35

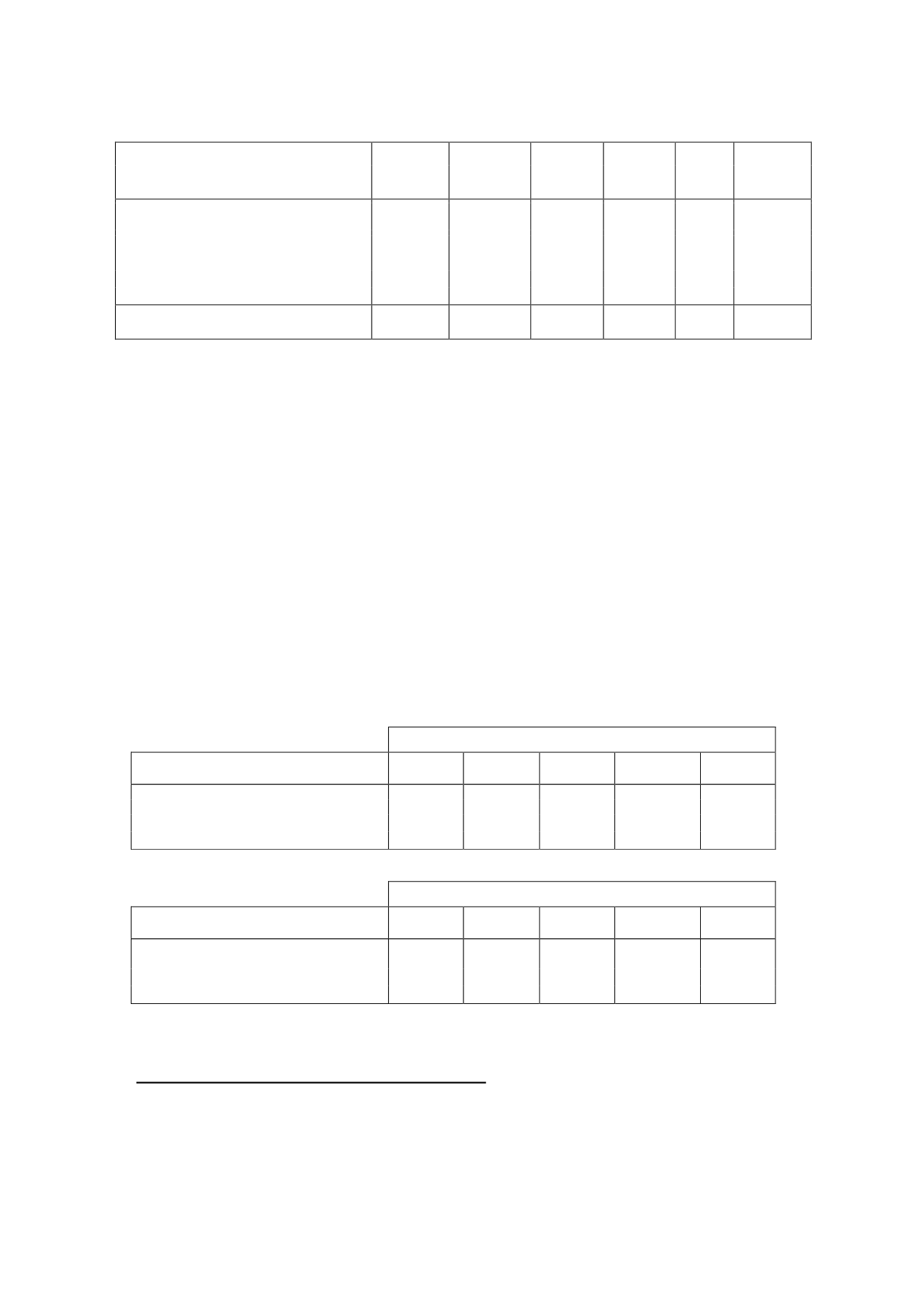

Thousands of euros

Balance at Changes in

the scope of

consolidation

Additions

or charge

for the year

Disposals

or

reductions

Transfers

Balance at

01/01/13

31/12/13

Investments accounted for using the

equity method

I3 Televisión, S.L.U.

86

-

44

-

-

130

Cordina Planet, S.L.

-

-

-

(912)

912

-

Hola TV América, S.L.

-

-

478

(126)

-

352

Atlantis Global Solutions, S.L.

-

112

-

(48)

-

64

Investments accounted for using the

equity method

86

112

522

(1,086)

912

546

In 2014, as part of the Hola TV América Group, the following companies were included in the

scope of consolidation: Hola TV Latam, S.L. and Hola TV US, LLC, which are subsidiaries of the

associate Hola TV América, S.L. and whose company objects comprise the management and

operation of audiovisual communication services and the creation, acquisition, production, co-

production and marketing of audiovisual products. (see Note 2-b).

In February 2013 Antena 3 de Televisión Colombia, S.A. and Canal 3 Televisión Colombia, S.A.

were liquidated. This transaction did not have any impact on the consolidated financial

statements.

As discussed in Note 2-b in the section on changes in the scope of consolidation, in December

2013 Cordina Planet, S.L. changed from being accounted for using the equity method to being

a fully consolidated subsidiary of the Group.

None of the Group's investees are listed on Spanish or foreign stock exchanges.

The detail of the main financial aggregates of the companies accounted for using the equity

method for 2014 and 2013 is as follows:

2014

Thousands of euros

Assets

Equity

Liabilities

Income

Profit

(Loss)

I3 Televisión, S.L.

2,339

418

1,921

6,429

(58)

Hola TV América, S.L.

3,227

(2,448)

5,675

1,215

(4,341)

Atlantis Global Solutions, S.L.

36

27

9

40

(56)

2013

Thousands of euros

Assets

Equity

Liabilities

Income

Profit

(Loss)

I3 Televisión, S.L.

3,156

261

2,896

6,821

26

Hola TV América, S.L.

3,222

702

2,520

-

(253)

Atlantis Global Solutions, S.L.

142

83

59

-

(145)

8.

Financial assets and other non-current assets

The detail of “Non-Current Financial Assets” and “Derivative Financial Instruments” in the

consolidated balance sheets at 31 December 2014 and 2013 is as follows: