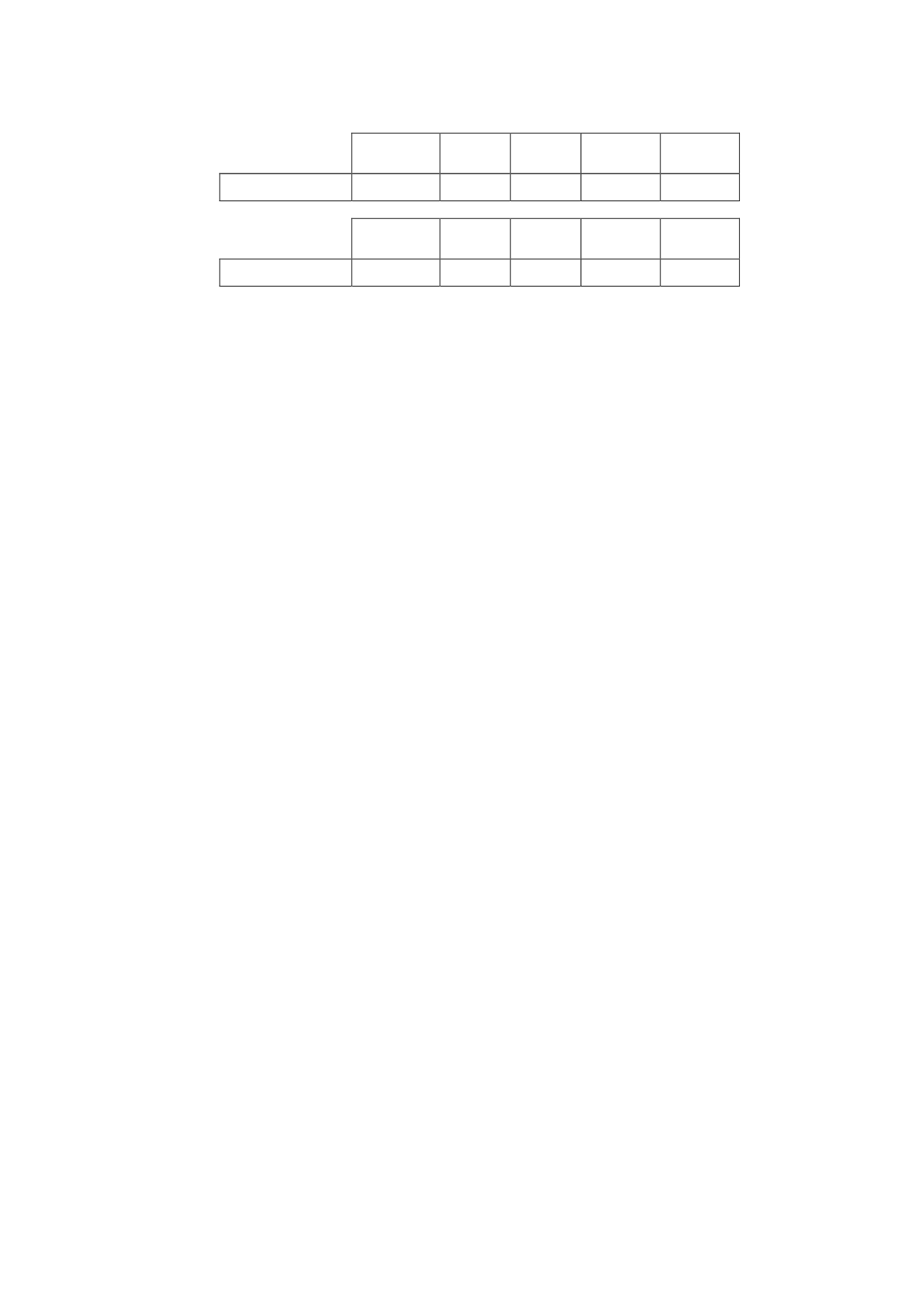

Balance at

01-01-14

Additions

Transfers

Disposals

or

reductions

Balance at

31-12-14

Inventory

write-downs

(33,754)

(6,347)

529

1,772

(37,800)

Balance at

31-12-12

Additions

Transfers

Disposals

or

reductions

Balance at

31-12-13

Inventory

write-downs

(19,516)

(6,976)

(9,508)

2,246

(33,754)

The write-downs recognised arose since it was decided that certain titles would not be

marketable and it was not likely that they would form part of the Company’s programme

schedule. These write-downs were recognised under "Programme Amortisation and Other” in

the accompanying income statement. In addition, regarding the impact of the closure of three

channels (see Note 1), the Company has made an adjustment in the value of certain media

rights amounted to EUR 3 million. These movements are reflected in the caption consumption

and other programs of the accompanying income statement.

At 31 December 2014, the Company had commitments, mainly for the purchase of audiovisual

property rights, amounting to EUR 279,146 thousand (31 December 2013: EUR 116,704

thousand). In addition, the Company has purchase commitments to distributors, the definitive

amount and price of which will be determined once the programmes are produced and, in

certain cases, by establishing the acquisition price on the basis of box-office takings. In 2014

the best estimate of these commitments amounts to EUR 94,312 thousand (2013: EUR 80,400

thousand).

It is estimated that in 2015 inventoriable in-house productions will be amortised in full and

approximately EUR 140,000 thousand of programme rights on outside productions (see Note

4.5).

12.- Equity and shareholders’ equity

On 29 October 2012, the merger resolutions adopted by the shareholders of Atresmedia

Corporación de Medios de Comunicación, S.A., as the absorbing company, and Gestora de

Inversiones Audiovisuales La Sexta, S.A., as the absorbed company, at their respective Annual

General Meetings on 25 April 2012, were executed in public deeds, as a result of which the

draft terms of merger were fully approved.

Following the merger resolution approved by the shareholders at the Annual General Meetings

of the two companies and the filing of the merger deed at the Madrid Mercantile Registry on

31 October 2012, the shareholders of La Sexta received, as consideration for the assets and

liabilities of this company, 15,801,296 shares of Atresmedia Corporación de Medios de

Comunicación, S.A., which represented 7% of its share capital.

For the purposes of the share exchange, on 29 October 2012 Atresmedia Corporación de

Medios de Comunicación, S.A. increased share capital by a nominal amount of EUR 10,965

thousand through the issue of (i) 13,438,704 shares of EUR 0.75 par value each, of the same

class and series as the shares outstanding prior to the increase and without dividend rights

with a charge to the profit generated before the date on which the merger was filed at the

Mercantile Registry, irrespective of the payment date, and (ii) 1,181,296 shares of EUR 0.75

par value each, of a different class and carrying the same restriction on dividend rights as the

aforementioned shares, applicable for 24 months following the date on which the merger was

filed at the Mercantile Registry, which took place on 31 October 2012.

As a result, once this period had ended, the Company's Board of Directors, acting under

powers delegated from the Annual General Meeting of 25 April 2012 in which the merger was