53

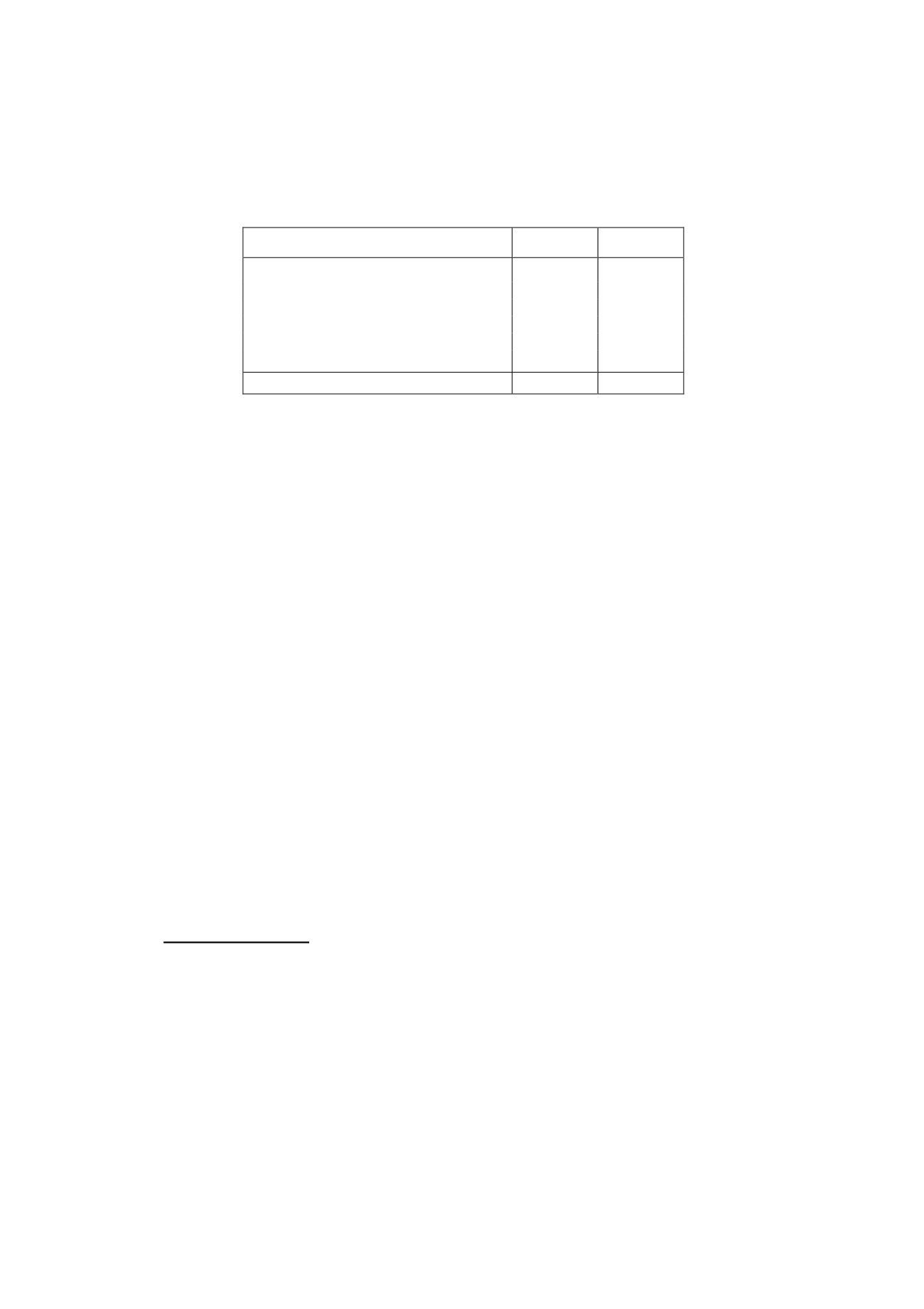

The detail of “Other Operating Expenses” in the consolidated income statement is as

follows:

Thousands of euros

2014

2013

Operating leases and charges

64,382

71,042

Work performed by other companies

42,115

41,179

Copyrights

39,858

30,990

Communications

10,324

10,765

Advertising and publicity

7,343

6,386

Other overheads

24,068

29,907

Total

188,090

190,269

“Operating Leases and Charges” in the accompanying consolidated income statement

includes mainly the charge for the distribution of the audiovisual signal and the television

operators’ contribution to the financing of Corporación RTVE.

e)

Other disclosures

The fees for audit services provided to the various companies composing the Atresmedia

Corporación de Medios de Comunicación, S.A. and Subsidiaries Group by the principal

auditor, Deloitte, S.L., and by other entities related thereto in 2014 amounted to EUR 261

thousand (2013: EUR 247 thousand). The fees for audit-related services in 2014

amounted to EUR 4 thousand (2013: EUR 4 thousand).

Also, the fees for other professional services provided to the various Group companies by

the principal auditor and by other entities related thereto amounted to EUR 83 thousand

(2013: EUR 36 thousand). No tax advisory services were provided in 2014 or in 2013.

The Annual Corporate Governance Report includes a description of the work of the Audit

Committee and an explanation of the manner in which the objectivity and independence of

the auditor is guaranteed when the auditors provide non-audit services.

19.

Other gains/losses

a)

Net gain (loss) due to changes in the value of financial instruments at fair value

“Net Gain (Loss) due to Changes in the Value of Financial Instruments at Fair Value” in the

consolidated income statement includes mainly the net gain (loss) due to the change in fair

value of the hedging instruments detailed in Note 14 to these consolidated financial

statements and the gain on the held-for-trading financial asset at year-end (see Note 8).

b)

Exchange differences