The tax credit earned at Group level in this connection is EUR 373 thousand and was credited

to "Adjustments to Income Tax".

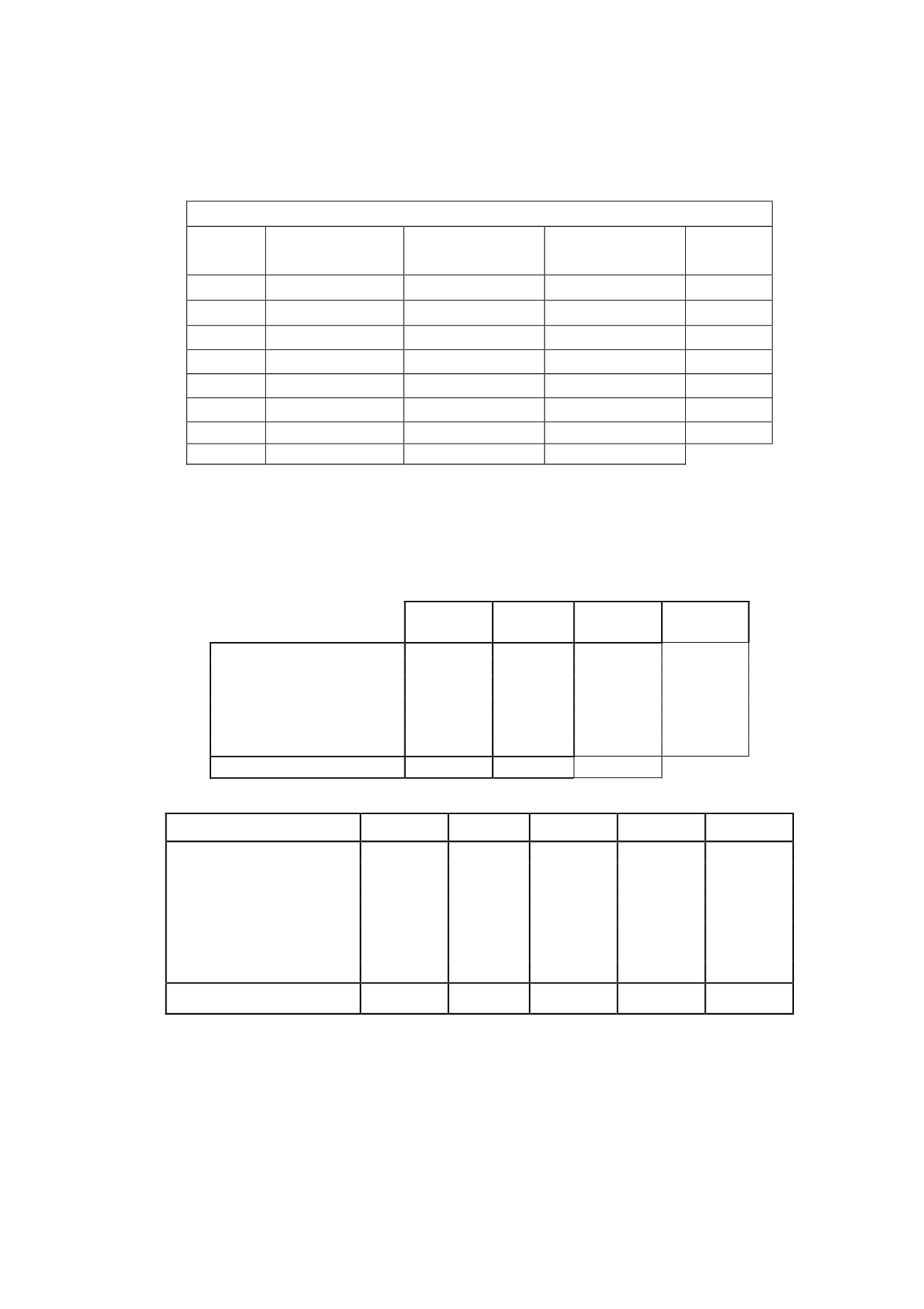

Thousands of euros

Amount

Deducted in

the year

Additions

(DT 37

th

Law

27/2014)

Carried forward

Last year

for

deduction

482

482

-

-

2023

3,909

3,909

-

-

2024

14,391

22

-

14,369

2025

21,023

-

-

21,023

2026

17,478

-

-

17,478

2027

10,990

-

-

10,990

2028

11,342

-

373

11,715

2029

79,615

4,412

373

75,577

As a result of the merger by universal succession, the Company assumed the right to deduct

the tax credits and tax loss carryforwards of the transferor, in accordance with the following

schedule of deductions:

Thousand

euros

31/12/2013

Deducted

in the year

Pending

31/12/2014

Maturity

Year

5,257

2,099

4,801

2008

482

482

-

2023

2009

1,617

1,617

-

2024

2010

1,010

-

1,034

2025

2011

2,148

-

2,150

2026

Outstanding deductions

5,257

2,099

4,801

Generation Year

Amount

Deducted

in the year

Others

Tax Effect

Pending

31/12/14

2006

58,166

8,491

-

(7,509)

42,166

2007

45,185

-

-

(7,531)

37,654

2008

38,301

-

-

(6,383)

31,918

2009

34,758

-

-

(5,793)

28,965

2010

10,053

-

-

(1,675)

8,378

2011

18,568

-

-

(3,095)

15,473

2012

15,564

-

(459)

(2,595)

12,510

Total deferred tax assets

220,595

8,491

(459)

(34,581)

177,064

In the column "Other" it is recognised the regularization of taxable income generated by La

Sexta in 2012, derived from the difference between the estimate at the time of the merger

and the amount finally declared in the statement of income tax collected. The counterpart is

recorded in the "adjustments to income tax" account.

Deductions applied during the year (EUR 6,704 thousand), EUR 6,287 thousand are deductions

for audiovisual production, of which EUR 4,412 thousand correspond to Atresmedia

Corporacion Medios de Comunicacion, S.A. and EUR 1,875 thousand to a group company, EUR