30

Under the draft terms of merger by absorption of Atresmedia Corporación de Medios de

Comunicación, S.A. and Gestora de Inversiones Audiovisuales La Sexta, S.A. (“La Sexta”),

the remaining shares representing the Parent's share capital, i.e. 1,181,296 shares, that

were delivered to the La Sexta shareholders as part of the share exchange and whose

related dividend rights were temporarily restricted do not carry rights to this interim

dividend. The owners were not eligible to receive dividends distributed out of the Parent's

profit in the 24 months following the date of registration of the merger deed at the Madrid

Mercantile Registry, which took place on 31 October 2012.

This dividend, which was paid to the shareholders as an interim dividend on 18 December

2014, totalled EUR 22,341 thousand.

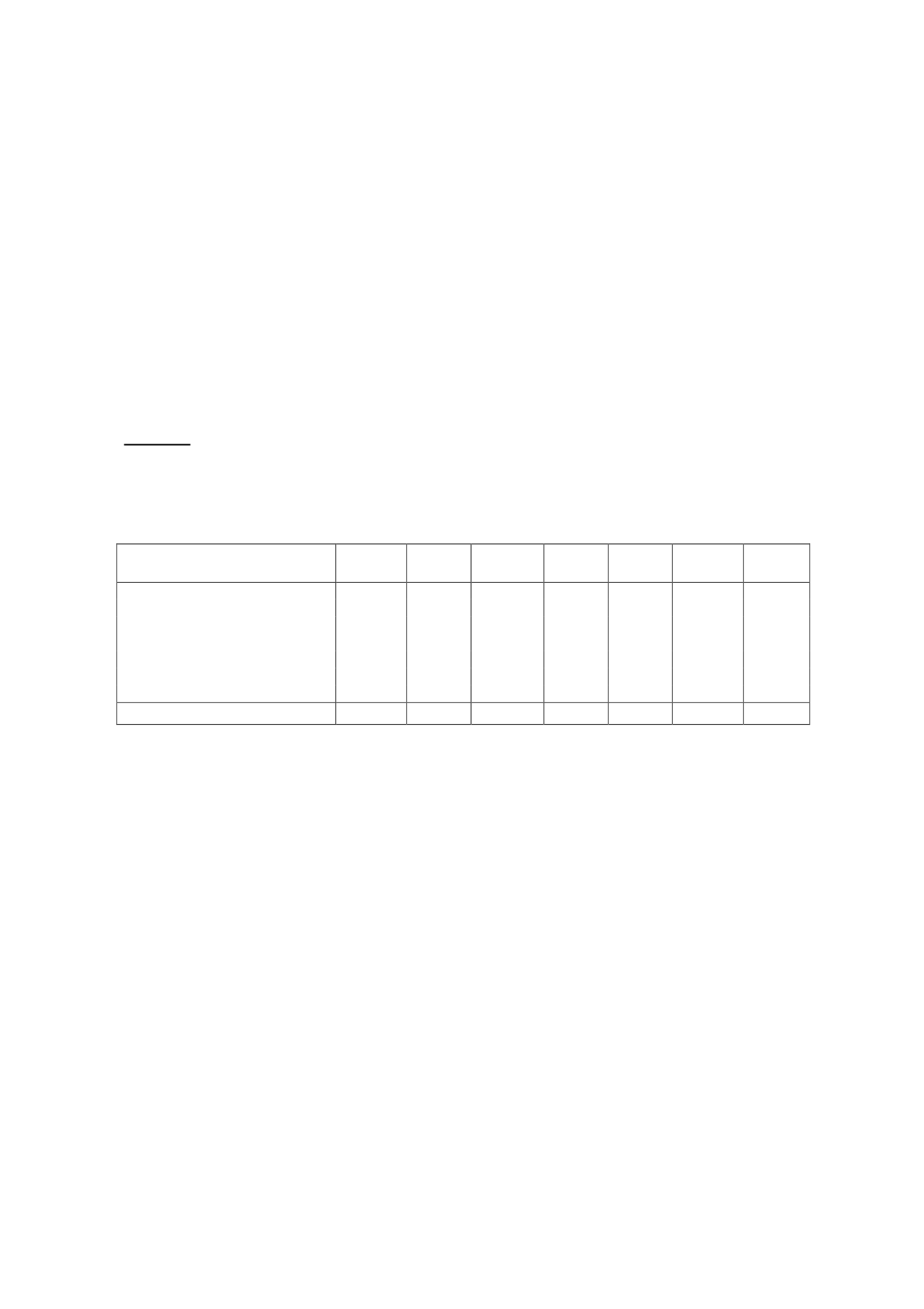

4. Goodwill

The changes in “Goodwill” in the consolidated balance sheets in 2014 and 2013 were as

follows:

Thousands of euros

Balance at

31/12/12

Additions/

Disposals

Impairment

Balance at

31/12/13

Additions/

Disposals

Transfers

Balance at

31/12/14

RADIO BUSINESS:

Uniprex, S.A.U.

147,558

-

555 148,113

-

- 148,113

Canal Media Radio, S.L.U.

1,899

-

-

1,899

-

-

1,899

Canal Media Radio Galicia, S.A.U.

295

-

(295)

-

-

-

-

Ipar Onda, S.A.U.

260

-

(260)

-

-

-

-

OTHER BUSINESSES:

Cordina Planet, S.L.U.

-

3,181

-

3,181

-

-

3,181

TOTAL

150,012

3,181

- 153,193

-

- 153,193

The change in the goodwill of the Radio business in 2014 is due to the merger by absorption

into the Group company Uniprex, S.A. (Sole-Shareholder Company) of several of its

subsidiaries, as described in Note 2-b on changes in the scope of consolidation.

Also, the Parent's acquisition of control over Cordina Planet, S.L.U. gave rise to goodwill of

EUR 3,181 thousand (see Note 2-b).

The Group periodically assesses the recoverability of the goodwill described in the foregoing

table, considering the cash-generating units on the basis of the business activities of its

subsidiaries, which at year-end were the radio business and other businesses.

The Group uses the strategic plans of the various businesses to calculate any possible

impairment losses and discounts expected future cash flows. The Group prepares the various

projections individually, taking into account the expected future cash flows of each cash-

generating unit.

For the radio cash-generating unit (which coincides with the radio segment), the key

assumptions on which the cash flow projections are based relate mainly to advertising

markets, audience figures, advertising efficiency ratios and cost forecasts. Except for

advertising, which is measured on the basis of external sources of information, the data