Deductible temporary differences:

15,145

36,803

(21,658)

Arising in the year:

Provision for litigation

10,723

-

10,723

Non-current accounts payable

-

-

-

Impairment losses

4,422

4,422

Arising in prior years

:

Provisions and accounts payable

-

8,765

(8,765)

Provision for contingencies and charges

-

3,184

(3,184)

Impairment losses

24,854

(24,854)

Taxable temporary differences:

791

-

791

Arising in the year:

Impairment losses

791

-

791

Gross taxable profit

22,978

53,163

4,283

Offset of prior years' tax losses

(1,143)

Tax rate

30%

Gross tax payable

942

Accounts receivable from (payable to) Group companies

8,416

Tax credits used in 2012

(3,002)

2012 tax prepayments

(7,003)

Income tax payable (refundable)

(647)

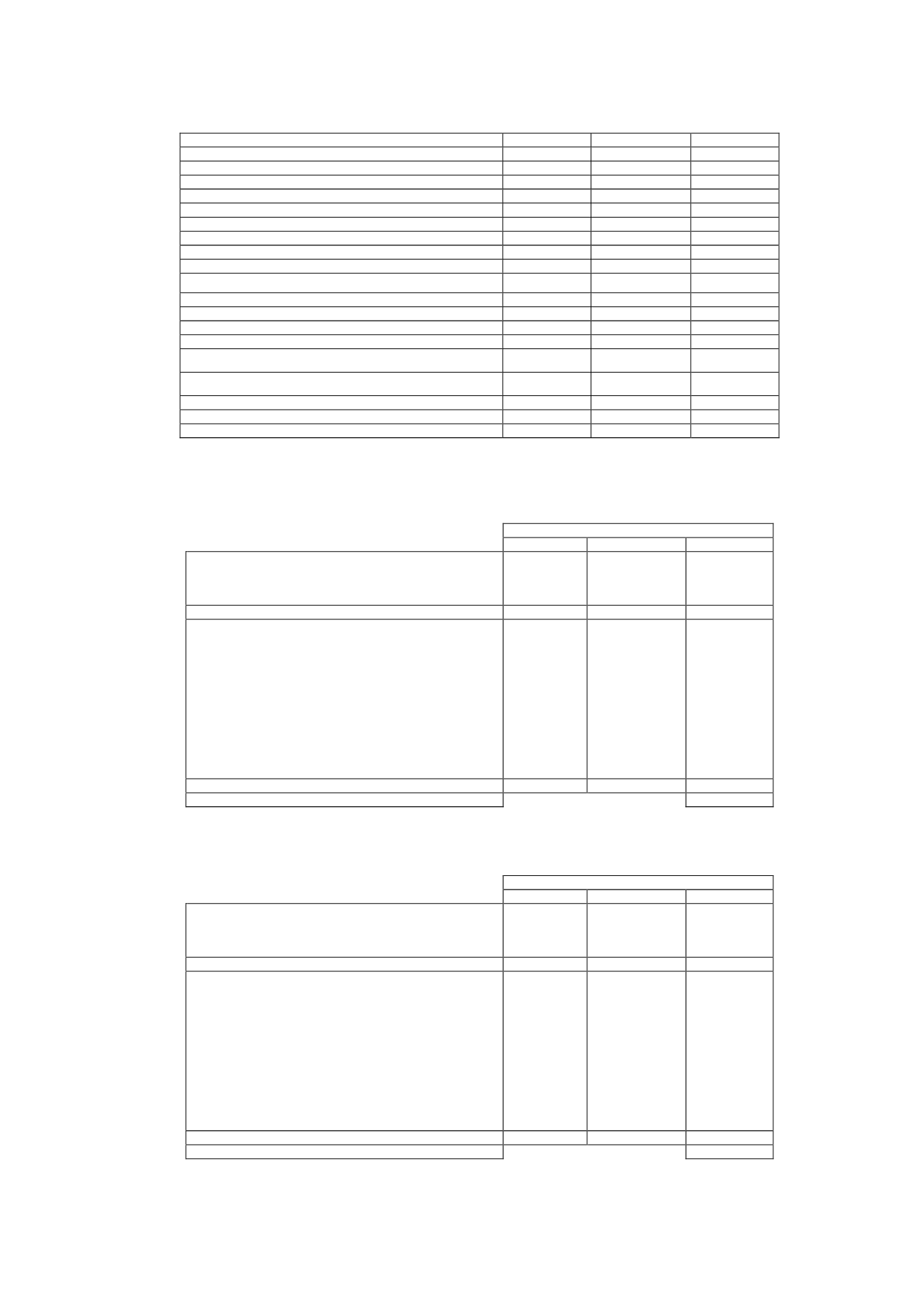

16.3 Tax recognised in equity

The detail of the taxes recognised directly in equity in 2014 is as follows:

Thousands of euros

Increase

Decrease

Total

Current taxes:

Capital increase expenses

Capital reduction expenses

Total current taxes

Deferred taxes:

Arising in the year:

Available-for-sale financial assets

Revaluation of other financial assets

Grants

Effect of first-time application of New Spanish

National Chart of Accounts

Arising in prior years:

Available-for-sale financial assets

Revaluation of other financial assets

Grants

-

571

(571)

Total deferred taxes

-

571

(571)

Total tax recognised directly in equity

(571)

The detail of the taxes recognised directly in equity in 2013 is as follows:

Thousands of euros

Increase

Decrease

Total

Current taxes:

Capital increase expenses

Capital reduction expenses

Total current taxes

-

-

-

Deferred taxes:

Arising in the year:

Available-for-sale financial assets

Revaluation of other financial assets

Grants

Effect of first-time application of New Spanish

National Chart of Accounts

Arising in prior years:

Available-for-sale financial assets

Revaluation of other financial assets

Grants

-

152

(152)

Total deferred taxes

-

152

(152)

Total tax recognised directly in equity

(152)