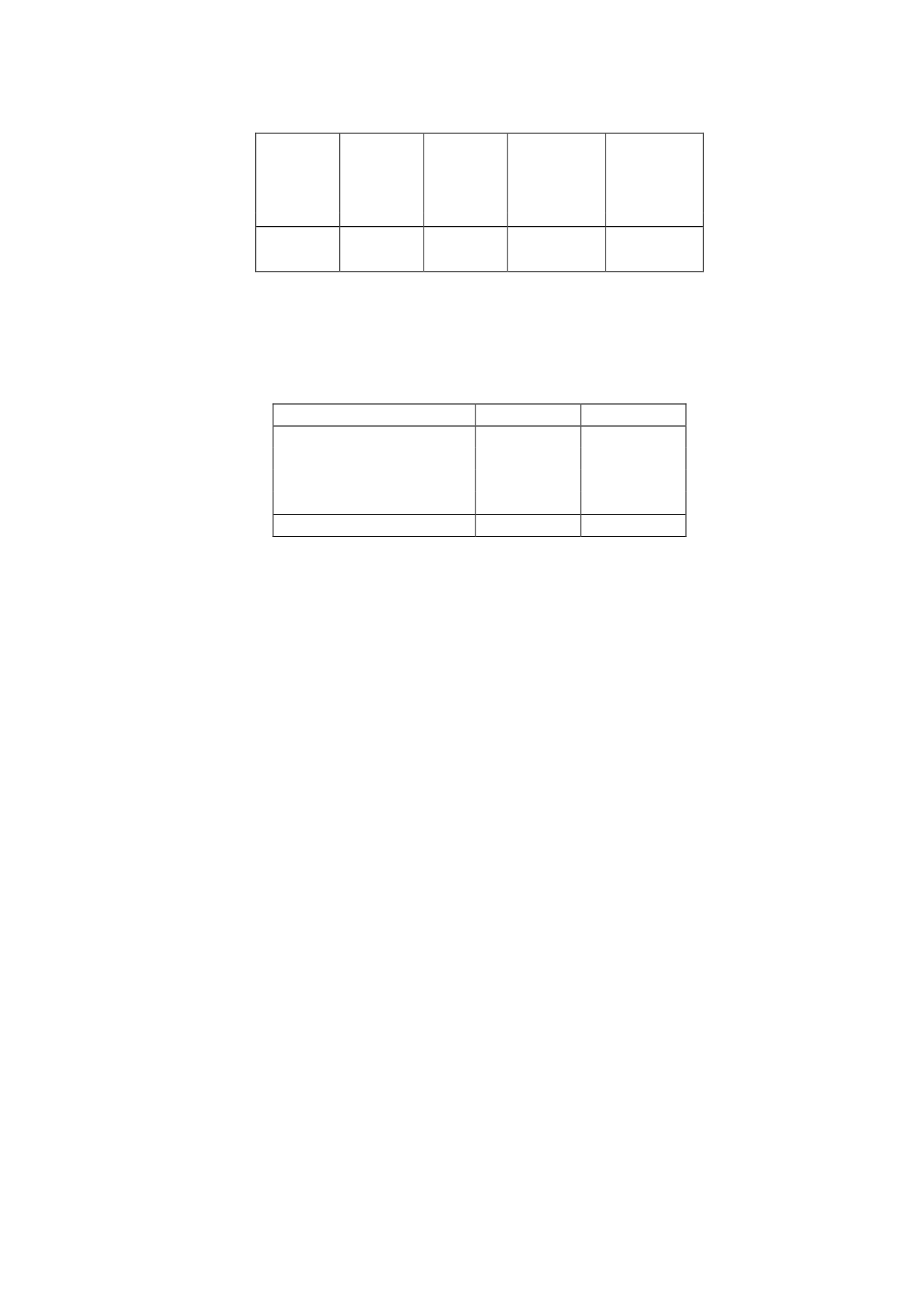

Year

Number of

shares

Nominal

value (EUR)

Average

Purchase Price

(EUR)

Total

Adquisition

Cost

(thousand

EUR)

2014

1,145,594

859,196

6.29

7,202

2013

15,818,704 11,864,028

6.29

99,453

-

At 31,594 shares, with a value of EUR 7,202 thousand and an average acquisition price of EUR

6.29 per share.

-

The changes in “Treasury Shares” in 2014 and 2013 were as follows:

-

Number of Shares

2014

2013

At beginning of year

15,818,704

15,818,704

Purchases

-

-

Sellings

(6,298,784)

-

Delivery of shares (Note 4)

(8,374,326)

-

At end of year

1,145,594

15,818,704

On 6 March 2014, the Parent reported through a relevant event communication the sale for

EUR 79,680 thousand of a total of 6,298,784 treasury shares representing 2.79% of its share

capital. The carrying amount of these shares was EUR 39,601 thousand. The difference

between both amounts was recognised in equity. This transaction carried a cost of 1% on the

sale price, which was also recognised in equity.

The Annual General Meeting held on 24 March 2010 approved a resolution authorising the

Parent to acquire treasury shares provided that they did not exceed the maximum legal limit

permitted by law at any given time. This limit was established at 10% of subscribed share

capital by Law 3/2009, of 3 April, on structural changes to companies.

12.4 Dividends

At the Parent's Board of Directors meeting held on 19 November 2014, it was resolved to

distribute out of the Parent's profit for 2014, gross amount of ten euro cents (EUR 0.10) for

each of the 224,551,504 shares with a par value of EUR 0.75 carrying dividend rights, of

which 1,145,594 are treasury shares. Accordingly, the dividend rights inherent to treasury

shares were attributed proportionately to the other shares that are eligible to receive the

dividend, in accordance with Article 148 of the Spanish Limited Liability Companies Law.

Under the draft terms of merger by absorption of Atresmedia Corporación de Medios de

Comunicación, S.A. and Gestora de Inversiones Audiovisuales La Sexta, S.A. (“La Sexta”), the

remaining shares representing the Parent's share capital, i.e. 1,181,296 shares, that were

delivered to the La Sexta shareholders as part of the share exchange and whose related

dividend rights were temporarily restricted do not carry rights to this interim dividend. The

owners were not eligible to receive dividends distributed out of the Parent's profit in the 24

months following the date of registration of the merger deed at the Madrid Mercantile Registry,

which took place on 31 October 2012.

This dividend, which was paid to the shareholders as an interim dividend on 18 December

2014, totalled EUR 22,341 thousand.