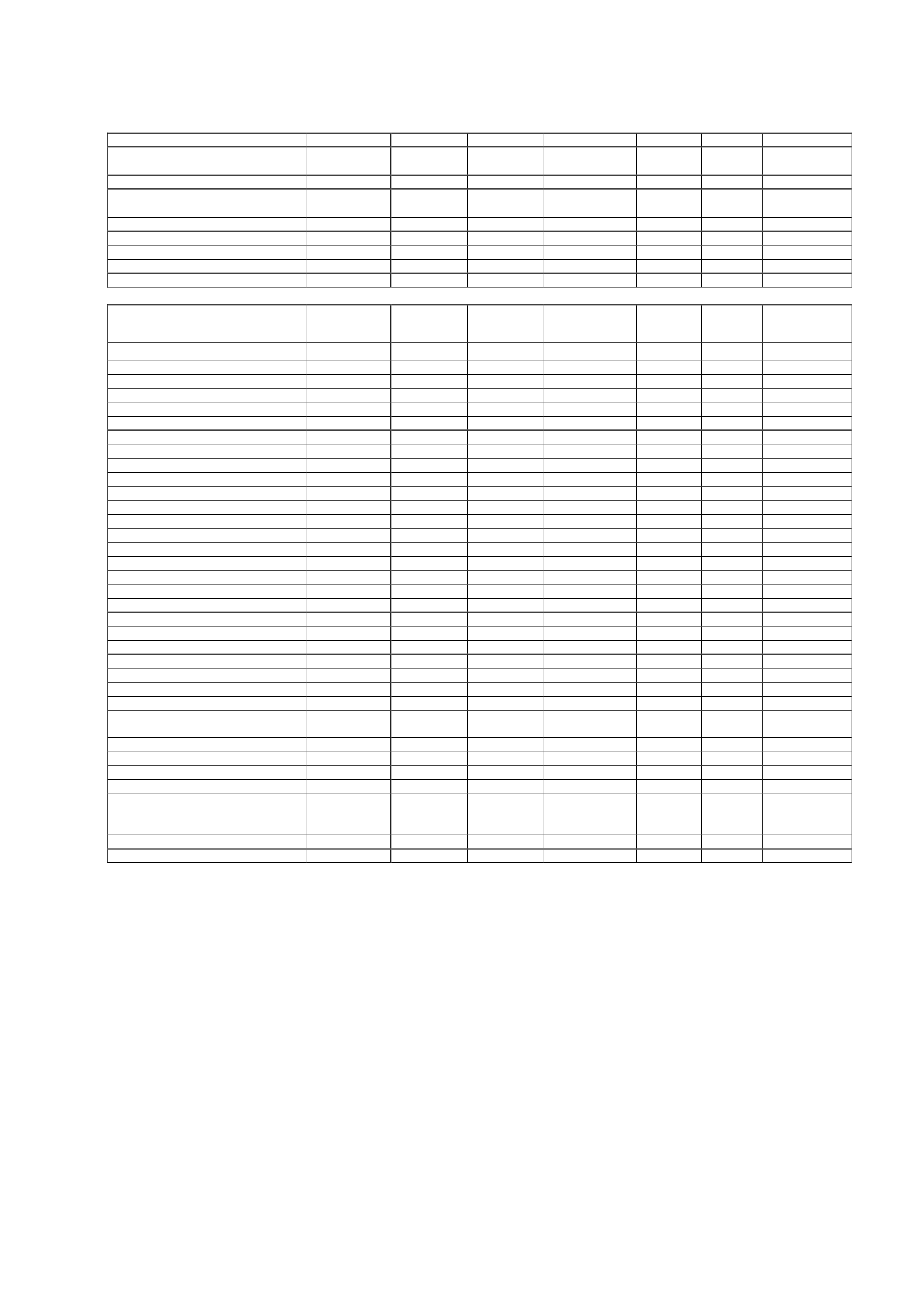

Hola Televisión América, S.L.

1.648

-

105

6.529

-

-

-

Hola Televisión América, S.L. US

-

-

43

-

-

-

-

I3 Televisión, S.L.

209

-

79

-

-

-

828

Financial assets

5.956

-

-

2.211

-

-

-

Related companies:

-

-

1.505

-

-

2

56.934

Imagina Media Audiovisual, S.L.

-

-

-

-

-

-

112

Planeta Group

-

-

221

-

-

2

4.375

RTL Group

-

-

-

-

-

-

362

Imagina Group

-

-

1.284

-

-

-

52.085

2013

Equity

instruments

Non-current

loans to

companies

Trade

receivables

Current

financial

assets

Non-

current

payables

Current

payables

Trade

payables

Group companies

75,807

125,322

155,029

28,674

2 52,118

9,418

Antena 3 Eventos, S.L.U.

1,285

-

16

3

-

111

49

Antena 3 Films, S.L.U.

5,794

47,322

29

-

-

283

605

Antena 3 Juegos, S.A.

100

-

-

65

-

409

21

Antena 3 Multimedia, S.L.U.

3

-

25

505

-

-

1,482

Antena 3 Noticias, S.L.U.

-

-

103

4,328

-

189

5,844

Antena 3 TDT de Canarias, S.A.

-

-

-

-

-

1,002

350

Atres Advertising, S.L.U.

3

-

154,225

5,282

- 33,006

111

Atresmedia Foto, S.L.

45

-

-

-

-

38

-

Cordina Planet, S.L.

502

-

8

2,270

-

-

-

Guadiana Producciones, S.A.

50

-

-

-

-

89

-

La Sexta Editorial Musical, S.L.U.

1,180

-

-

283

-

592

-

Música Aparte, S.A.U.

60

-

142

1,253

-

6,928

-

Publiseis Iniciativas Publicit

6,485

-

-

80

-

4,387

-

Uniprex Televisión, S.L.U.

-

-

56

526

-

-

287

Uniprex Valencia Telev, S.L.U.

-

-

-

-

-

6

-

Uniprex, S.A.U.

60,300

78,000

425

14,079

2

5,078

669

Associates:

481

-

159

2,450

-

607

749

Fundación Atresmedia

-

-

26

-

607

-

I3 Televisión, S.L.

130

-

28

-

-

749

Hola Televisión América, S.L.

351

-

105

2,450

-

-

Financial assets

1,472

-

-

-

-

-

El Armario de la Tele, S.L. (Note

9.1)

1,472

-

-

-

-

-

Related companies:

-

-

2,655

-

- 34,686

65,434

GAMP Audiovisual, S.A.

-

-

-

-

- 18,029

-

Imagina Media Audiovisual, S.L.

-

-

-

-

- 14,141

130

Gala Desarrollos Comerciales,

S.L.

-

-

-

-

-

2,516

-

Planeta Group

-

-

24

-

-

-

5,510

RTL Group

-

-

183

-

-

-

402

Imagina Group

-

-

2,448

-

-

-

59,392

“Current Financial Assets” includes the amounts drawn down against the credit facilities

granted by the Company to companies in its Group and the balances receivable from them

relating to income tax.

The short-term participating loan granted by the Company to Uniprex, S.A. (Sole-Shareholder

Company) for EUR 223,000 thousand was repaid at the maturity date, 30 November 2012. In

December 2012, a loan was entered into with this subsidiary for a total of EUR 100,000

thousand, of which EUR 10,000 thousand mature at short term and earn interest at a fixed

rate of 3%, subject to review each year. In 2013 EUR 12,000 thousand were transferred to

short term and EUR 10,000 thousand were repaid (see Note 8.3).

"Current Payables” includes the balances relating to cash surpluses managed by the Company

on behalf of its Group companies and the balances payable to them relating to income tax.