39

at the Mercantile Registry, irrespective of the payment date, and (ii) 1,181,296 shares of

EUR 0.75 par value each, of a different class and carrying the same restriction on dividend

rights as the aforementioned shares, applicable for 24 months following the date on which

the merger was filed at the Mercantile Registry, which took place on 31 October 2012.

As indicated in the relevant event communication of 20 November 2014, once this period

had ended, the Parent's Board of Directors, acting under powers delegated from the

Annual General Meeting of 25 April 2012 in which the merger was approved, adopted the

necessary resolutions to reword Articles 5 and 7 of the bylaws so that they state that all

the shares that represent the share capital of Atresmedia Corporación de Medios de

Comunicación, S.A. are of the same class and carry the same dividend rights for the

holders thereof in respect of the profit earned by the Company from 31 October 2014

onwards.

In addition, as part of this convergence process and also in accordance with the merger

agreements, the Parent's Board of Directors resolved to request the official listing of these

1,181,296 shares on the Madrid, Barcelona, Valencia and Bilbao Stock Exchanges through

the Spanish stock market interconnection system, as reported in the aforementioned

relevant event communication on 20 November 2014.

At 31 December 2014, the share capital of the Parent amounted to EUR 169,300 thousand

and was represented by 225,732,800 fully subscribed and paid shares of EUR 0.75 par

value each, which carry the same dividend rights.

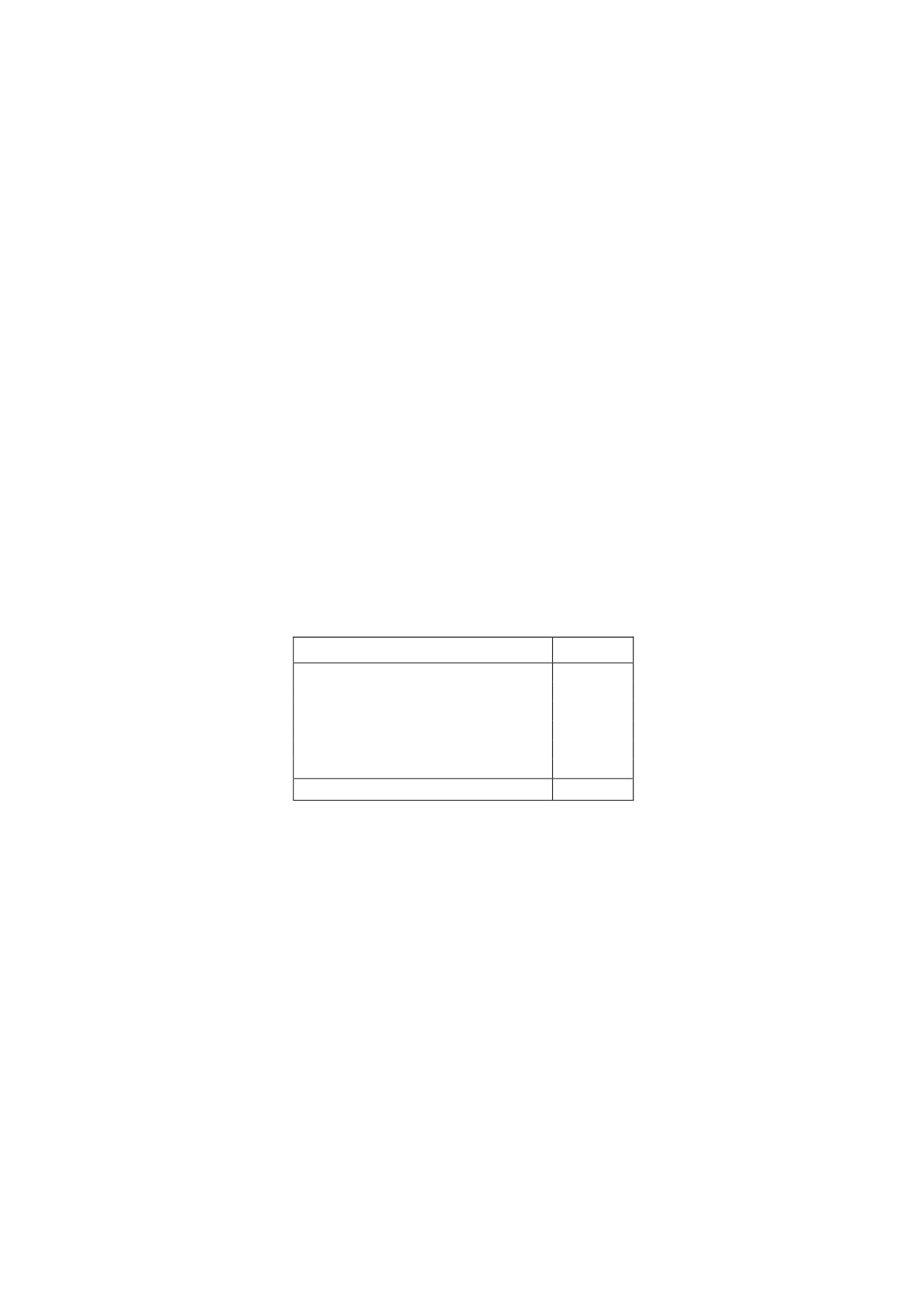

At the end of 2013 the Parent's shareholder structure was as follows:

% of ownership

2014

Grupo Planeta-de Agostini, S.L.

41.70

Ufa Film und Fernseh, GMBH

19.17

Treasury shares

0.51

Gamp Audiovisual, S.A.*

4.16

Imagina Media Audiovisual, S.L.

4.48

Other shareholders

29.98

Total

100.00

* Gamp Audiovisual, S.A. is an Imagina Group company, which is controlled, within the meaning

of Article 4 of the Spanish Securities Market Law.

The Parent's shares are listed on the Spanish stock market interconnection system and all

carry the same voting and dividend rights, except for the 1,181,296 shares mentioned

above, which admission to trading has been applied but not occurred at December 31,

2014.

There are agreements among the main shareholders that guarantee the Parent’s

shareholder stability, the grant of mutual rights of acquisition on their shares, the

undertaking not to take control of the Parent or to permit a third party to do so, and also

include Group management agreements, as described in the consolidated directors’ report.

For management purposes, the Group treats the equity attributable to the Parent as

capital. The only external requirements to which this capital for management purposes is

subject are those contained in current Spanish corporate law, and there are no other legal

restrictions thereon.