43

Corporación de Medios de Comunicación, S.A. equal to 2.079% and 1.631% of its share

capital, respectively, were delivered with a charge to treasury shares.

The terms and conditions agreed upon in the integration agreement relating to Gala

Desarrollos Comerciales, S.L. remain unchanged and, accordingly, it continues to be

entitled to receive an additional ownership interest of 0.508% of the share capital of

Atresmedia Corporación de Medios de Comunicación, S.A., conditional upon the earnings

performance of the Atresmedia Group in the period 2012 to 2016. The delivery of these

additional shares will be carried out in full through treasury shares of the Parent and,

therefore, does not constitute an additional issue.

"Other Equity Instruments" includes the measurement of the aforementioned

consideration at the fair value of the shares whose delivery continues to be deferred. This

measurement was calculated on the basis of the forward price of the shares of Atresmedia

Corporación de Medios de Comunicación, S.A. on 5 October 2012 taking into account a

0.90% IRS rate and in accordance with management's estimate of the profit for 2012 to

2016 in order to estimate the time of delivery.

12. Provisions and other liabilities

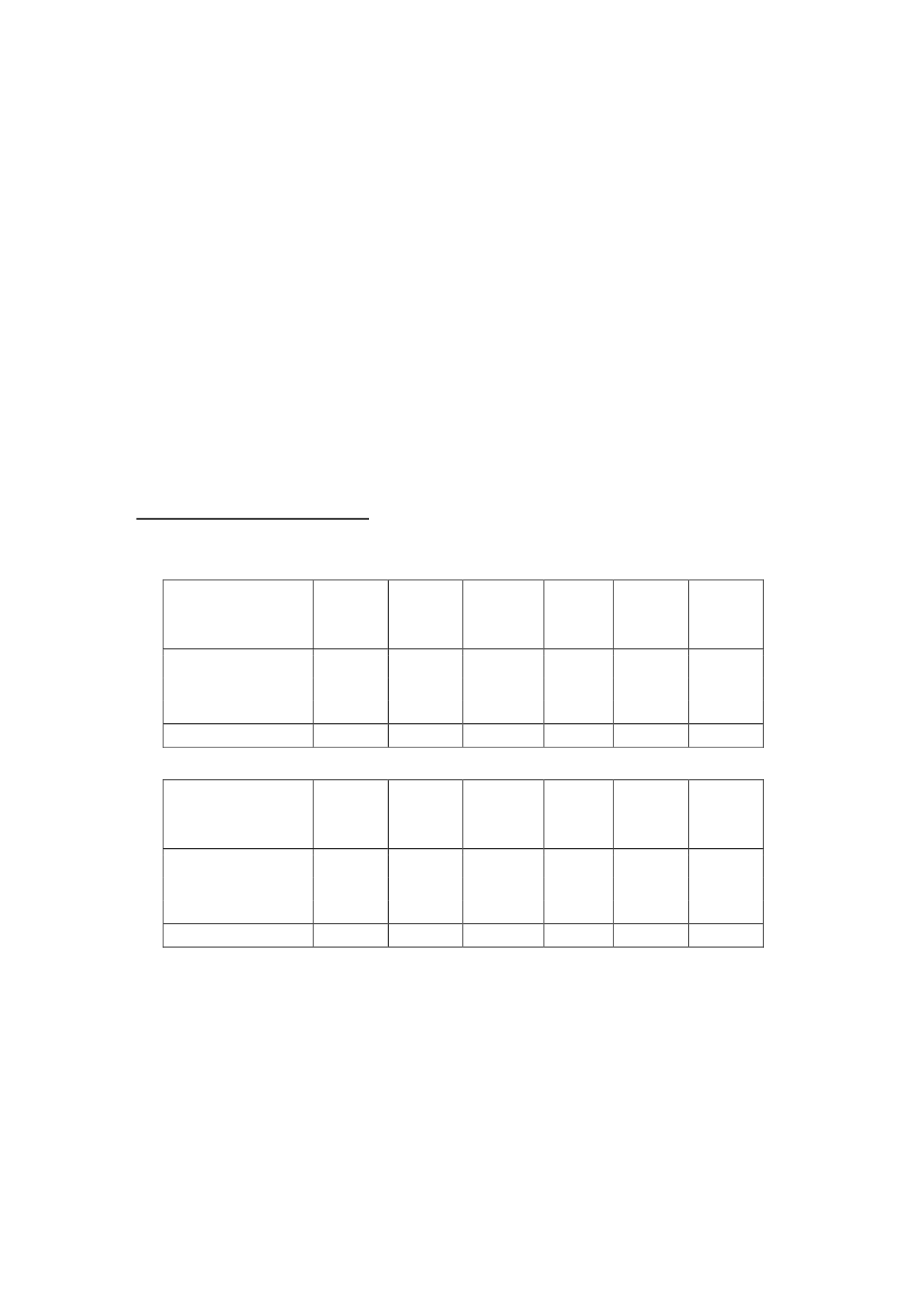

The changes in the short- and long-term provisions in 2014 and 2013 were as follows:

Thousands of euros

Balance at

31/12/13

Provisions

Amounts

used and

payments

Excessive

provisions

Transfers

Balance at

31/12/14

Operating provisions

34,206

36,602

(26,320)

-

-

44,488

Provisions for litigation

27,502

7,107

(7,274)

(4,369)

7,341

30,307

Other provisions

13,642

6,532

(730)

-

(5,895)

13,549

Total provisions

75,350

50,241

(34,324)

(4,369)

1,446

88,344

Thousands of euros

Balance at

31/12/12

Provisions

Amounts

used and

payments

Excessive

provisions

Transfers

Balance at

31/12/13

Operating provisions

35,715

49,928

(50,437)

(1,000)

-

34,206

Provisions for litigation

24,809

6,556

(1,651)

(2,212)

-

27,502

Other provisions

18,668

3,985

(514)

(1,915)

(6,582)

13,642

Total provisions

79,192

60,469

(52,602)

(5,127)

(6,582)

75,350

Short- and long-term provisions in the consolidated balance sheet include, inter alia, operating

provisions relating basically to volume rebates paid yearly which accrue over the course of the

year, the period additions, use and excessive amounts of which are recognised under

“Revenue” in the consolidated income statement.

“Provisions for litigation” relates mainly to the best estimate in this connection. The payment

schedule related to litigation is based on court judgments and is therefore difficult to estimate.

“Other Provisions” relates mainly to estimated future payments. The period additions, use and