332 thousand deduction for international double taxation and EUR 85 thousand deduction for

donation to Nonprofit Organizations.

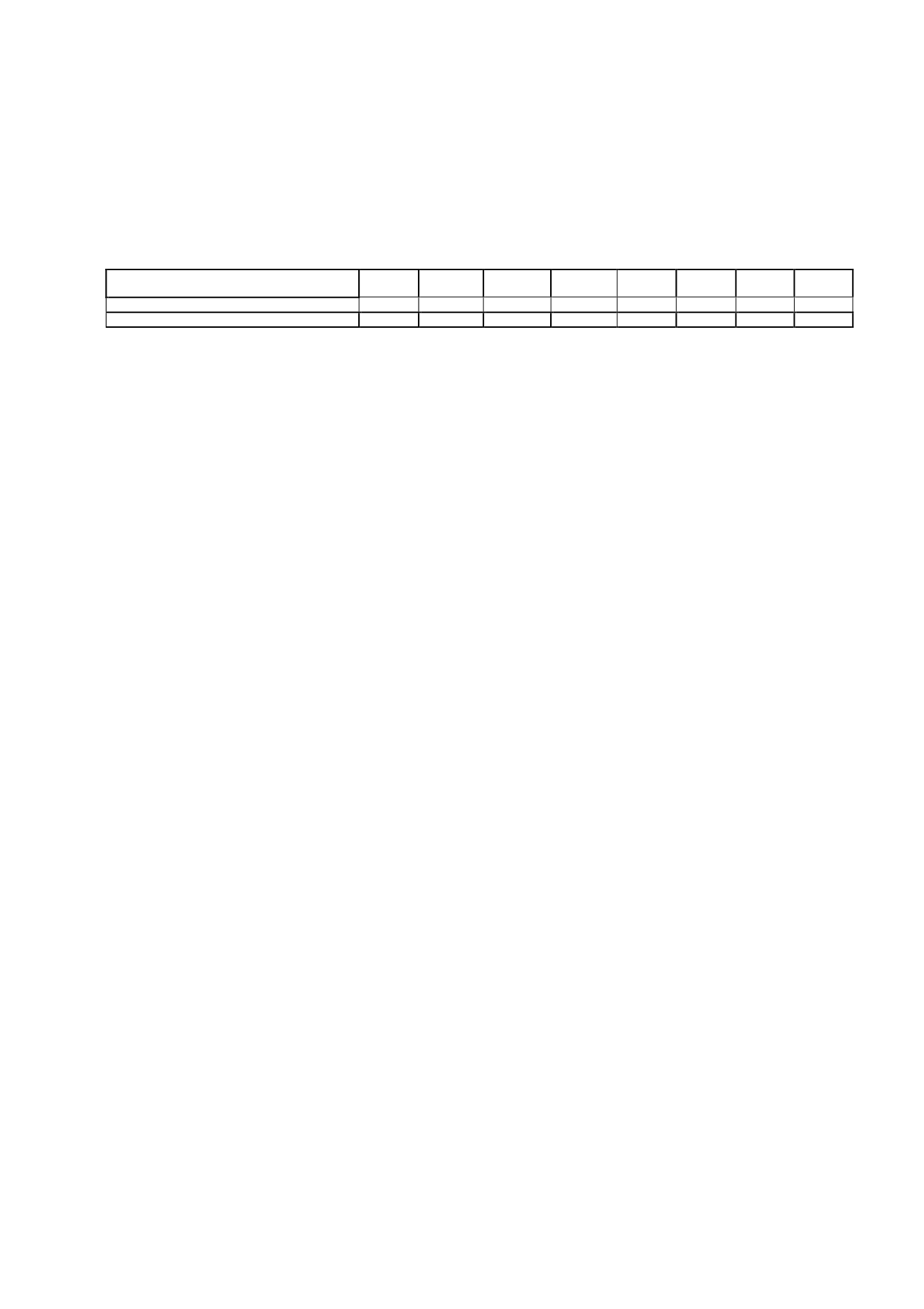

16.6 Deferred tax liabilities recognised

The detail of “Deferred Tax Liabilities" and of the changes therein is as follows:

DEFERRED TAX LIABILITIES

2012 Additions Disposals

2013 AdditionsDisposals

Tax

Effect

2013

Tax effect of identification of intangible assets 22,886

-

(237)

22,649

-

(237) (3,712) 18,700

Total

22,886

-

(237)

22,649

-

(237) (3,712) 18,700

In accordance with income tax recognition and measurement standard number 13, the

Company will recognise the deferred tax liabilities relating to goodwill provided that these do

not arise on the initial recognition thereof.

The deferred tax liabilities relate to the identification of the "La Sexta" brand and signal

transmission licence. The brand is amortised for accounting purposes at an annual rate of 5%

(amortisation charge for 2013: EUR 792 thousand), while the licence is not amortised.

The amortisation is not deductible for tax purposes and, therefore, gives rise to a positive

adjustment to the taxable profit (tax loss) which is recognised as a deferred tax liability.

16.7 Years open for review and tax audits

Under current legislation, taxes cannot be deemed to have been definitively settled until the

tax returns filed have been reviewed by the tax authorities or until the four-year statute-of-

limitations period has expired. At 31 December 2014, the Company had open for review for

income tax since 2010.

The Company's directors consider that the tax returns for the aforementioned taxes have been

filed correctly and, therefore, even in the event of discrepancies in the interpretation of

current tax legislation in relation to the tax treatment afforded to certain transactions, such

liabilities as might arise would not have a material effect on the accompanying financial

statements.

16.8. Other disclosures

In 2009 the Company acquired non-current assets as required under the terms established in

Article 36.ter of the Spanish Corporation Tax Law as amended in Law 24/2001, for the

reinvestment of the extraordinary income obtained by Gloway Broadcasting Services, S.L., in

compliance with the requirement of Article 42.

The Company used these tax credits in 2011.

These non-current assets continue to be used and are held in the equity of Atresmedia

Corporación de Medios de Comunicación, S.A., as set out in the 42.8 Decree of RDL 4/2004

Tax Law.

17.- Foreign currency balances and transactions

The detail of the most significant balances and transactions in foreign currency, valued at the

year-end exchange rate and the average exchange rates for the year, respectively, is as

follows (in thousands of euros):