45

consequently, 1,145,594 shares of the Parent remain pledged as security. The fair value of

this financing approximates its carrying amount.

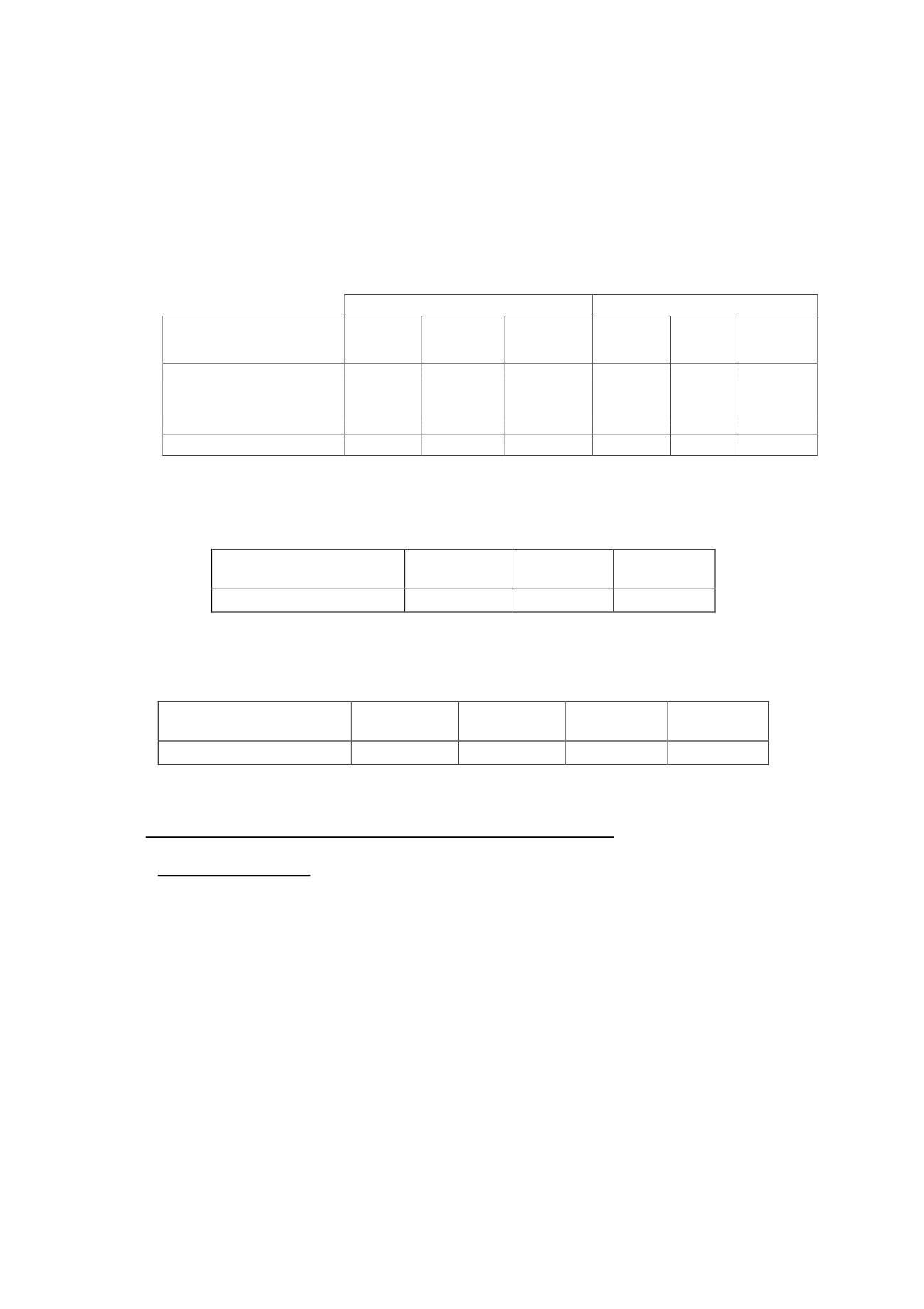

The detail of the items included under “Bank Borrowings” at 31 December 2014 and 2013 is as

follows:

2014

2013

Thousands of euros

Limit

Short-term

balance

drawn down

Long-term

balance

drawn down

Limit

Short-term

balance

drawn

Long-term

balance

drawn down

Syndicated financing

235,750

37,574

126,331

270,000

2,671

200,129

Interest payable

-

1,432

-

-

3,918

-

Total

235,750

39,007

126,331

270,000

6,589

200,129

The detail at December 31, 2014, by maturity, of the long-term balances drawn down is as

follows:

The detail at December 31, 2013, by maturity, of the long-term balances drawn down is as

follows:

14.

Derivative financial instruments and other financial liabilities

a) Hedging derivatives

Foreign currency hedges

The Group uses currency derivatives to hedge significant future transactions and cash flows.

The instruments purchased are denominated in US dollars.

The Group applies hedge accounting and documents the hedging relationships and measures

their effectiveness as required by IAS 39. All these relationships are cash flow hedges of firm

commitments, in which the risk hedged is the exposure to the EUR/USD forward exchange

rate, which results in variability in the cash flows payable in euros for broadcasting rights.

For 2014, due to the commencement of the period in which the broadcasting rights underlying

the hedge will be in force, EUR 635 thousand were capitalised to inventories from equity. For

2013 the amount deducted from equity and recognised as a deduction from inventories was

Thousands of euros

2016

2017

Total

Syndicated financing

62,331

64,000

126,331

Thousands of euros

2015

2016

2017

Total

Syndicated financing

36,350

62,602

101,177

200,129