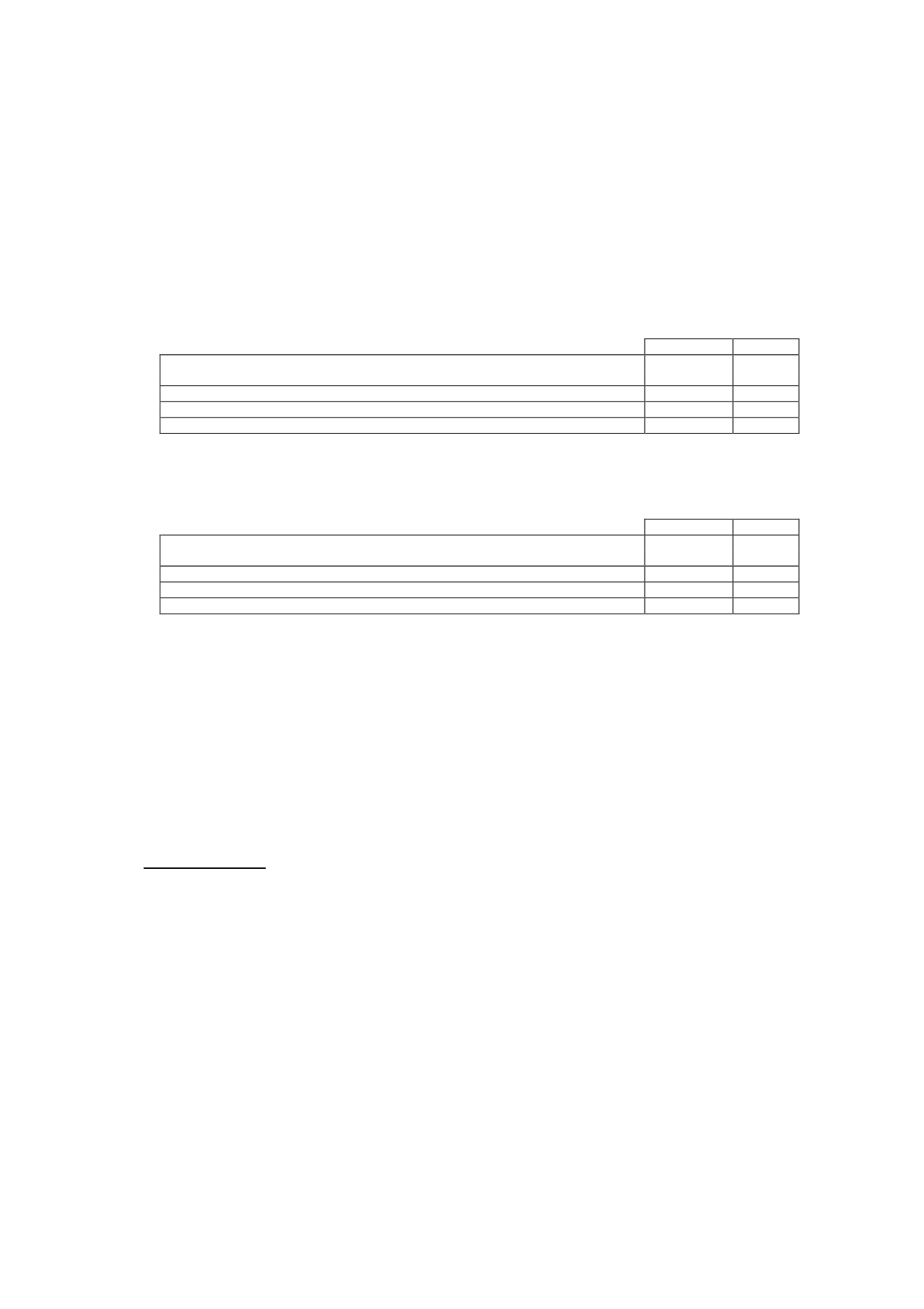

15.- Trade payables

The maximum payment period applicable to the Company under Law 3/2004, of 29 December,

on combating late payment in commercial transactions and pursuant to the transitional

provisions contained in Law 15/2010, of 5 July, is 60 days in 2014 (2013: 60 days).

The detail of the amounts paid and payable at 31 December 2014 is as follows (in thousands

of euros):

Amount

%

Within the maximum payment period

207,498

40%

Other

314,267

60%

Total payments made in 2014

521,765

Weighted average period of late payment (in days)

48

Payments at year-end not made in the maximum payment period

31,440

The detail of the amounts paid and payable at 31 December 2013 is as follows (in thousands

of euros):

Amount

%

Within the maximum payment period

189,760

35%

Other

359,981

65%

Total payments made in 2013

549,741

Weighted average period of late payment (in days)

47

Payments at year-end not made in the maximum payment period

37,084

Weighted average period of late payment was calculated as the quotient whose numerator is

the result of multiplying the payments made to suppliers outside the maximum payment

period by the number of days of late payment and whose denominator is the total amount of

the payments made in the year outside the maximum payment period.

16.- Tax matters

16.1 Current tax receivables and tax payables

The detail of the current tax receivables and payables is as follows (in thousands of euros):

Tax receivables