47

The foreign currency derivatives have been arranged in such a way that they are totally

effective and, therefore, they are recognised in full in equity until inventories are recognised.

The sensitivity analysis indicates that positive or negative changes of 10% in the spot

EUR/USD exchange rate would give rise to changes of approximately EUR 35 million in the fair

value of the foreign currency derivatives in 2014 (2013: EUR 14 million). Increases in the

value of the euro (depreciation of the US dollar) would increase negative values while

decreases in the value of the euro would increase positive values.

Financial instruments measured at fair value must be classified as levels 1 to 3, based on the

degree of verification of their fair value. Therefore, fair values derived from quoted prices on

active markets will be classified as level 1. Those derived from external information other than

quoted prices will be classified as level 2. And values obtained using valuation techniques

including data that are not observable in active markets will be classified as level 3. The

Group’s derivative instruments detailed in this section on “Foreign Currency Hedges” would be

classified as level 2.

Interest rate hedges

In August 2013 the Parent arranged interest rate swaps in order to fix the finance cost arising

from the floating rates applicable to each of the tranches of the syndicated financing arranged

at that date. These swaps expire in August 2017 and the hedged amount is EUR 111,209

thousand, with an fixed interest rate of 1.01% and EUR 20,844 thousand, with an fixed

interest rate of 0.71%. At 31 December 2013, the fair value of the swaps amounted to EUR 5

thousand and was recognised as a financial asset.

b) Other current and non-current financial liabilities

The main item under “Other Current Financial Liabilities” relates mainly to the account payable

by Gestora de Inversiones Audiovisuales La Sexta, S.A. to its shareholders, which was

assumed by the Parent in the merger transaction carried out in 2012. This account payable

amounted to EUR 34,687 thousand at 31 December 2013 and bears interest a floating rate

tied to Euribor plus a market spread (see Note 22).

In the first halfyear of 2014 this account payable had been fully repaid.

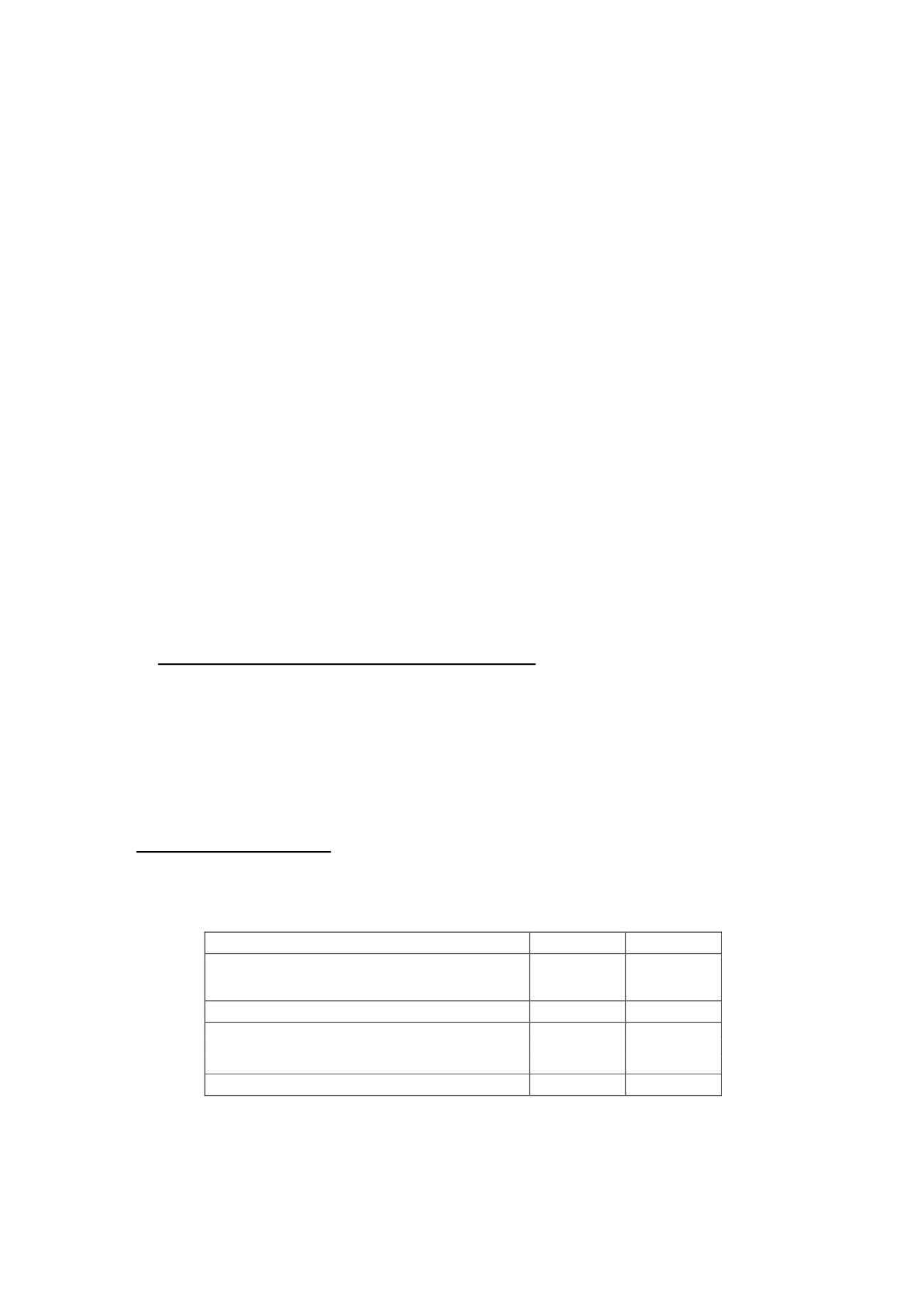

15. Trade and other payables

The detail of trade and other payables in the consolidated balance sheets at 31 December

2014 and 2013 is as follows:

Thousands of euros

2014

2013

Payable to suppliers

339,879

353,236

Payable to associates and related parties (Note 23)

59,178

67,927

Total payable to suppliers

399,057

421,163

Other accounts payable to public authorities (Note 22-d)

10,669

15,740

Other non-trade payables

16,218

18,330

Customer advances

2,552

3,649

Total other payables

29,469

37,719