31/12/12

Additions Disposals

Other

Balance at

31/12/13 Transfers Additions Disposals

Other

Tax Effect

Balance at

31/12/14

Thousands

of euros

4Contingencies

and charges

12,275

3,620

(4,027)

521

12,389

203

6,221

(3,323)

77

(1,561)

14,006

Non-current

accounts

payable

2,228

5

(982)

(644)

607

181

300

(795)

568

(144)

717

Hedging

instruments

(209)

-

(152)

-

(361)

-

(571)

-

-

155

(777)

Tax effect of

assets at fair

value

9,483

-

(6,845)

(97)

2,541

-

-

(1,287)

-

(724)

530

Other

2,266

3,349

(611)

276

5,280

(384)

3,097

(212)

627

(1,752)

6,656

Total

26,043

6,974 (12,617)

56

20,456

-

9,047

(5,617)

1,272

(4,026)

21,132

The changes in deferred tax assets, included in the “Other” column, include most notably the

difference between the projected income tax expense for 2012 and the tax return actually

filed.

At 31 December 2013, the Group had recognised unused tax credits amounting to EUR

103,469 thousand, of which EUR 4,801 thousand relate to La Sexta.

Amount

Limit

1,794

2024

19,458

2025

26,166

2026

18,971

2027

12,955

2028

24,126

2029

103,469

In 2014 the Group acquired ownership interests of 40% and 14% in the Enelmar Productions

economic interest grouping (EIG) and Producciones Ramsés economic interest grouping (EIG),

respectively.

Under Transitional Provision 37 of Spanish Corporation Tax Law 27/2014, companies subject

to the limit on the depreciation and amortisation charge established in Article 7 of Law

16/2012, of 27 December, adopting various tax measures aimed at shoring up public finances

and boosting economic activity, will be entitled to a tax credit, to be deducted from the gross

tax payable, of 5% of the taxable profit, arising from the depreciation and amortisation not

deducted in the tax periods commencing in 2013 and 2014.