50

concentration of credit risk exposure to third parties and no noteworthy incidents arose in

2014. The percentage of past-due receivables at 31 December 2014 was 5.2%.

The Corporate Governance Report includes an extensive summary of the risk control systems.

b) Liquidity risk

The Group’s liquidity policy is to arrange credit lines and short-term investments that are

sufficient to support its financing needs, on the basis of expected business performance. All of

the foregoing are tied to floating interest rates (see Note 13).

c) Market risk (including interest rate and foreign currency risk)

Both the Group’s cash and its bank borrowings are exposed to interest rate risk, which could

have an adverse effect on financial profit or loss and cash flows. The Group's financing is

arranged at interest rates tied to Euribor. In view of the bank borrowings at 31 December

2014, changes of 100 basis points in the total cost borne would give rise to a +/- EUR 2

million change in the debt at that date. To mitigate this risk, the Parent has arranged interest

rate swaps to limit the finance costs arising from its floating-rate borrowings (see Note 14).

Foreign currency risk is concentrated at the Parent and relates basically to the payments to be

made in international markets to acquire broadcasting rights. In order to mitigate foreign

currency risk, the Parent arranges hedging instruments, mainly currency forwards, to hedge

its exposure to the EUR/USD forward exchange rate. Sensitivity to changes in the exchange

rate is described in Note 14.

18.

Income and expenses

a)

Operating income

The breakdown, by line of business and geographical market, of the Group's revenue for 2014

and 2013 is as follows:

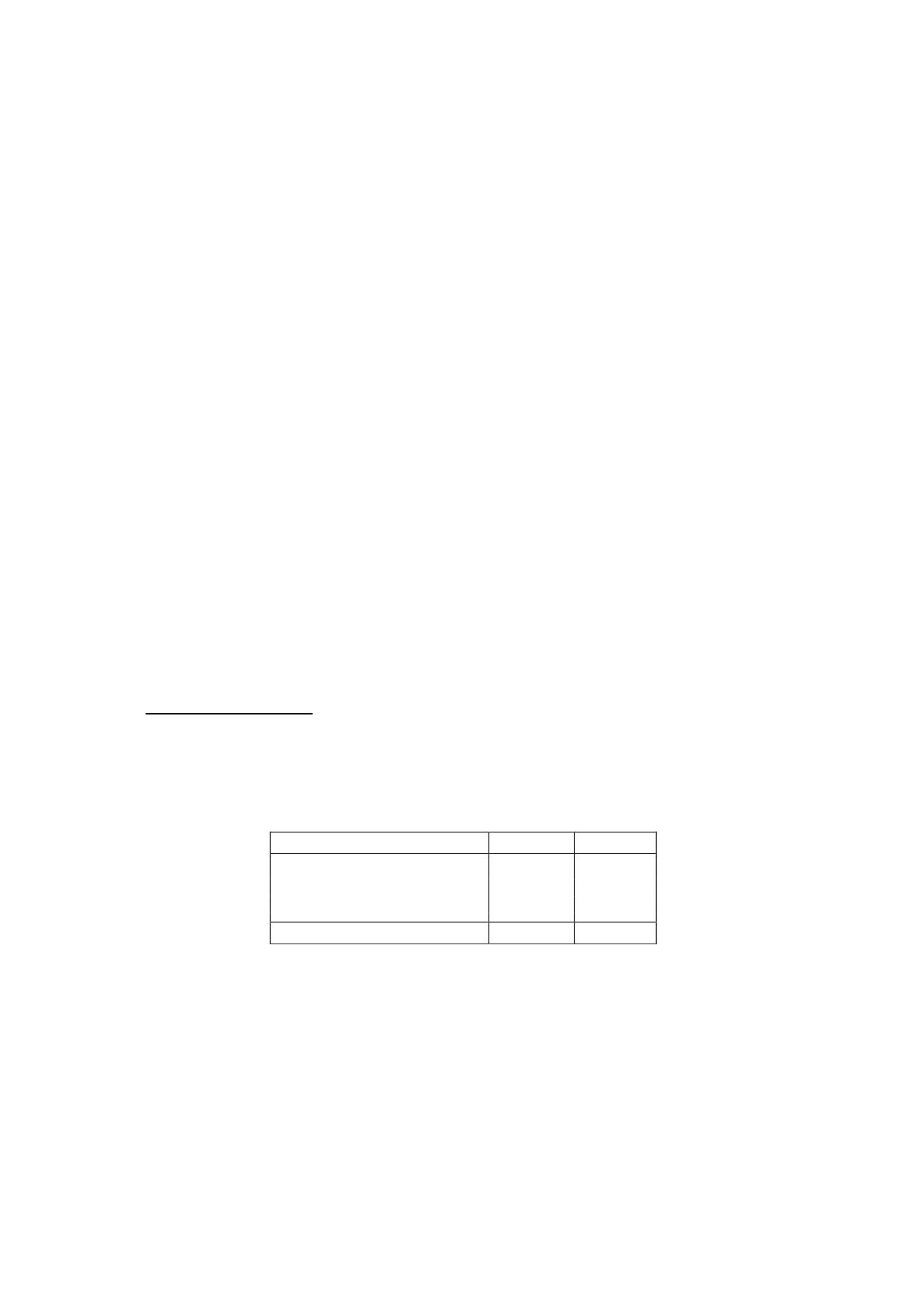

Thousands of euros

2014

2013

Advertising sales

858,017

800,482

Other sales

29,578

28,116

Trade and other discounts

(37,704)

(32,824)

Total

849,891

795,774

In 2014 transactions exceeding 10% of total operating income were performed with three

customers (media buyers grouping together advertising orders of various advertisers), which

represented 19% and 18% (individually) and 37% (as an aggregate) of total advertising sales.

In 2013 transactions exceeding 10% of total operating income were performed with three

customers (media buyers grouping together advertising orders of various advertisers), which

represented 17%, 16% and 13% (individually) and 46% (as an aggregate) of total advertising

sales.