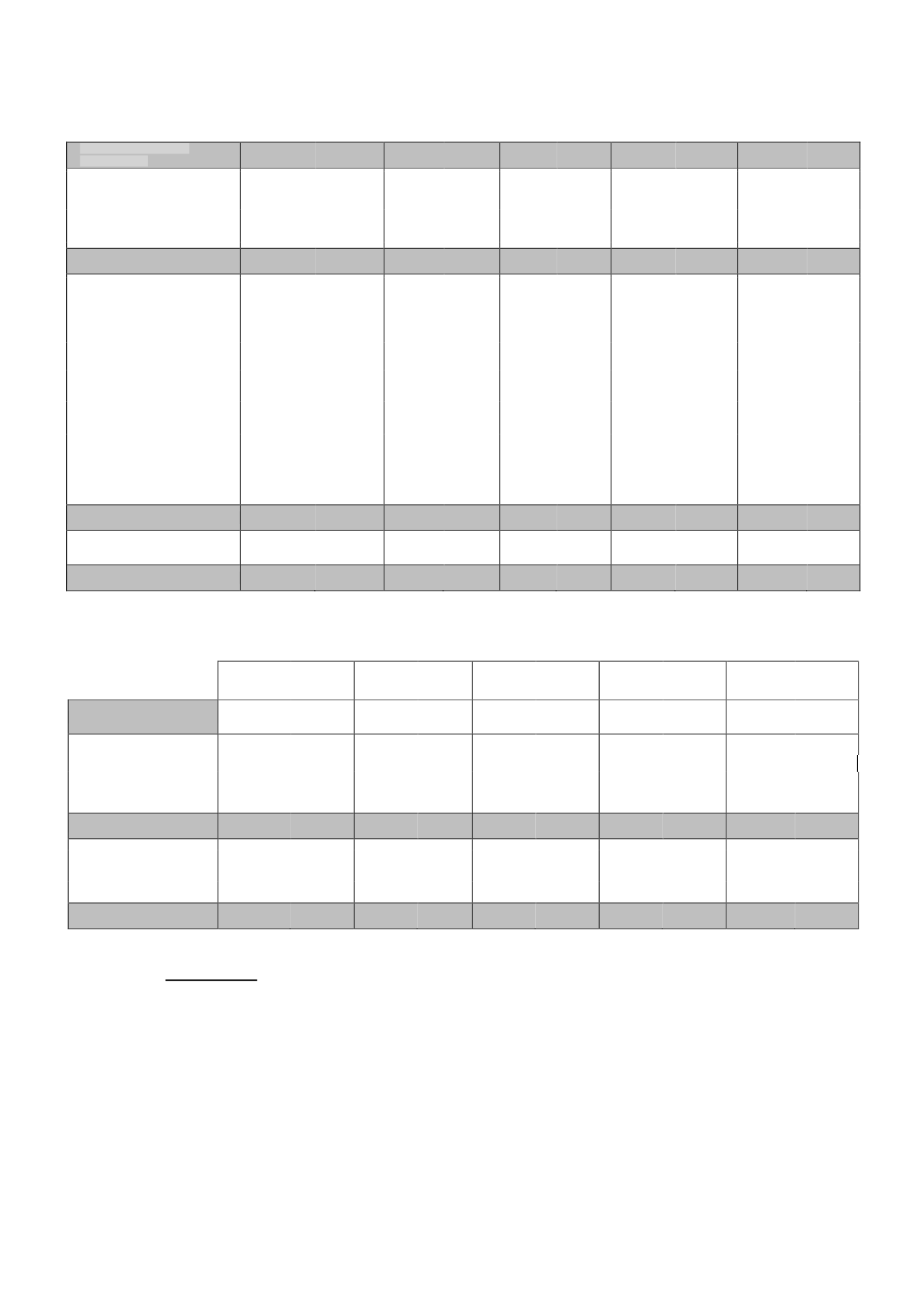

55

GROSS PROFIT FROM

OPERATIONS

103,401

52,094

17,578

16,961

6,690

11,099

-

-

127,669 80,154

Depreciation and amortisation

charge, impairment and gains or

losses on disposals of non-current

14,202

14,434

1,789

2,651

446

190

-

-

16,437

17,275

Gains on bargain purchases

arising on business combinations

-

-

-

-

-

-

-

-

-

-

PROFIT (LOSS) FROM

OPERATIONS

89,199

37,660

15,789

14,310

6,244

10,909

-

-

111,232 62,879

Net gain (loss) due to changes in

the value of financial instruments

at fair value

18,958

(952)

-

-

-

-

-

-

18,958

(952)

Exchange differences

(19,463)

6,475

-

-

13

(59)

-

-

(19,450)

6,416

Financial profit (loss)

(7,093)

(10,268)

(3,747)

(4,209)

(950)

(1,200)

-

-

(11,790) (15,677)

Impairment of financial assets

-

-

-

-

(1,405)

(3,786)

-

-

(1,405) (3,786)

Gains (losses) on disposals of

financial assets

-

-

-

-

-

-

-

-

-

-

Share of results of associates and

joint ventures accounted for using

the equity method

(29)

13

-

-

(2,189)

(1,086)

-

-

(2,218) (1,073)

PROFIT (LOSS) BEFORE TAX

81,572

32,928

12,042

10,101

1,713

4,778

-

-

95,327 47,807

Income tax

43,472

(744)

3,869

1,814

1,334

683

-

-

48,675

1,753

PROFIT (LOSS) AFTER TAX

38,100

33,672

8,173

8,287

379

4,095

-

-

46,652 46,054

Thousands of euros

Television

Radio

Other businesses

Adjustments and

eliminations between

segments

Atresmedia

consolidated

BALANCE SHEET

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

ASSETS

Segment assets

1,351,850

1,381,177

222,199 222,838

170,132

111,601

(530,364) (455,166)

1,213,853 1,260,450

Investments accounted for

using the equity method

209

130

-

-

45

416

-

-

254

546

TOTAL ASSETS

1,352,059 1,381,307

222,199 222,838

170,177

112,017

(530,364) (455,166) 1,214,107 1,260,996

EQUITY AND LIABILITIES

Segment liabilities

1,352,059 1,381,307

222,199

222,838

170,177

112,017 (530,364) (455,166)

1,214,107 1,260,996

TOTAL EQUITY AND

LIABILITIES

1,352,059 1,381,307

222,199 222,838

170,177

112,017 (530,364) (455,166) 1,214,107 1,260,996

21. Tax matters

a) Consolidated tax group

Pursuant to current legislation, the consolidated tax group includes Atresmedia Corporación de

Medios de Comunicación, S.A., as the Parent, and the Spanish subsidiaries that meet the

requirements provided for in Spanish legislation regulating the taxation of the consolidated

profits of corporate groups (in which an ownership interest of more than 75% is held).