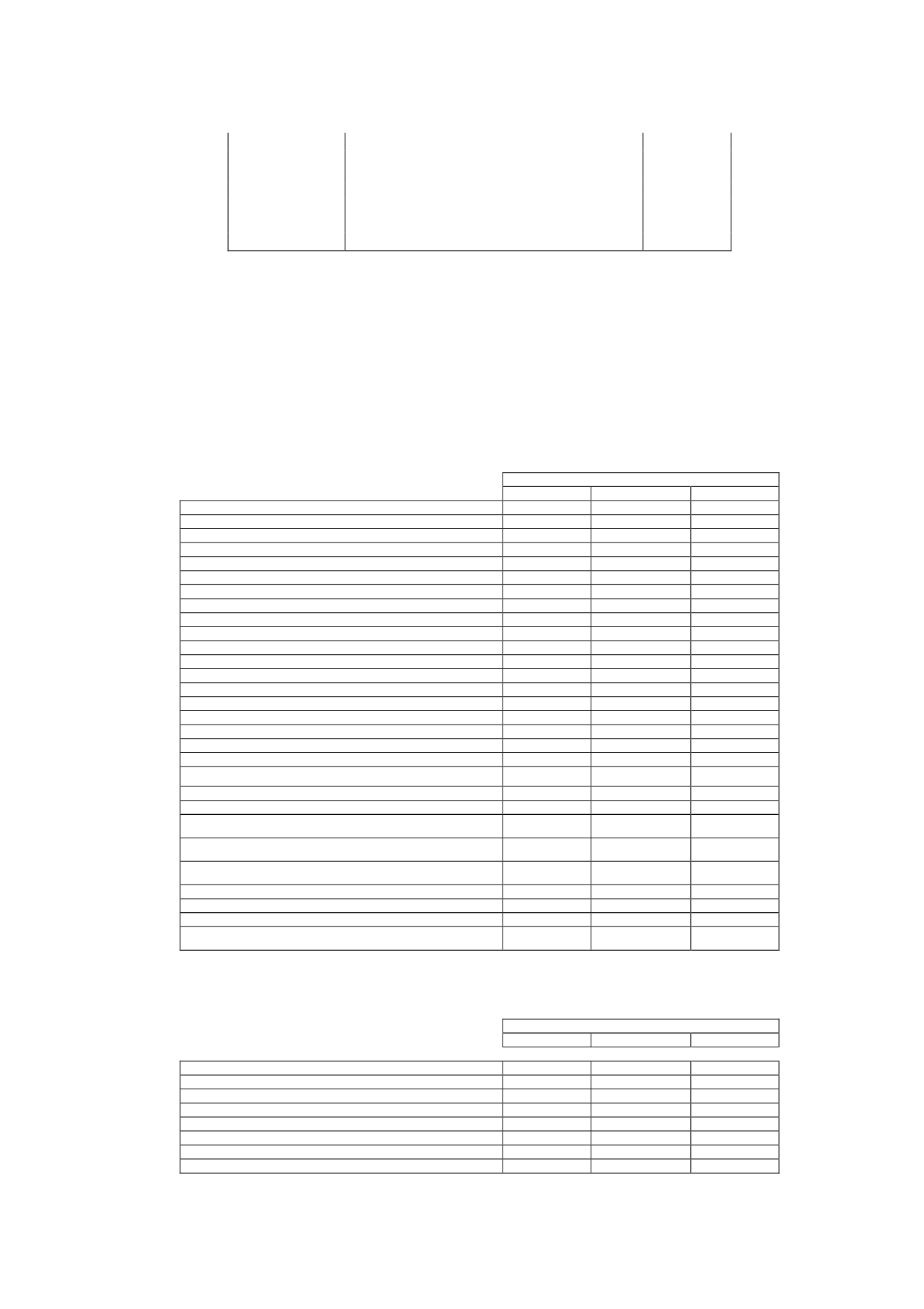

A80847601

Guadiana Producciones, S.A.U.

01/01/2001

B85408128

La Sexta Editorial Musical, S.L.U.

01/10/2012

A79458535

Música Aparte S.A.U.

01/01/2001

A84615178

Publiseis Iniciativas Comerciales, S.A.U.

01/10/2012

B84196914

Uniprex Televisión, S.L.U.

01/01/2004

B84405422

Uniprex Valencia TV, S.L.U.

01/01/2005

A28782936

Uniprex, S.A.U.

01/01/2001

The filing of consolidated tax returns gives rise to reciprocal intra-Group balances, due to the

offset of the losses incurred by certain companies against the profit earned by other Group

companies. These balances are recognised under “Payable to Group Companies” and

“Receivable from Group Companies”, as appropriate.

Income tax is calculated on the basis of the accounting profit determined by application of

generally accepted accounting principles, which does not necessarily coincide with the taxable

profit.

The reconciliation of the accounting profit to the taxable profit for income tax purposes for

2014 is as follows:

Thousands of euros

Increase

Decrease

Total

Accounting profit after tax

45,233

Income tax

41,897

-

41,897

Permanent differences –

6,616

23,554

(16,938)

Penalties

79

-

79

Donations

237

-

237

Impairment of investments

5,195

-

5,195

Elimination of dividends

-

3,359

(3,359)

Incorporation of Impairment Participations

20,195

(20,195)

Elimination of intra-Group transactions

1,105

1,105

Deductible temporary differences:

12,358

13,951

(1,593)

Arising in the year:

Provision for contingencies and charges

7,251

-

7,251

Non-current accounts payable

1,000

-

1,000

Impairment losses

4,107

4,107

Arising in prior years

:

Provision for contingencies and charges

-

6,954

(6,954)

Non-current accounts payable

-

53

(53)

Impairment losses

6,944

(6,944)

Taxable temporary differences:

791

-

791

Arising in the year:

Impairment losses

791

-

791

Gross taxable profit

19,765

37,489

69,390

Offset of prior years' tax losses

(28,303)

Tax rate

30%

Gross tax payable

12,326

Accounts receivable from (payable to) Group companies

13,155

Tax credits used in 2013

(6,704)

2013 tax prepayments

(19,745)

Income tax payable (refundable)

(968)

The reconciliation of the accounting profit to the taxable profit for income tax purposes for

2013 is as follows:

Thousands of euros

Increase

Decrease

Total

Accounting profit after tax

34,468

Income tax

4,006

(4,006)

Permanent differences –

7,041

12,353

(5,312)

Penalties

1,143

-

1,143

Donations

809

-

809

Elimination of provisions

1,949

-

1,949

Elimination of dividends

-

12,353

(12,353)

Elimination of intra-Group transactions

3,140

-

3,140