approved, adopted the necessary resolutions to reword Articles 5 and 7 of the bylaws so that

they state that all the shares that represent the share capital of Atresmedia Corporación de

Medios de Comunicación, S.A. are of the same class and carry the same dividend rights for the

holders thereof in respect of the profit earned by the Company from 31 October 2014

onwards.

In addition, as part of this convergence process and also in accordance with the merger

agreements, the Company's Board of Directors resolved to request the official listing of these

1,181,296 shares on the Madrid, Barcelona, Valencia and Bilbao Stock Exchanges through the

Spanish stock market interconnection system.

Once 24 months elapsed from the registration of the merger, i.e. on 31 October 2014, the

1,181,296 shares that at that date were B shares became ordinary shares. From this date, all

the shares composing the share capital of Atresmedia Corporación carried the same dividend

rights.

At 31 December 2014 and 2013, the share capital of the Company amounted to EUR 169,300

thousand and was represented by 225,732,800 fully subscribed and paid shares of EUR 0,75

par value each, with the same rights except for the restriction on dividend rights mentioned in

Note 12.3.

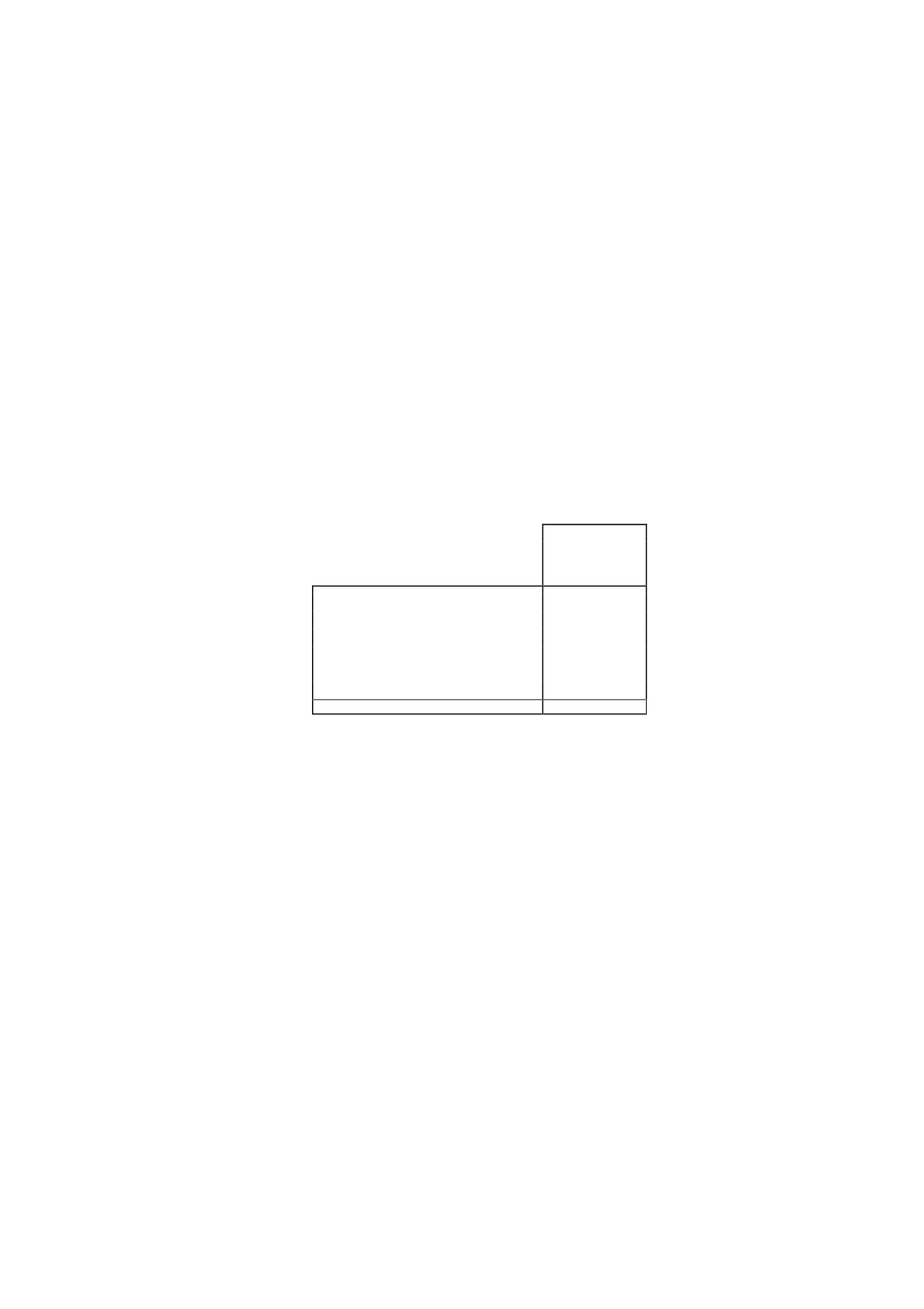

The detail of the shareholder structure at the end of 2014 is as follows:

% of

ownership

Planeta-de Agostini, S.L. Group

41.70

Ufa Film und Fernseh, GMBH

19.17

Imagina Media Audiovisual, S.L.

4.48

Gamp Audiovisual, S.A. (*)

4.16

Treasury shares

0.51

Other shareholders

29.98

Total

100.00

* Gamp Audiovisual, S.A. is an Imagina Group company, which is controlled, pursuant to Article 4 of the

Spanish Securities Market Law.

The Company's shares are listed on the Spanish stock market interconnection system and all

carry the same voting and dividend rights, except for the 1,181,296 shares mentioned above,

which admission to trading has been applied but not occurred at December 31, 2014.

There are agreements between the main shareholders that guarantee the Company’s

shareholder stability, the grant of mutual rights of acquisition on their shares and the

undertaking not to take control of the Company or to permit a third party to do so, and also

include management agreements, as described in the Corporate Governance Report.

12.1 Reserves

LEGAL RESERVE

Under the Spanish Limited Liability Companies Law, the Company must transfer 10% of net

profit for each year to the legal reserve until the balance of this reserve reaches at least 20%

of the share capital. The legal reserve can be used to increase capital provided that the

remaining reserve balance does not fall below 10% of the increased share capital amount.