The Company applies hedge accounting and documents the hedging relationships and the

measurement of their effectiveness as required by current legislation. In all cases, these

include the cash flow hedges of firm commitments, of which the EUR/USD forward exchange

rate exposures to possible variations in the cash flows payable in euros associated with

broadcasting rights is hedged.

For 2014, due to the commencement of the period in which the broadcasting rights being

hedged come into force, EUR 635 thousand was capitalised to inventories from equity. For

2013, inventories were reduced by EUR 52 thousand with a charge to equity. The changes in

the fair value of the derivatives arranged by the Company depend on the change in the

EUR/USD exchange rate and on the euro yield curve.

At 31 December 2014, the Company had arranged instruments to hedge its foreign currency

asset and liability positions amounting to USD 230,233 thousand, at a weighted average

exchange rate of EUR 1.3279/USD 1. At 31 December 2013, the Company had arranged

hedging instruments amounting to USD 89,863 thousand, at a weighted average exchange

rate of EUR 1.3117/USD 1.

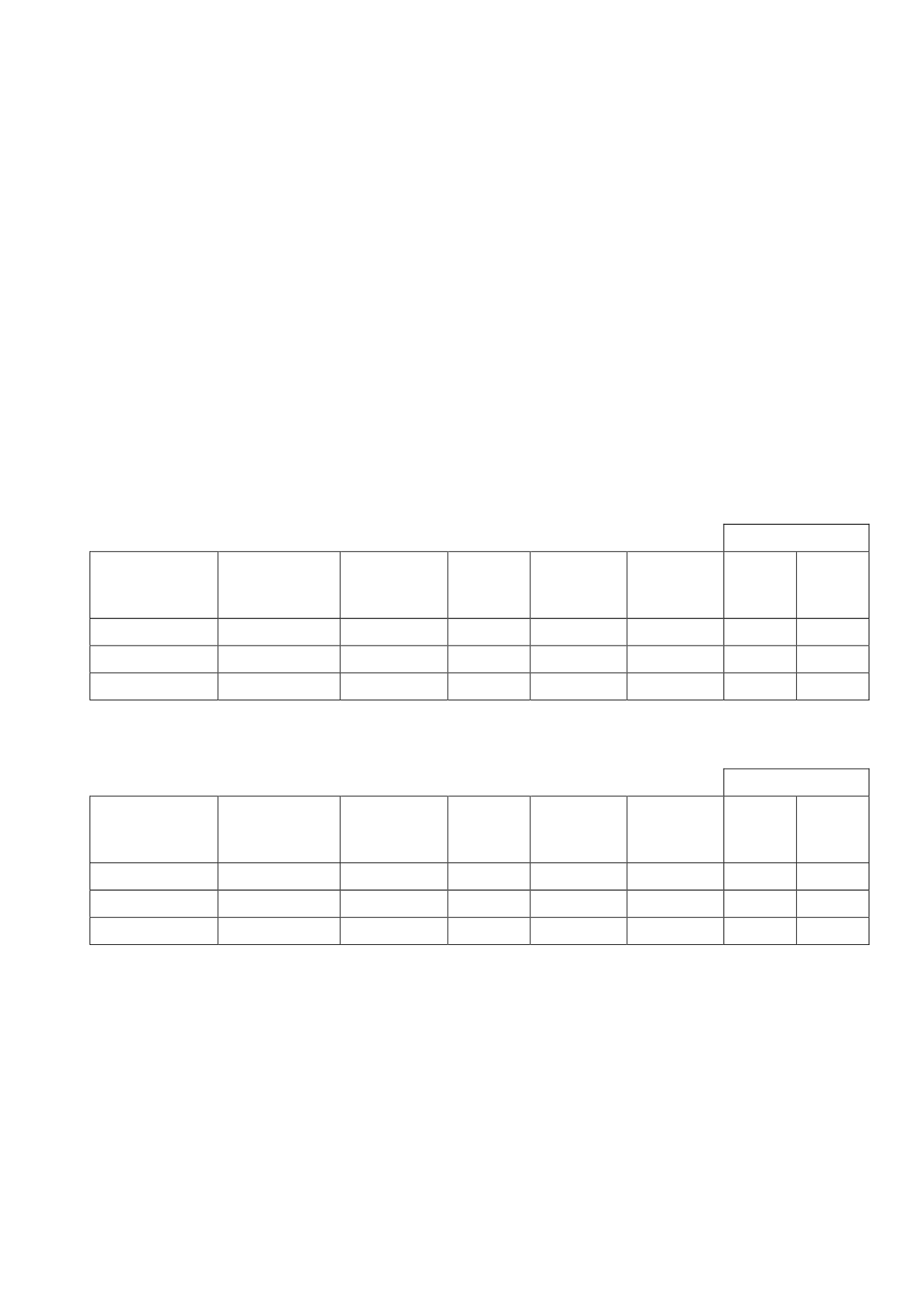

At the end of 2014 and 2013, the total amount of outstanding forward currency contracts

entered into by the Group is as follows (the terms reflect the moment in which the hedged

portion is recognised and in which the value of the hedging instruments is adjusted in equity

as an increase in/reduction of inventories):

Fair value

(thousands of euros)

Classification

Type

Maturity

Amount

arranged

(thousands

of euros)

Ineffectiveness

recognised in

profit or loss

(thousands

of euros)

Assets

Liabilities

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2015

151.142

-

11.740

8

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2016

72.103

-

3.982

6

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2017

6.988

-

415

1

The information in this connection at 31 December 2013 is as follows:

Fair value

(thousands of euros)

Classification

Type

Maturity

Amount

arranged

(thousands

of euros)

Ineffectiveness

recognised in

profit or loss

(thousands

of euros)

Assets

Liabilities

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2014

62,520

-

698

3,025

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2015

7,313

-

-

189

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2016

8,053

-

-

18

At 31 December 2014, the fair value of the Company’s foreign currency derivatives, which are

designated and are effective as cash flow hedges, was estimated to be positive by EUR 16,224

thousand and negative by EUR 15 thousand (31 December 2013: positive by EUR 698

thousand and negative by EUR 3,232 thousand). This amount was deferred and recognised in

equity.

The derivatives were measured by estimating the present value of the future cash flows that

will arise under the terms and conditions arranged by the parties in the derivative contract.

The cash price is taken to be the reference exchange rates of the European Central Bank on