31 December 2014, the swap points (offer/bid) and the interest rates prevailing at the

measurement date.

The foreign currency derivatives have been arranged in such a way that they are fully effective

at each reference date and, accordingly, are recognised in full in equity, until the inventories

are recognised.

The sensitivity analysis indicates that positive or negative changes of 10% in spot EUR/USD

exchange rates would give rise to changes of approximately EUR 35 million in the fair value of

the foreign currency derivatives (2013: EUR 14 million). Increases in the value of the euro

(depreciation of the US dollar) would increase negative values while decreases in the value of

the euro would increase positive values.

Interest rate hedges

In August 2013 the Company arranged interest rate derivatives (IRSs) in order to fix the

financial cost arising from the floating interest rates applicable to each of the tranches of

syndicated financing arranged at that date.

These IRSs expire on August 2017 and the hedged amount is EUR 111,209 thousand with a

fixed interest rate of 1.01%. At 31 December 2014, the fair value thereof amounted to EUR 5

thousand (2013: EUR 5 thousand)

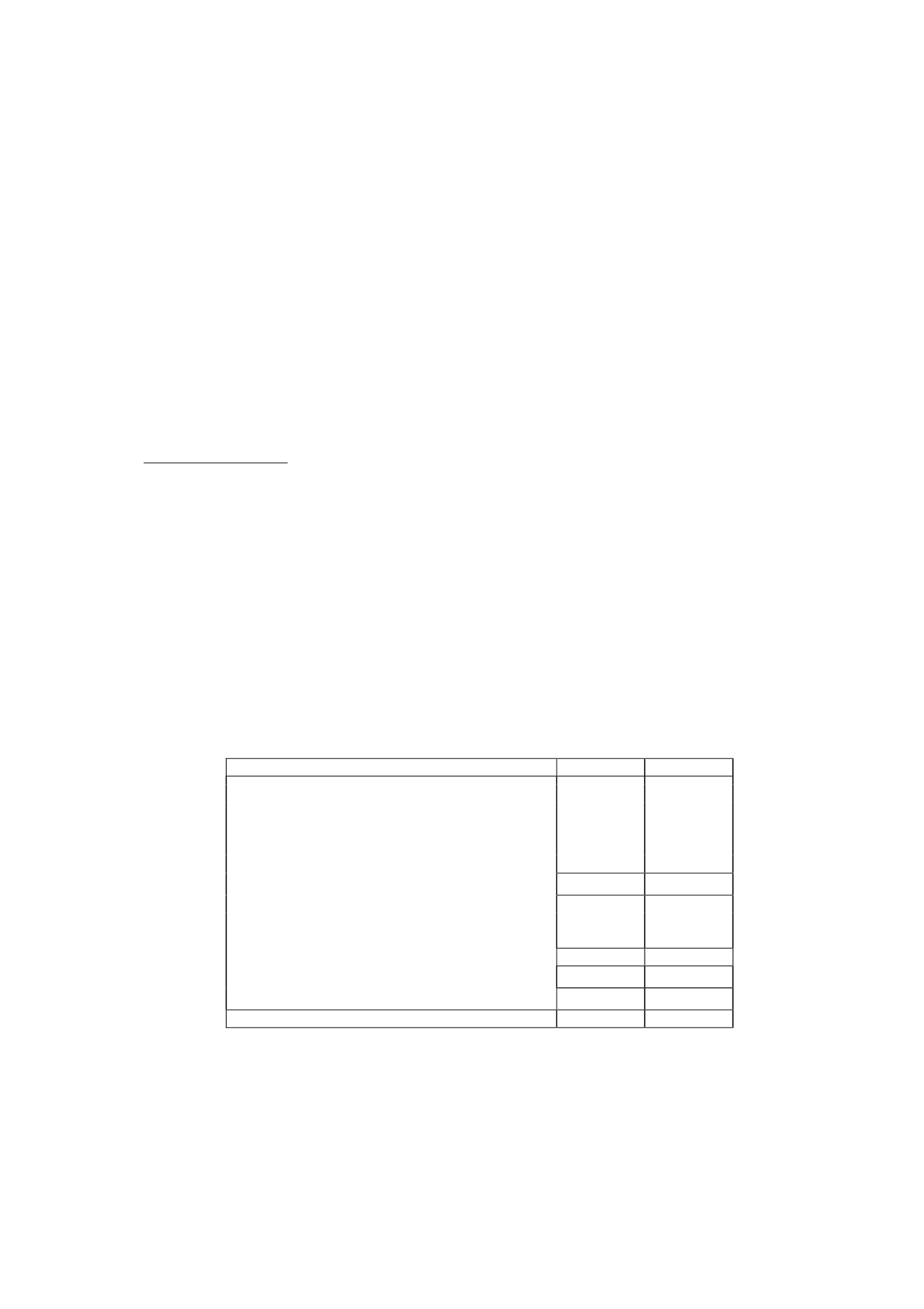

11.- Inventories

The detail of “Inventories” in the balance sheets at 31 December 2014 and 2013 is as follows:

Thousands of euros

Programme rights, net-

Rights on outside productions

280,497

254,144

In-house productions and programmes in process

18,782

36,455

Sports broadcasting rights

3,214

3,460

Inventory write-downs - outside productions

(37,800)

(33,754)

264,693

260,305

Consumables and other inventories-

Dubbings, soundtracks and titles

2,454

2,076

Other materials

1,026

940

3,480

3,016

Advances to suppliers

17,712

29,181

285,885

292,502

“Advances to Suppliers” in the accompanying balance sheets at 31 December 2014 and 2013

includes basically advances paid in connection with outside production commitments.

The changes in the write-downs relating to “Inventories” in the accompanying balance sheets

were as follows (in thousands of euros):