25

Also, the initial value of all the external productions acquired by the Group for which

derivative instruments designated as cash flow hedges pursuant to IAS 39 were

arranged in order to hedge foreign currency risk includes:

the portion of the cumulative gain or loss recognised in equity (effective hedge) on

the hedging instrument at the beginning of the term of the right.

for payments made prior to the commencement of the term of the right, the

accumulated exchange gains or losses on that date.

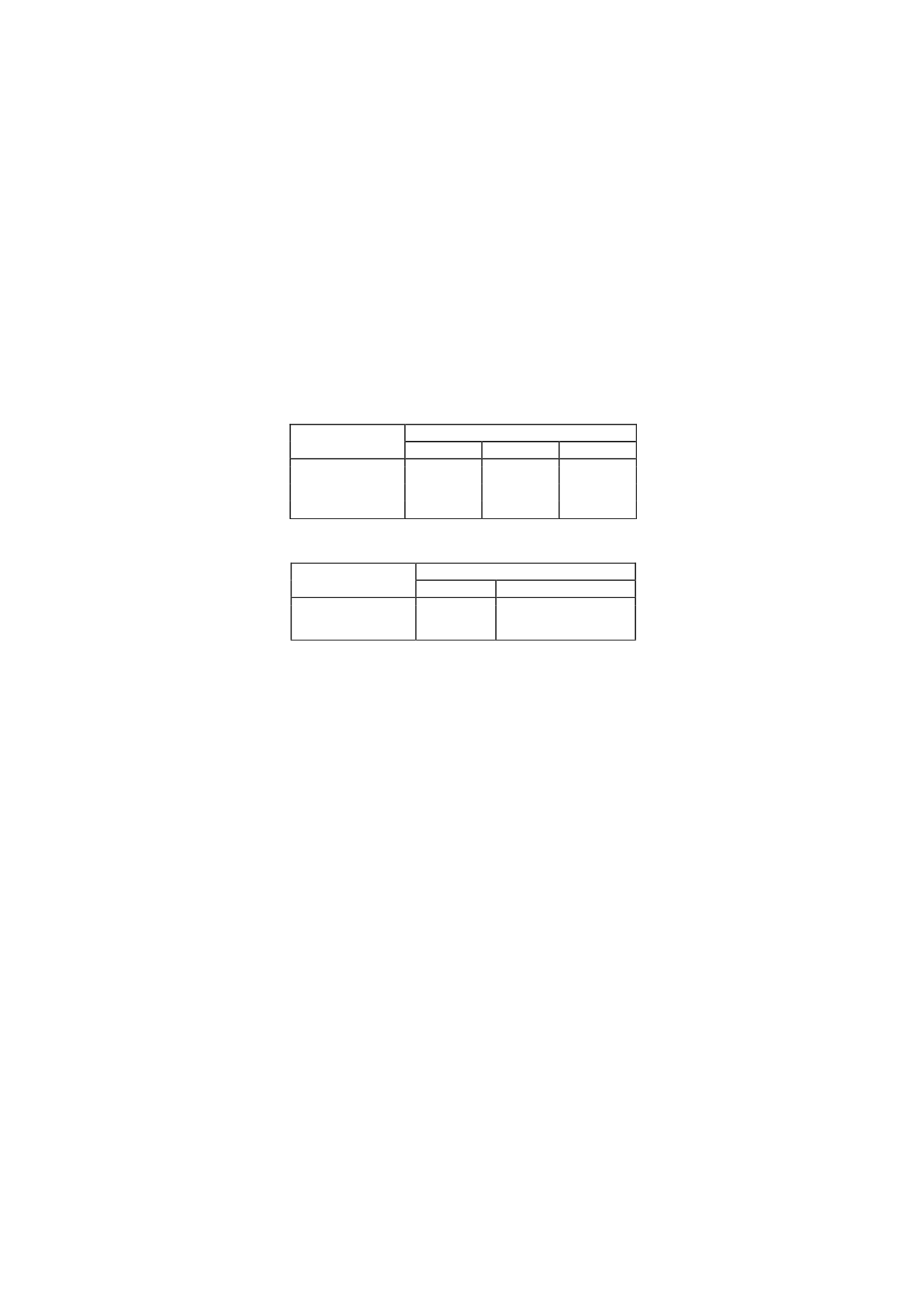

The amortisation of the rights is recognised under “Programme Amortisation and Other

Procurements” in the consolidated income statement, on the basis of the number of

showings, at the rates shown below, which are established on the basis of the number

of showings contracted:

FILMS

Number of showings contracted

1

2

3 or more

1st showing

100%

50%

50%

2nd showing

-

50%

30%

3rd showing

-

-

20%

SERIES

Number of showings contracted

1

2 or more

1st showing

100%

50%

2nd showing

-

50%

4.

Live broadcasting rights are measured at cost. The cost of these rights is recognised

as an expense under “Programme Amortisation and Other Procurements” in the

consolidated income statement at the time of broadcast of the event on which the

rights were acquired.

Advances on purchases of rights

Payments made to external production distributors prior to the commencement of the

term of the rights are recognised under “Programme Rights - Advances on Purchases of

Rights” in the consolidated balance sheet and if such payments are in foreign currency

they are translated to euros at the year-end exchange rate.

Write-downs

The Group recognises write-downs to reduce the unamortised value of in-house

productions and of the rights on external productions which it considers will not be shown.

When these rights expire, the valuation adjustments are recognised in profit or loss when

the cost of the rights is derecognised.

Classification of programme rights

In accordance with standard practice in the industry in which the corporate Group

operates, programme rights are classified as current assets and the portion that is

amortised over more than one year is detailed in Note 10.