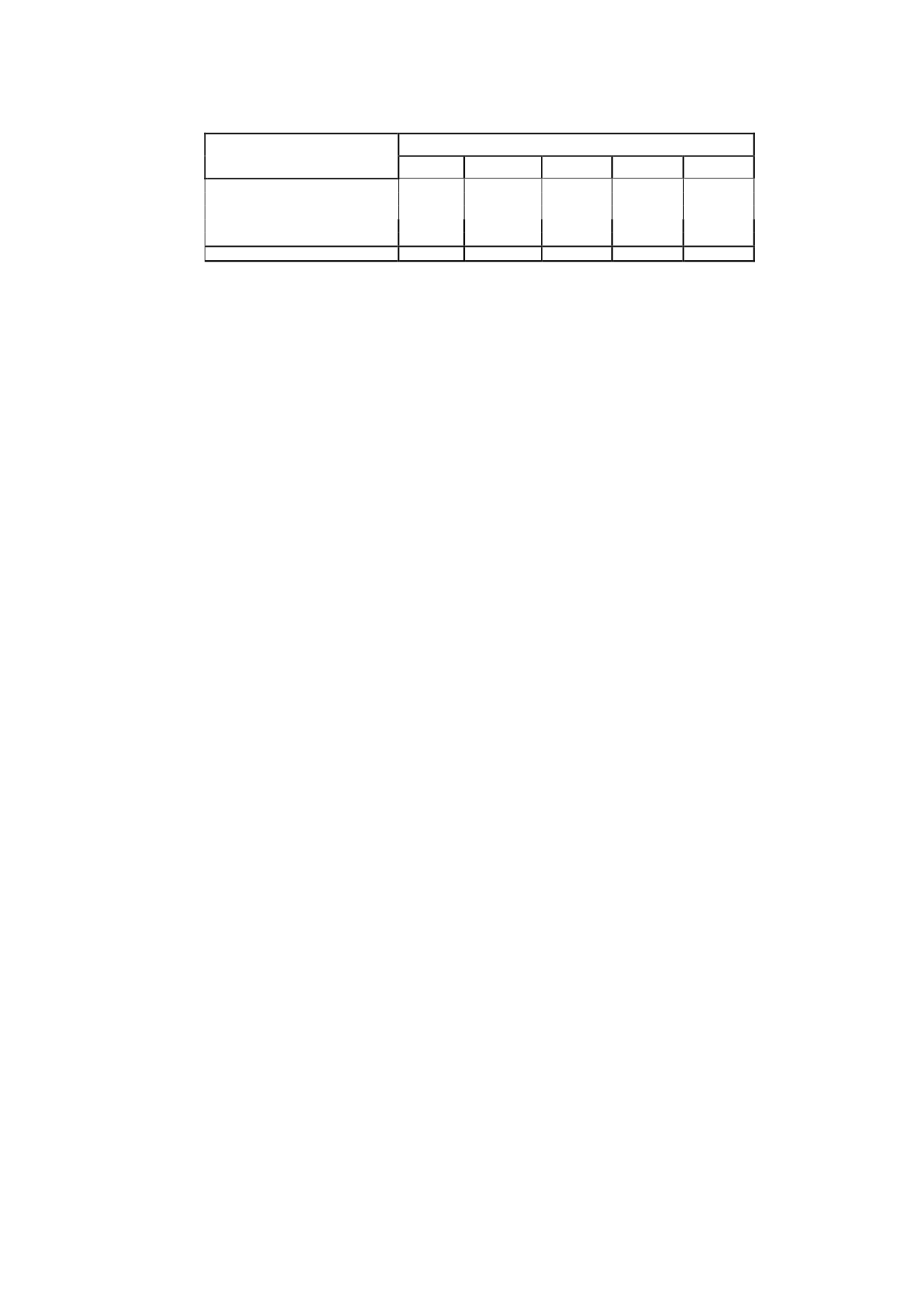

CHANGES IN DEFERRED TAX

ASSETS

Thousands of euros

2012

Additions Disposals

Other

2013

Contingencies and charges

9,609

3,217 (2,630)

551

10,747

Accounts payable

2,148

-

(955)

(540)

653

Other items

1,320

1,327

(611)

285

2,321

Tax effect of assets at fair value

9,483

- (6,845)

(97)

2,541

Financial hedging instruments

(209)

(152)

-

(361)

Total

22,351

4,544 (11,193)

199

15,901

At 31 December 2014, the tax effect of the valuation adjustments relating to the hedging

instruments amounting to EUR (571) thousand was recognised under “Non-Current Assets”.

The deferred tax assets indicated above were recognised because the Company's directors

considered that, based on their best estimate of the Company's future earnings, including

certain tax planning measures, it is probable that these assets will be recovered.

On the basis of the estimate made by the Company’s directors of the timing of future profits

for the offset and use of these deferred tax assets, EUR 14,429 thousand were considered to

be recoverable in the long term while EUR 1,472 thousand were considered to be recoverable

in the short term. Both amounts are recognised under “Deferred Tax Assets”. Also, on the

basis of the aforementioned estimate of the timing of future profits, the directors consider that

there are no reasonable doubts as to the recovery of the amounts recognised in the

accompanying balance sheet within the statutory time periods and limits.

Also, on the basis of the aforementioned timing estimate of future profits, the directors

consider that there are no reasonable doubts as to the recovery of the amounts recognised in

the accompanying balance sheet within the statutory time periods and limits on the basis of

the prepared projections.

The key assumptions on which the cash flow projections are based relate mainly to advertising

markets, audience, advertising efficiency ratios and the evolution of expenses. Except for

advertising data, which is measured on the basis of external sources of information, the

assumptions are based on past experience and reasonable projections approved by Company

management and updated in accordance with the performance of the advertising markets.

These future projections cover the next ten years.

The Company performs sensitivity analyses in the event of reasonable changes in the key

assumptions used to determine the recoverability of these assets. Therefore, the sensitivity

analyses are prepared under various scenarios based on the variables that are considered to

be most relevant, i.e. advertising income, which mainly depends on the performance of the

advertising market, the investment share reached and the operating margin achieved.

The changes in deferred tax assets recognised under "Other” include the difference between

the estimated tax for 2013 and the amount actually reported in the tax return, giving rise to

an adjustment of EUR 471 thousand to deferred tax assets. Also, the effect of this difference,

amounting to EUR (1,241) thousand, on the income tax expense is recognised under

“Negative Adjustments to Income Tax”.

At 31 December 2014, the Company had recognised unused tax credits amounting to EUR

75,577 thousand (of which EUR 4,801 thousand arise from the merger with La Sexta) and tax

loss carryforwards (arising from the merger with La Sexta in their entirety) amounting to EUR

177,064 thousand.

Under Transitional Provision 37 of Spanish Corporation Tax Law 27/2014, companies subject

to the limit on the depreciation and amortisation charge established in Article 7 of Law

16/2012, of 27 December, adopting various tax measures aimed at shoring up public finances

and boosting economic activity, will be entitled to a tax credit, to be deducted from the gross

tax payable, of 5% of the taxable profit, arising from the depreciation and amortisation not

deducted in the tax periods commencing in 2013 and 2014.