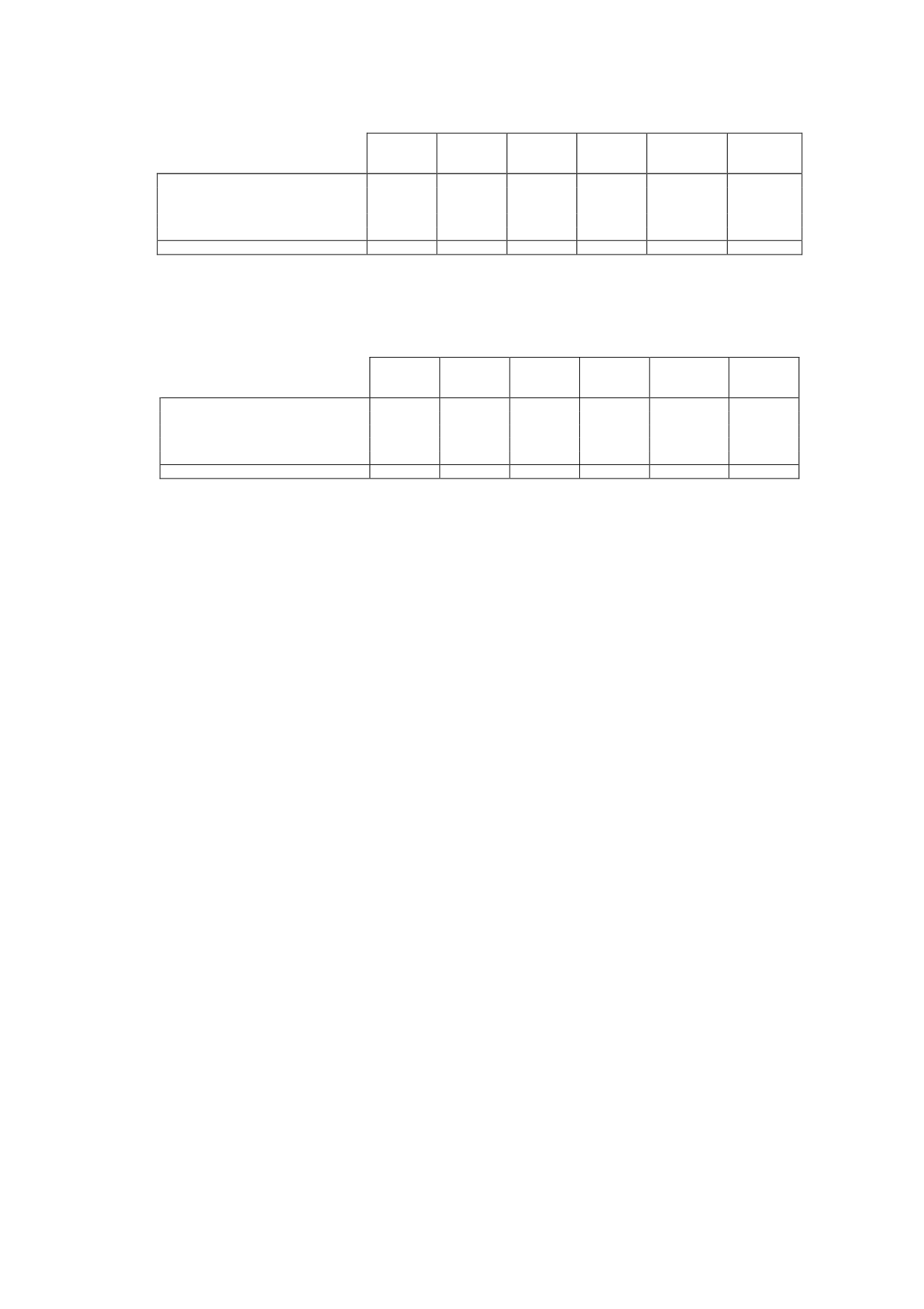

2016

2017

2018

2019

2020 and

subsequent

years

Total

Bank borrowings

62,331

64,000

-

-

-

126,331

Trade payables

45,639

4,710

42

-

-

50,391

Derivatives

7

-

-

-

-

7

Other payables

75

9

9

9

18

120

Total 31/12/2014

108,052

68,719

51

9

18

176,849

The detail at December 31, 2013, by maturity, of “Non-Current Payables” is as follows (in

thousands of euros):

2015

2016

2017

2018

2019 and

subsequent

years

Total

Bank borrowings

36,350

62,602

101,177

-

-

200,129

Trade payables

52,908

9,383

807

37

-

63,135

Derivatives

189

18

-

-

-

207

Other payables

71

10

10

33

5

129

Total at 31/12/13

89,518

72,013 101,994

70

5 263,600

On 2 August 2013, the Company arranged syndicated financing of EUR 270,000 thousand in

order to repay the existing bilateral credit facilities, meet the obligations included in the

financial structure assumed as a result of the merger by absorption of Gestora de Inversiones

Audiovisuales La Sexta, S.A. and to satisfy the Company's general cash needs. At December

31, 2014, the limit of the funding amounted to EUR 235,750 thousand.

74% of the total amount is a four-year loan with partial repayments and the remaining 26% is

a revolving credit facility maturing at four years. Nine banks with which the Company has

regular dealings participated in the transaction.

The applicable interest rate is Euribor plus a market spread and the transaction is subject to

compliance with financial covenants habitually used in transactions of this kind, relating to the

debt to EBITDA ratio and the interest coverage ratio. This transaction was guaranteed by a

security interest in all the treasury shares. Under the agreement reached with the former

shareholders of La Sexta (see Note 12.2), this guarantee was partially released and,

consequently, 1,145,594 shares of the Parent remain pledged as security. The fair value of

this financing approximates its carrying amount.

The balance of "Non-Current Trade Payables" relates to the maturities at more than twelve

months of the amounts payable to suppliers for rights on outside productions set on the basis

of the periods in which the productions become available. These payables do not bear interest

and the fair value thereof amounts to approximately EUR 50 million.

14.2 Current financial liabilities

At 31 December 2014, current bank borrowings amounted to EUR 38,859 thousand (2013:

EUR 6,305 thousand).

The rate of interest paid by the Company in 2014 on the loans and credit facilities arranged

with banks was mainly tied to Euribor.